‘Weak Pound’ Argument for Prime London Property Starts to Fade

June 2024 PCL sales index: 5,297.2

June 2024 POL sales index: 273.6

3 minutes to read

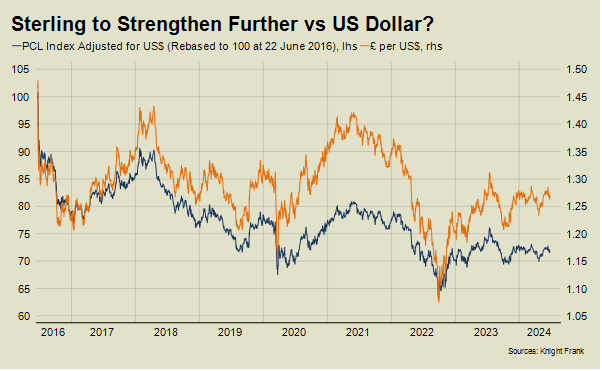

Overseas buyers in London looking to take advantage of the weak pound might start to sense their window of opportunity closing.

Sterling has strengthened against the US dollar in recent weeks as the prospect of a UK rate cut has become more remote due to high wage growth and a stronger outlook for the retail sector, both of which are seen as inflationary.

The pound was trading at US$1.27 last week, having climbed from US$1.20 in October as the economic data pointed to an earlier US rate cut. A higher interest rate makes a currency more attractive for overseas investors to hold, which increases its value.

Meanwhile the pound reached a 22-month high against the Euro at EUR1.18 last month. The European Central Bank cut rates three weeks ago, and the euro’s weakness has been exacerbated by recent political volatility in mainland Europe, including the French elections on Sunday.

The outcome of the UK election this week is likely to be one of comparative stability, which may increase the appeal of UK assets (and demand for Sterling) among global investors. The size of the London stock exchange recently overtook that of Paris.

Political volatility following the US election could also mean the dollar weakens versus the pound, says Savvas Savouri, chief economist at Quantmetriks, citing a failure to tame the ballooning US deficit by either candidate and the possible imposition of trade barriers following the vote.

While a number of forecasters expect the pound to strengthen to the extent it breaks the US$1.30 barrier next year, some, including Savouri, expect this to happen before the end of 2024.

The UK faced its own political upheaval eight years ago following its decision to leave the European Union, which caused the pound to fall 18% against the dollar in four months.

It made Sterling-denominated assets like prime central London (PCL) property more attractive to overseas investors.

When you combine the impact of a weaker pound and price declines in PCL over recent years, an effective discount of 28% is available compared to the pre-referendum level for dollar-denominated buyers or those purchasing in currencies pegged to the US dollar such as the Hong Kong dollar or UAE dirham.

In simple terms, the same house in PCL that cost US$100 in May 2016 would now cost US$72.

It wouldn’t be quite such a good deal for investors buying pounds as opposed to bricks and mortar, as the chart shows. The equivalent change over the same period is -14% thanks to the recent gains made by the pound.

The more Sterling strengthens, the smaller this effective discount for PCL property will become.

Average prices fell by 2.4% in prime central London in the year to June for the second month in a row. Demand has been held in check by uncertainty over the timing of the first rate cut in more than four years and the possible implications of a new government, which we analyse here.

In prime outer London, prices fell 0.9% over the same period, reflecting how markets where a higher proportion of demand is driven by factors like employment and education, have performed better in this higher mortgage rate environment. Our latest analysis of what may happen next to mortgage rates is here.

For those watching currency as well price movements, the result and immediate aftermath of this year’s election will be revealing - on both sides of the Atlantic.