Rising geopolitical risk and the implications for borrowing costs

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

We're greeted this morning with an alarming set of newspaper front pages following Iran's drone and missile attack on Israel.

The attack was framed by Iran as a retaliation for the Israeli bombing of the Iranian consulate in Damascus. Though it represents "a big deal" and "a clear escalation", there are reasons for calmer heads to prevail, according to Eurasia Group's Ian Bremmer. In a short video update, Bremmer points out that Iran "gave a heads up days in advance" and, though there was a significant risk of a more serious accident, this was a "maximal display of force with the minimum likelihood of casualties."

Columbia University professor Adam Tooze considers the economic angles and largely shares Bremmer's view: "the reading currently favoured by most economic commentators and the folks who have to deploy trillions of dollars on Monday morning, is that though this escalation is alarming, it is an example of the key players successfully signalling that they “have to act”, but seeking to avoid general escalation."

The key metric for the global economy over the coming days - and by extension housing markets - will be any movement in the price of oil. As Tooze points out, a surge in oil prices will worry the US Federal Reserve due to the prospect it fuels inflation, raising the likelihood that officials opt to hold rates higher for longer or even pursue another hike. Higher oil prices also tend to correlate with a strong dollar, which will squeeze nations that have borrowed in dollars or use dollars to buy imports.

Both of these factors are key considerations for central banks on the cusp of cutting rates, including both the Bank of England and the European Central Bank - I talked about these links in more detail on Wednesday and Friday. There had been little impact on the price of Brent crude as markets opened this morning.

Global housing markets

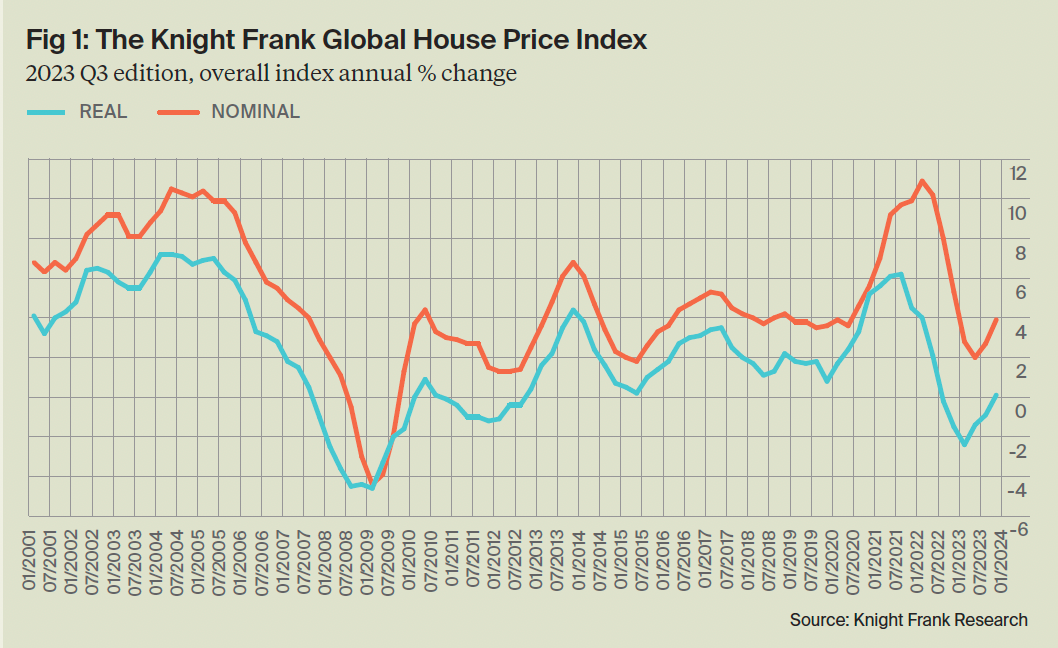

Price growth continues to gather pace across global housing markets. Average values in the 56 markets covered by Knight Frank's Global House Price Index climbed 3.9% during 2023, the fastest rate of growth since the end of 2022.

The impact of higher mortgage rates is still clear to see - values declined in 18 markets during the final three months of the year, though that narrowed from 24 in the previous quarter. The primary factor driving this price revival is the acute shortage of housing inventory in many markets. The US is a notable example, where higher mortgage rates have discouraged potential home sellers from listing their properties because they risk a significantly higher mortgage rate when purchasing their next home.

This shortage of available properties has been intensified by a slowdown in the delivery of new homes, a consequence of supply disruptions affecting the construction sector in numerous major developed markets over the past four years.

The pattern is set for further price growth across the majority of global housing markets. Persistent low supply, combined with anticipated shift to lower interest rates in the latter half of this year, is expected to bolster buyer confidence and enhance affordability. However, as we approach 2025 and housing stock starts to accumulate, we anticipate a slowdown in price growth.

The urban perspective

City markets share these drivers. Price growth in the 107 markets covered by our Global Residential Cities Index accelerated to 3% for the 2023 calendar year, up from 1.6% in the previous quarter.

Leading city markets are dominated by key Turkish cities, where substantial growth in Ankara and Istanbul is fueled by high inflation in the broader economy. Australian markets are making a strong comeback, with cities like Brisbane, Perth, and Sydney recording robust growth in the past year (11.1%, 10.8%, and 9.2% respectively).

In the United States, low housing stock is bolstering prices in major cities. Philadelphia, Los Angeles, Chicago, Miami, New York, and Boston are all seeing annual growth exceeding 7%. The weaker markets are primarily in Europe, with Luxembourg City and Lyon in France ranking lowest in our index. Notably, only three non-European cities – Hong Kong, Seoul, and Shenzhen – feature among the weakest 20 cities in our rankings.

Build to Rent

UK BTR investment hit £1.3 billion in the first quarter of 2024, up 21% year-on-year, and the highest figure ever recorded for a first quarter, according to Knight Frank's latest update.

Operational deals - purchases of properties that are built out and let - accounted for 35% of investment flowing into the sector, the highest proportion since Q1 2021. Funding transactions made up the remaining 65% and remain a vital route to market as the sector matures.

Investors continued to up their exposure to different sub-sectors of BTR over the course of the quarter, with multifamily representing 53% of total investment in Q1 and co-living accounting for 20% of deals by value, its strongest quarter on record. Single Family Housing (SFH) investment stood at £345 million in the first quarter (27% of the total), building on a record 2023.

The UK’s BTR stock now stands at 109,803 completed homes with a further 63,240 homes under construction and 80,400 with full planning permission granted. This brings the total size of the sector to 253,443 homes completed, in development or with planning.

In other news...

Knight Frank's Jennifer Townsend on what the annual reports of the world’s largest life science companies tell us

Elsewhere - Treasury urged to reverse end of stamp-duty relief for multiple dwellings (FT).