US economy, heat pumps, and CPI

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

The UK Consumer Prices Index rose 6.7% in the year September, unchanged compared to the previous month.

The reading is a little above the 6.6% economists had been expecting, but on first reading it doesn't tell us much more than we got last month. Core CPI, which excludes volatile items like food eased very slightly to 6.1%, down from 6.2%. The CPI services annual rate rose from 6.8% to 6.9% and remains a primary cause of concern.

We'll keep an eye on swap rates but we're still of the view that mortgage rates should remain largely steady through to the end of the year. Lenders have continued making small reductions in the past ten days, though retail bank margins are fairly thin and we'll probably see a plateau soon.

The US economy

The degree to which rising interest rates have fed into western economies remains uncertain, which is why central bankers are treading increasingly carefully.

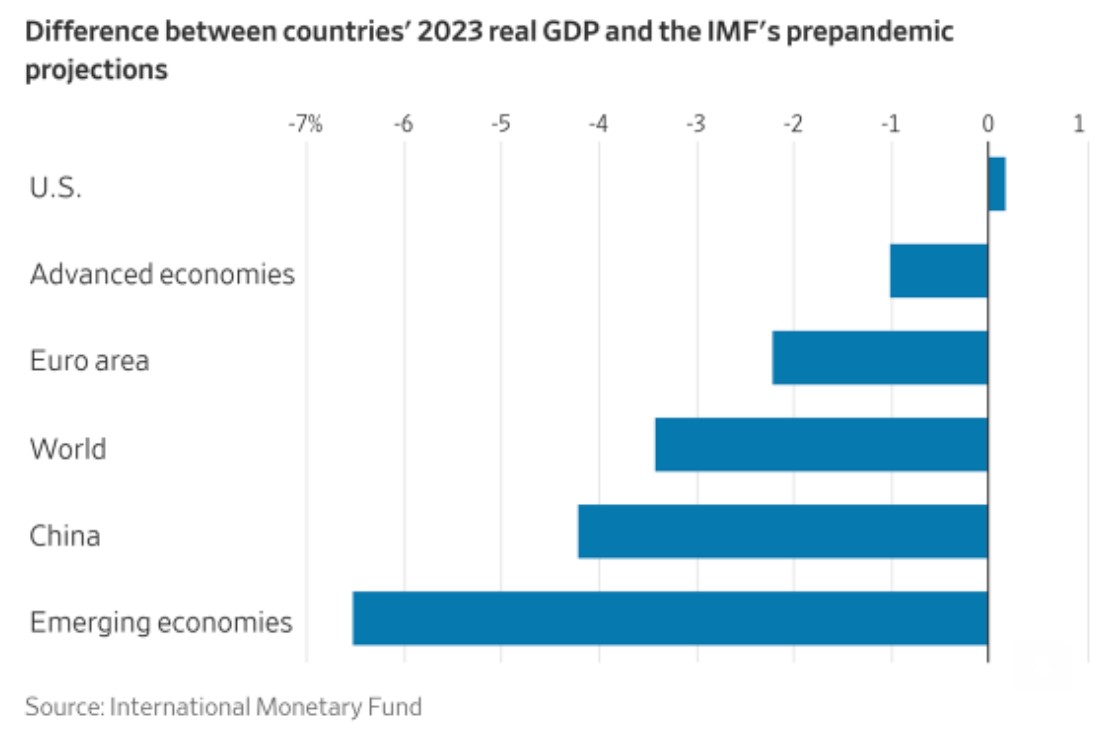

The strength of the US economy has consistently surprised on the upside and is (incredibly) in a better place now than the IMF was predicting back in 2019 - that's despite a global pandemic taking place during the intervening period - see chart below spotted by the economist Justin Wolfers.

A result like that with the Federal Funds Rate at a 22-year high of 5.25% - 5.5% would have seemed impossible a couple of years ago, which is why it's so hard to know how much slowing is still to come. It had looked like the Fed would keep rates on hold when it meets on November 1st, but warm inflation figures published last week and a very robust set of retail figures published yesterday have clouded the outlook.

Heat pumps

The UK government has committed to bringing emissions from buildings down by 50% by the mid 2030s, and to close to zero by 2050, yet it has repeatedly put off making key decisions as to how to green the UK's stock of existing homes.

Whether hydrogen or heat pumps are the best option for heating homes, or what mix of the two might work, was among the biggest questions when I wrote this note in 2021, and little has changed since. In the meantime, other European nations including the Netherlands, France and Poland have committed to heat pumps and accelerated uptake via a combination of effective government policies and incentives (see chart). The Netherlands, for example, offers low interest loans as well as a grant for heat pumps.

The National Infrastructure Commission (NIC) sought to break the deadlock this morning by calling on the government to finally commit to heat pumps:

"Heat pumps and heat networks are the solution. They are highly efficient, available now and being deployed rapidly in other countries. The Commission’s analysis demonstrates that there is no public policy case for hydrogen to be used to heat individual buildings. It should be ruled out as an option to enable an exclusive focus on switching to electrified heat."

Ramping up

The delay has been costly and installations will need to grow by a massive 35% every year in order to switch seven million existing fossil fuel heating systems to heat pumps or heat networks by the initial deadline of 2035. That's up from 14% growth in 2022.

The NIC thinks it's possible. It cites the 51% growth in installations in 2021 in support, but projections from the Climate Change Committee published by the NIC back in March demonstrate how challenging maintaining a similar rate of growth will be (see chart).

We'll see. Subsidies are going to play a central role because the average upfront cost of a heat pump amounts to about £10,000. That subsidy will need to be about £7,000 per household to make the pumps competitive with alternatives, the NIC says.

"This subsidy should encourage take up, grow the market in the near term and drive cost reductions. As cost reductions are realised, the government subsidy can be reduced. However, some degree of subsidy will likely be necessary until 2050 to deliver a low carbon heat solution to all buildings."

In other news...

Developers have responded positively to Keir Starmer’s pro-development rhetoric, but political aims will need to square with economic reality, writes Tom Bill.

There is growing concern in the farming sector that the extra cost of delivering the environmental improvements demanded by policymakers and consumers will not be fairly shared along the food chain, writes Andrew Shirley.

Chris Druce has our latest round up of the most up-to-date property market data as signs of stability emerge.