Three major lenders cut mortgage rates as buying activity rises

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

The government has invested a lot of political capital in preparing the public for the "tough decisions" it will make in next month's budget, but just how bad are the public finances?

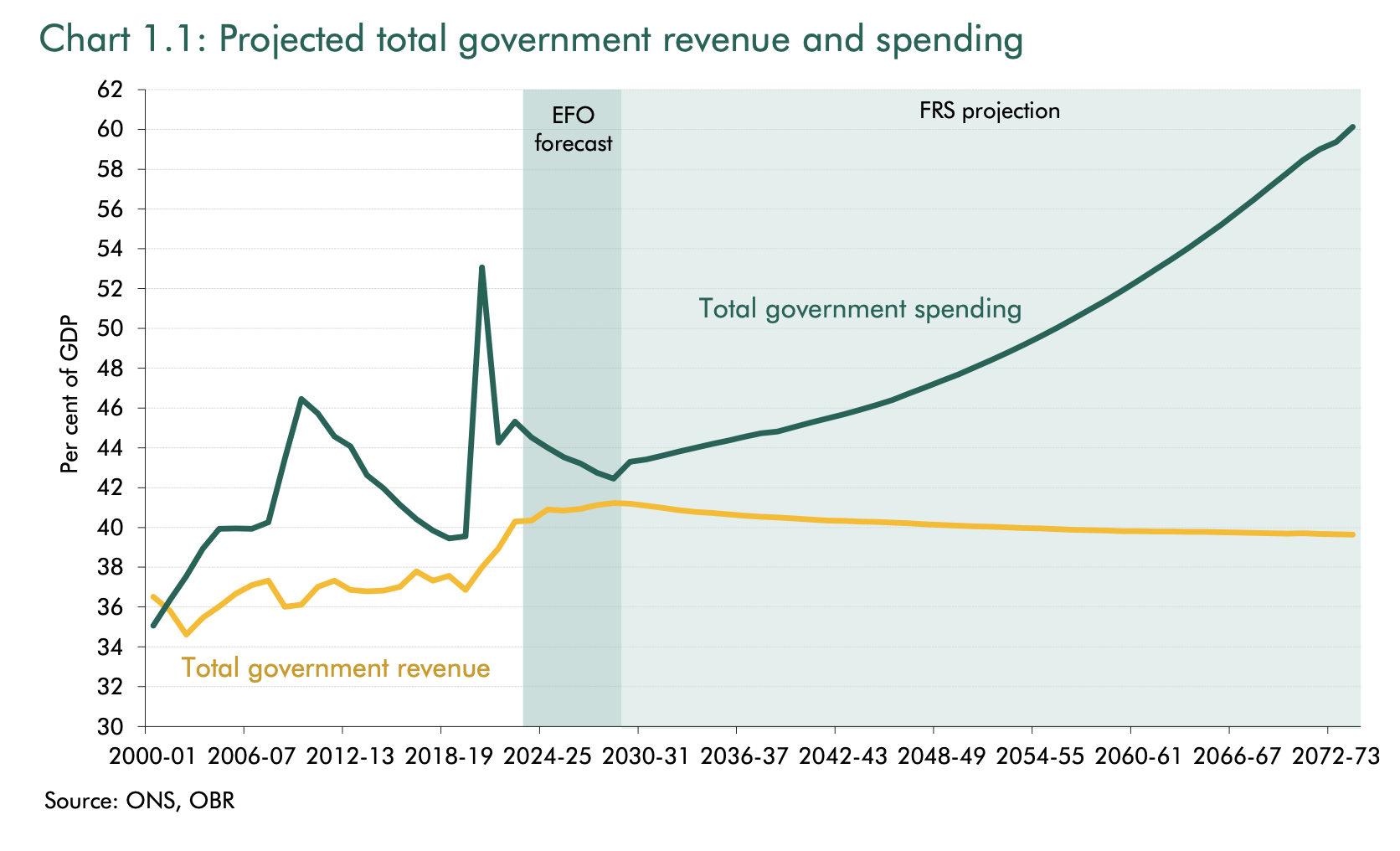

"Unsustainable" is the word the Office for Budget Responsibility used yesterday to describe the country's policy settings as they stood in March 2024. A glance at the chart from the spending watchdog's Fiscal Risks and Sustainability report below reveals why - during the next 50 years, public spending is projected to rise from 45% to more than 60% of GDP, while revenues will remain stuck at about 40% of GDP.

