Global Healthcare set for growth despite challenges

The global Healthcare sector is a vast and complex market, but it is also one with significant growth potential.

3 minutes to read

The ageing population, people living longer and the demand for long-term care have led to increased investment in the sector from various countries.

We explore some of the key investment opportunities as well as the challenges facing the market. You can dig deeper into the global Healthcare market by downloading the latest Global Healthcare Report 2023.

While there are some concerns about the sector's ability to absorb rising operational costs and the impact of rising interest rates on debt financing, overall, the global healthcare sector is poised for continued growth in the coming years.

Key global Healthcare trends

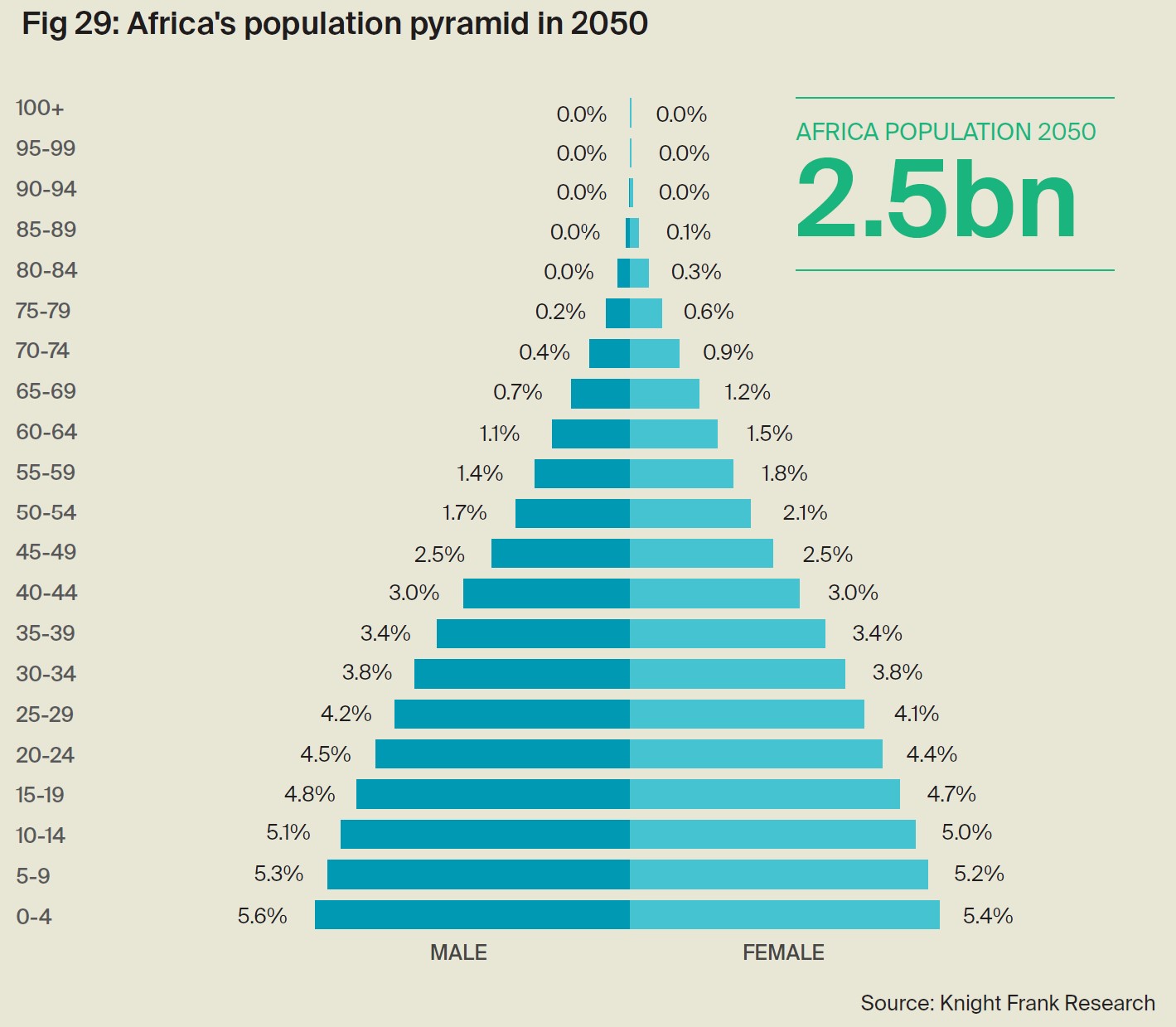

Ageing demographics: The global population is ageing rapidly, and this is driving demand for Healthcare services. By 2050, Africa alone is projected to have a population of 163 million people over the age of 60.

Additionally, there is a need for other Healthcare services such as managing chronic diseases and mental Healthcare.

