European Lifestyle Report: Wealth on the move

Seismic political and economic shifts are seeing the world’s wealthy vote with their feet

1 minute to read

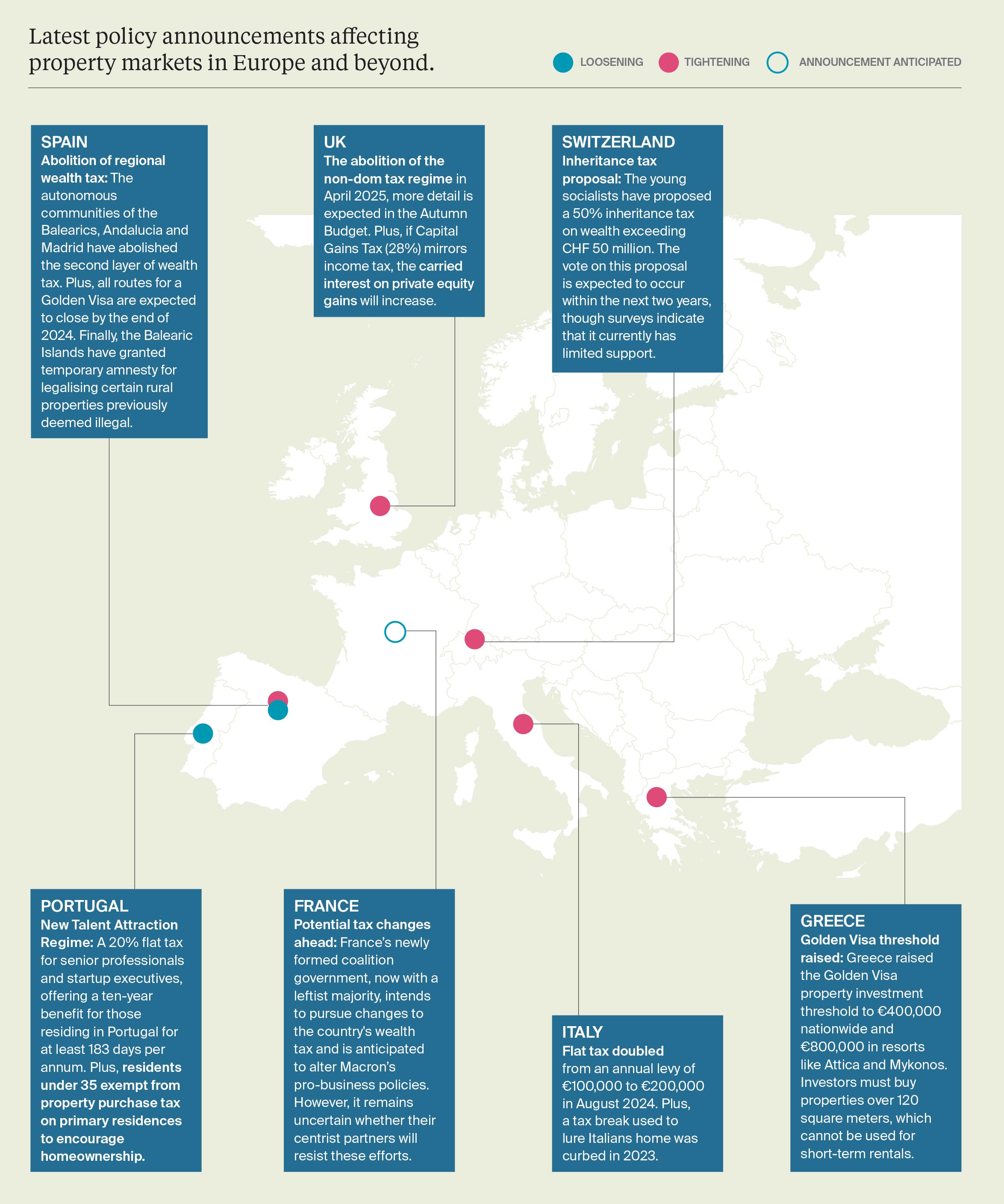

With 2024 the biggest election year in history, policy and tax changes are coming thick and fast, impacting property markets, cross-border investment and wealth flows. Newly- elected governments are trying to balance increased spending on affordable housing and infrastructure with the challenge of reducing deficits and still attracting foreign investment.

Geopolitical tensions and policy changes are driving HNWIs to relocate to more favourable jurisdictions. The swift withdrawal of CHF 1.5 billion from Credit Suisse in late 2022 by wealthy account holders highlighted how quickly affluent individuals can react to perceived financial risks.

Changes in market conditions, tax incentives, visa options, and lifestyle improvements can also drive relocation decisions among the wealthy. The pandemic, new hybrid working models and a rise in early or semi-retirement among those in their fifties have contributed to this trend of increased mobility.

Henley & Partners predict that a record 128,000 millionaires will relocate globally this year, surpassing the previous record of 120,000 set in 2023. However, an influx of wealthy foreigners has also triggered a policy response in some countries leading to a modification of financial incentives offered to expatriates. See below.

Download full report