The culprits form a potent mix. The birth rate is falling and the "'baby boom' cohorts" will continue moving into retirement, putting downwards pressure on revenues and upwards pressure on spending. The transition to net zero will be expensive, as will the damage from rising temperatures and severe weather. Meanwhile, the government aspires to raise defence spending to 2.5% of GDP, given the volatile geopolitical environment.

Without significant progress on key issues (see below), public debt will rise alarmingly from the late 2030s to 274% of GDP. Debt could rise to more than 300% of GDP when further, as yet unknownable, economic shocks are taken into account. “On almost any scenario the government is likely to have to raise taxes or cut spending to keep the public finances on a sustainable trajectory,” Richard Hughes, OBR chair, said during a press briefing made public yesterday.

Solutions

Whether the UK is locked into a sustained period of high taxes or biting austerity will depend on progress on three key issues.

Firstly, limiting the rise in global temperatures to less than 2°C rather than 3°C could alleviate around 10 percentage points of upward pressure on the debt-to-GDP ratio. That looks unlikely, given that countries' current emissions pledges put the world on track to warm by between 2.5% and 2.9%, according to the UN.

Secondly, improving the population's health could reduce the rise in debt by a further 40% of GDP. That's very broad, but the 160-page review into the NHS by Lord Darzi, published this week, didn't inspire confidence.