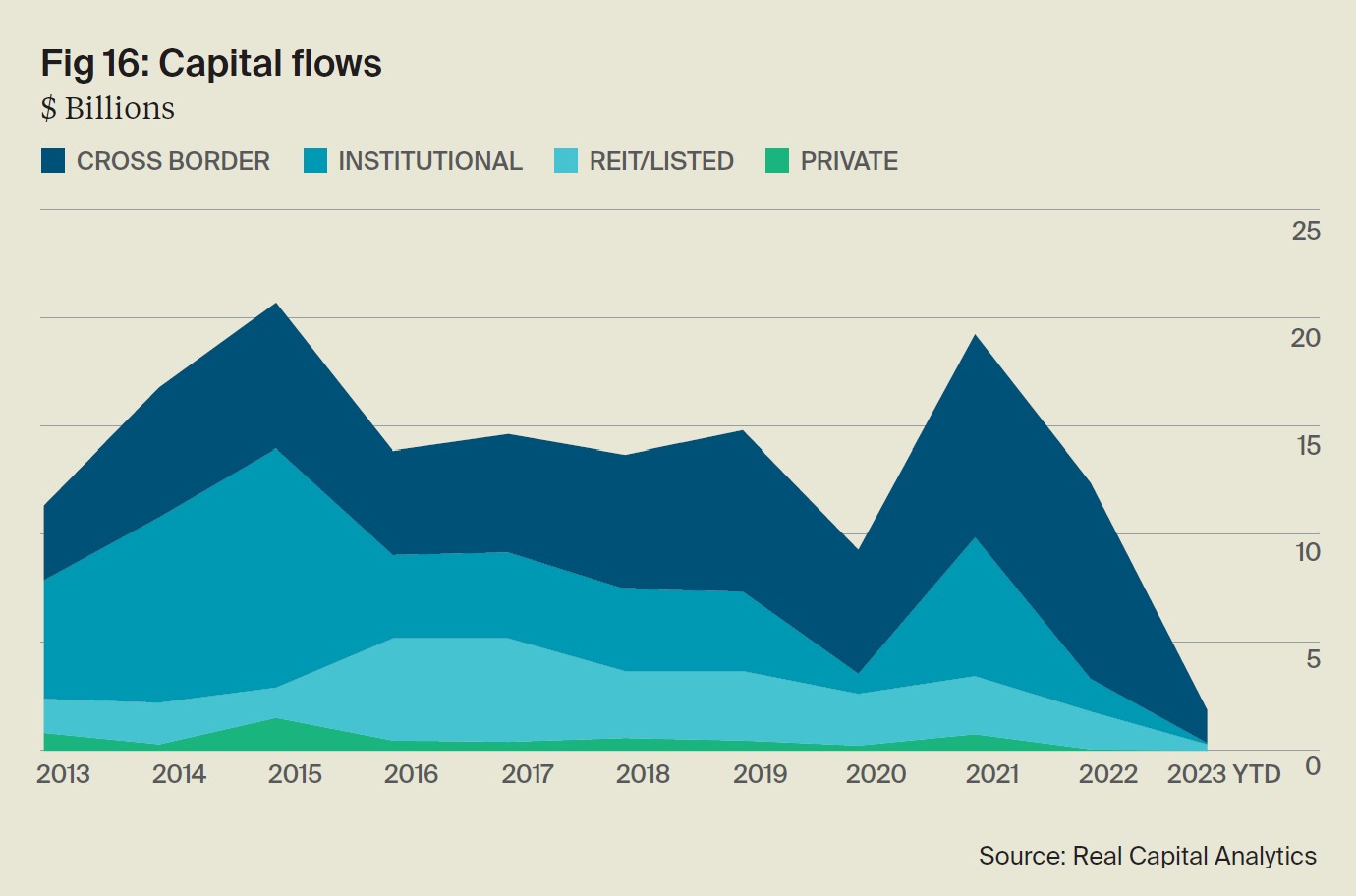

Cross-border investment: Cross-border investment in the global Healthcare sector is growing rapidly. Investors like the sector's variety, ESG reputation, and chance to benefit from increasing demand in developing countries.

Technology and efficiency: Technological advancements are playing a major role in supporting the efficiency of the Healthcare sector and meeting the growing demand for care.

Elderly care: As the population ages, the need for elderly care is increasing rapidly. This is creating a significant opportunity for investors to invest in companies that are developing new and innovative solutions to meet the needs of elderly patients.

Social impact: Investors are increasingly looking to invest in companies that are making a positive social impact. Healthcare companies are working to improve access to care, reduce disparities, and improve patient outcomes to meet the growing demand.

Challenges

Inflation: Rising inflation is putting pressure on Healthcare costs. Care providers need to be able to absorb rising operational costs without impacting delivery of care.

Rising interest rates: Rising interest rates could make it more expensive for Healthcare companies to borrow money. This could reduce investment activity in the sector.

Regulatory uncertainty: Healthcare regulations can vary significantly from country to country. This can create challenges for companies that operate in multiple jurisdictions.

Healthcare investment opportunities

Despite the challenges, there are a number of attractive investment opportunities in the global Healthcare sector.

Specialty care: The Healthcare market in the Middle East, for example, is set to thrive in the next decade, primarily because of the rise in population, especially the ageing population and increasing incidence of chronic and non-communicable diseases.

This will create demand for hospitals, specialty medical centres with a strong paradigm shift towards research, innovation and digital Healthcare solutions.

Medical devices: The medical devices industry is also constantly innovating, developing new devices that can improve patient outcomes. African Healthcare presents extensive growth opportunities in medical devices. Healthcare is a vital sector for the wellbeing and prosperity of Africa.

By 2030, experts estimate that the African Healthcare market will be worth USD $259 billion. Africa is expected to present 14% of health and wellbeing business opportunities, ranking second only to North America, which will have 21% of the opportunities.

Future of the sector

The global Healthcare sector is a complex and dynamic market, but it is also one with significant growth potential for investors who can find good opportunities.

Download the full report for more detailed insight and analysis into global Healthcare including breakdowns of markets across Europe, North America, Asia Pacific, Middle East and Africa.