Country Market Awaits Rate Cut and First Budget Under New Government

Annual change -3.0%. Quarterly change - 0.6%.

2 minutes to read

A sense of stability has returned to Westminster as Labour confirmed expectations this month by winning the general election with a majority of 172.

See this piece for more on what a Labour victory may mean for the property market.

However, there are three reasons that an unambiguous election result by itself won’t trigger a surge in activity among buyers and sellers.

The first and most obvious is that many of them are now on holiday.

The number of new prospective buyers registering with Knight Frank’s country business was on average 10.1% lower in July than May over the last decade (excluding 2020).

This natural seasonal lull makes it difficult to draw immediate conclusions about the impact of the new Labour government on the property market.

As our recent sentiment survey suggested, many will wait until autumn to activate their plans.

The second factor that may keep activity in check is uncertainty surrounding the government’s tax proposals, which is particularly true in higher-value markets.

Until the Budget takes place this autumn, the guessing game about which taxes Labour are going to increase will continue.

Although the government has pledged not to raise income tax, VAT or National Insurance, speculation has surrounded the tax implications of agreeing to requests for public sector pay rises and the possibility that private schools will be charged VAT from January rather than September 2025.

With rumours swirling about other tax increases, asking prices will need to remain realistic, even as people return from their summer break.

The final, and perhaps biggest question mark facing buyers and sellers, is the timing of the first interest rate cut since March 2020.

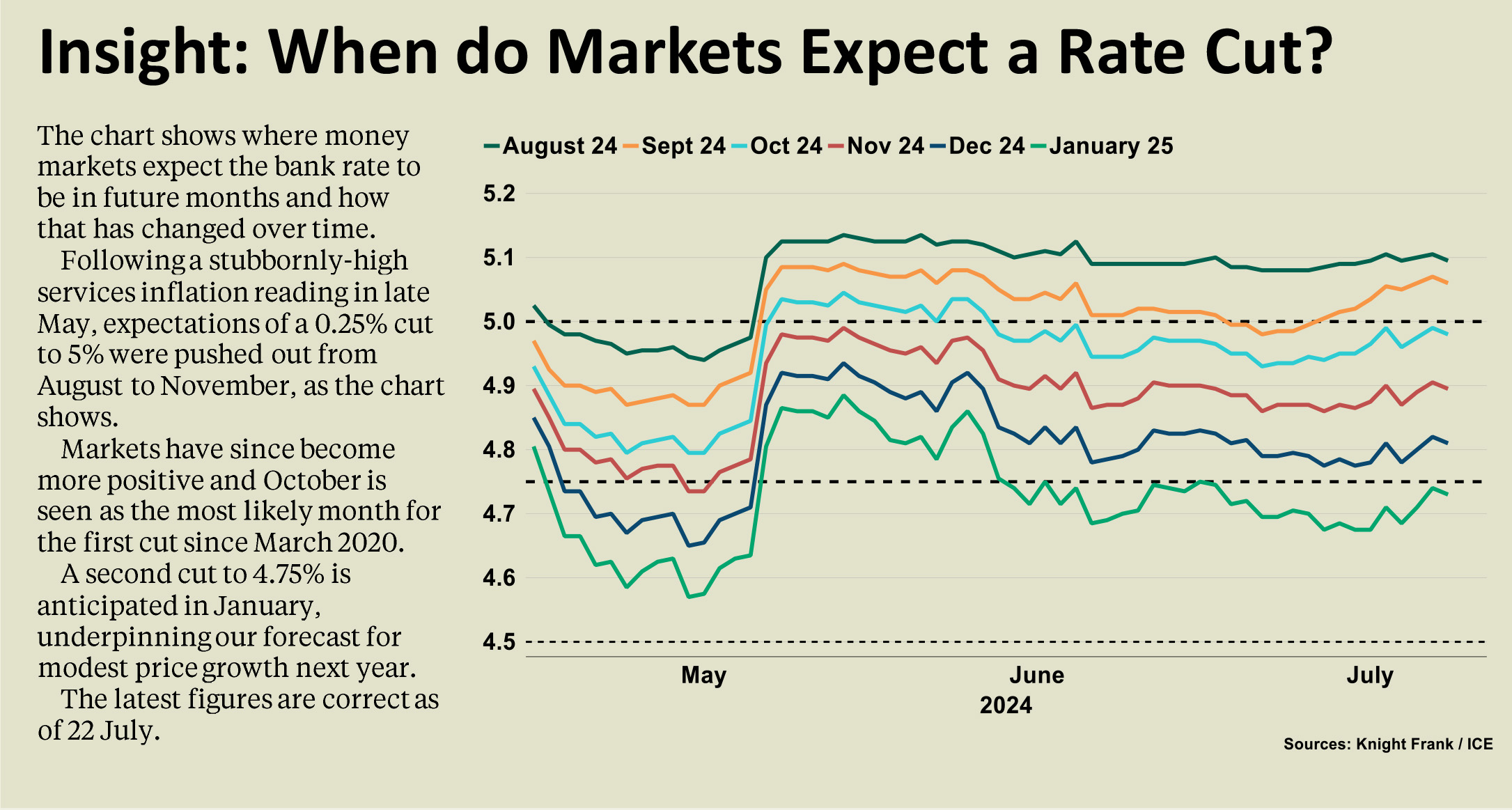

Expectations have been pushed further into the future due to stubbornly-high inflation, with October now seen as the most likely month for a cut (see chart below).