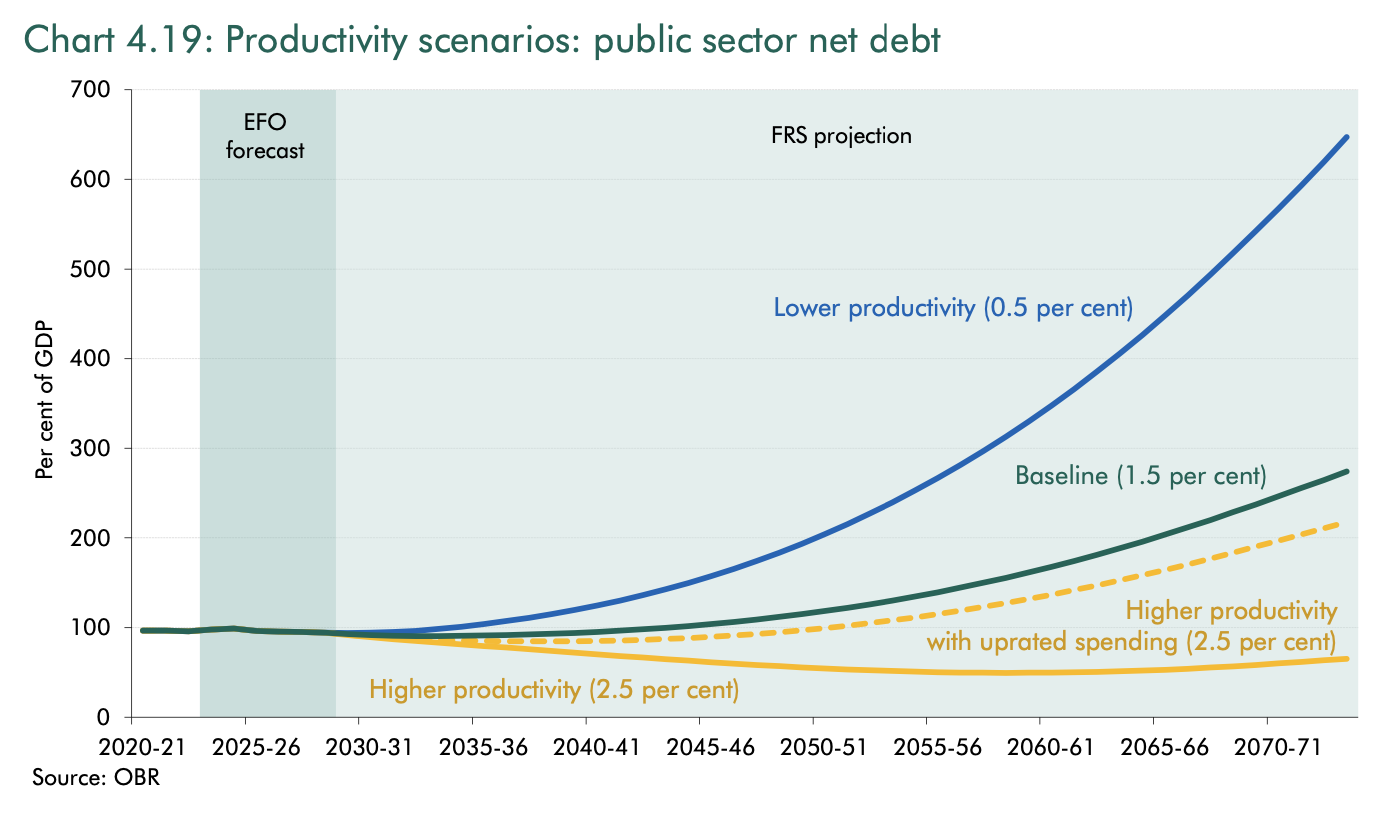

Still, the third key issue - boosting productivity - is the most important if the sole metric is putting the public finances on a sustainable path. Every 0.1% increase in productivity growth would cut the debt-to-GDP ratio by a whopping 25 percentage points. A full 1 percentage point increase, equivalent to a return to pre-financial crisis rates of productivity growth, could keep debt below 100% of GDP throughout the next 50 years.

The UK's 'productivity puzzle' has stumped economists for fifteen years, but let's be optimistic. Artificial intelligence, automation and rapid progress in R&D and innovation all have the potential to provide some improvements. The OBR's higher productivity scenario, in which productivity growth increases to 2.5% a year from its baseline projection of 1.5%, would bring productivity growth broadly in line with the UK’s average during the 1990s. That would put nominal GDP 55% higher than the baseline projection by 2073-74 (see chart).

The property sales market

UK lenders Nationwide, Clydesdale and HSBC all cut mortgage rates this morning - Nationwide has made reductions of as much as 0.25%.

The Bank of England probably won't cut rates on Thursday, but global inflation looks less likely to surprise with every data release - see the US inflation report earlier this week. The outlook enables lenders to keep cutting mortgage rates, and the five-year swap rate fell to a 2024 low on Wednesday.

It's early days, but mortgage rates are falling into territory that will support a fuller recovery. The RICS survey, out this week, showed new buyer enquiries increased to a net balance of +15% in August, up from +4% last month and the strongest reading since October 2021. Any reading above zero signals an increase on the previous month.

Respondents expect this increase in activity to translate into sales. Near-term sales expectations hit a net balance of +37%. A net balance of +45% expect sales to strengthen over the twelve-month time horizon. The supply picture is improving too - the new instructions series hit +7%. Net appraisals hit +23%.

The lettings market

Lettings market data continues to show rising demand and falling supply. Tenant demand registered a net balance of +11%, which is softer than the 26% recorded in July. Net landlord instructions slipped to -21%, from -9% last time.

Zoopla data out this morning showed there are now 21 prospective tenants competing for every property that comes onto the market.

The RICS figures show near-term rental price expectations hitting +39%, which is consistent with a steady rise in rents during the months ahead.

The Renters' Reform Bill is back, having been tossed when parliament was dissolved for the election. The Labour Bill is similar to the Conservative version, though the government does intend to issue a blanket ban on no-fault evictions. There is little in the Bill that is likely to prompt a reverse in the imbalance of supply and demand that is pushing rents higher.

In other news...

The industrial investment market is poised for growth, writes Claire Williams.

Elsewhere - US household net worth climbs to record on home values, stocks (Bloomberg), US mortgage rates fall to lowest since Feb 2023 (Bloomberg), short sellers wind down bets against European property stocks (Bloomberg), and finally, Bank of England to pause rate cuts (Reuters).