Although mortgage rates are lower than they were this time last year, there hasn’t been any significant downwards movement for six months, which has caused pent-up demand to build.

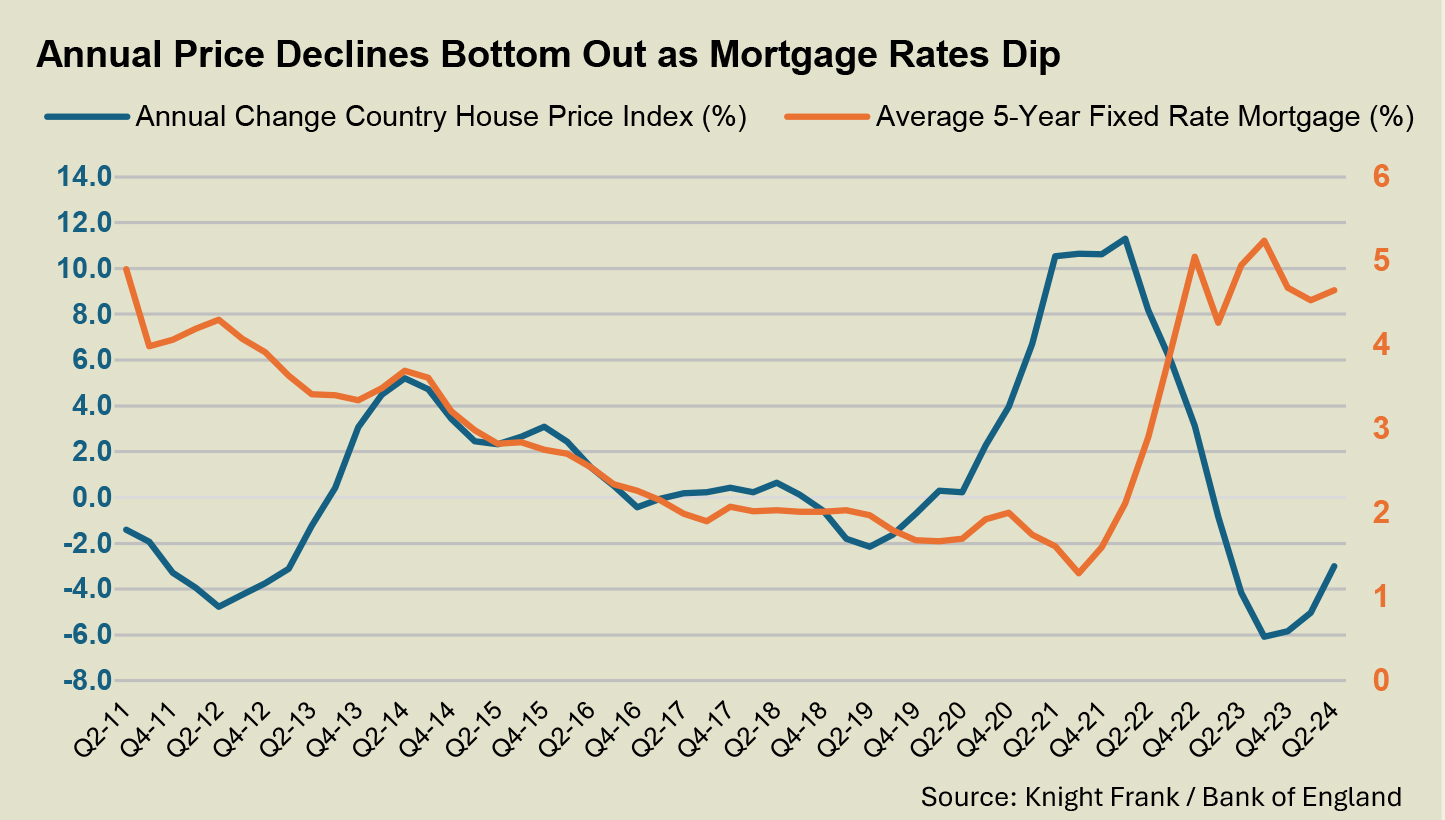

Average prices in Country markets fell by 3% in the year to Q2 2024, which was the narrowest decline since Q1 2023 and underlines how demand has strengthened as borrowing costs have fallen (see chart above).

Higher-value markets, which are more discretionary and less subject to the vagaries of the mortgage market, recorded more modest price declines over the last 12 months.

We expect demand to strengthen in the final quarter of this year as more clarity emerges around the government’s tax plans and at least one rate cut takes place.

A cut in September as the autumn market gets underway would have a greater overall impact than one in October.

We forecast that average prices in Country markets will decline by 2% in 2024 before rising 3% next year as mortgage rates continue to fall.