Edinburgh price declines narrow in Q3 but market remains subdued

Discretionary buyers hesitant but city-centre flats are back in demand.

3 minutes to read

Edinburgh City Index 128.6 / -1.2% Quarterly change / -3.2% Annual change

The pace of decline in Edinburgh property values slowed in the three months to September, with a quarterly fall of 1.2% compared with a fall of 1.8% in Q2.

This took the annual change in the average price of a property in the Scottish capital to -3.2%.

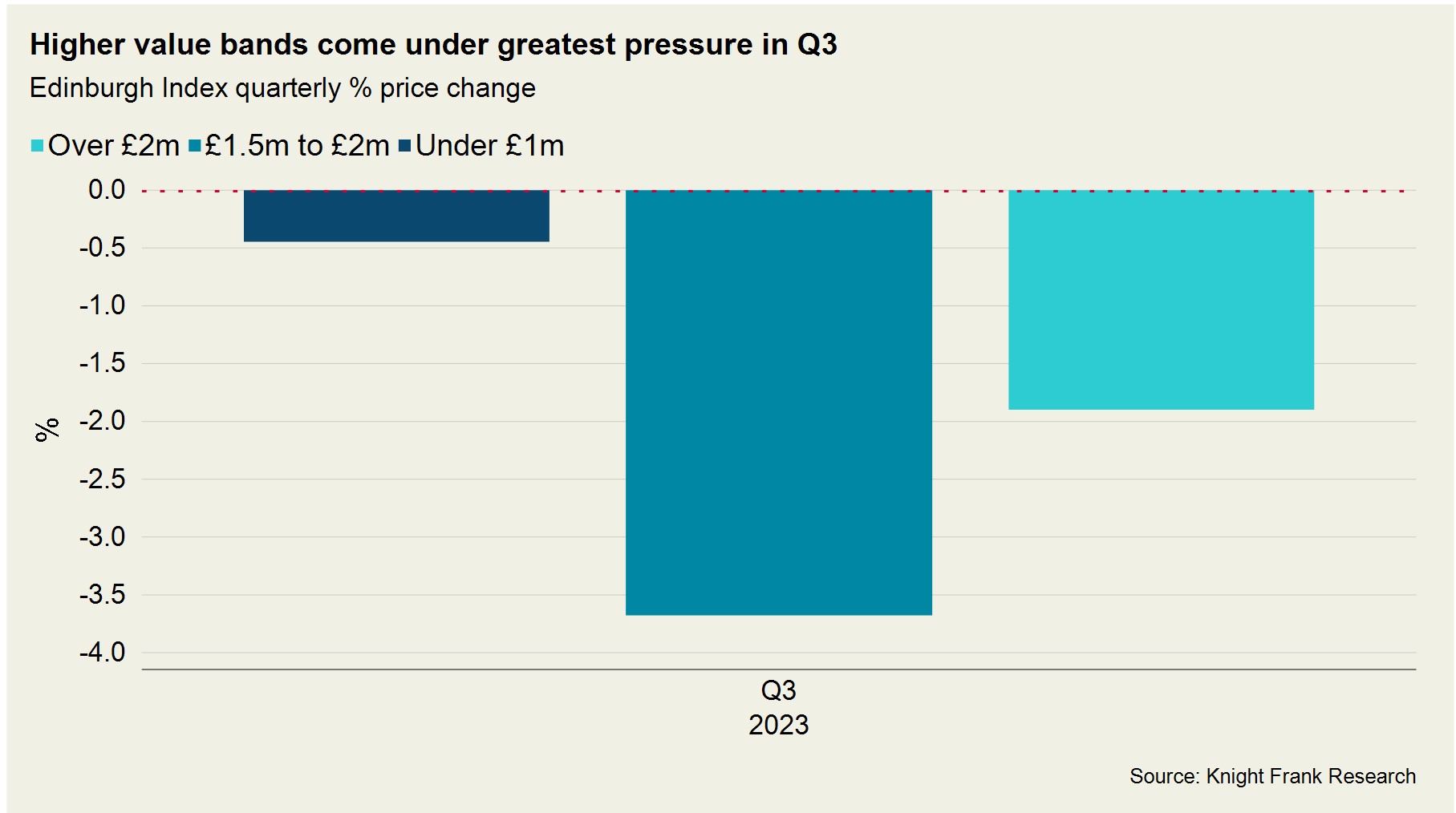

Price declines continued to be more pronounced at the top end of the city market, which saw the largest increases during the pandemic as people sought more space to live and work in.

The average value of a property valued between £1.5m to £2m fell 3.7% in Q3 on a quarterly basis, while at £2m+ the drop was 1.9%.

Meanwhile, homes under £1m saw a 0.4% drop in the same period (see chart).

On an annual basis, homes under £1m have seen values decline by 1.8% while in the £1.5m to £2m value band the decline is 8.1% in the 12 months to September.

Edinburgh with its mix of city amenities, cultural interest and convenience combined with easy access to countryside proved particularly popular during the recent pandemic period, attracting Brits from other parts of the UK.

Average prices peaked last September in Edinburgh having climbed by 22% since the reopening of the market in June 2020. They remained 18.2% higher as of Q3.

The experience in the Scottish capital was like the ‘race for space’ trend elsewhere, which saw activity boom as people upgraded their homes during the pandemic with prime regional prices south of the border climbing by a similar amount.

However, Edinburgh’s price performance is not uniform, with the city centre market bucking the trend and flats staging a comeback.

“Above £1.5m, the market is much more discretionary and within suburban areas of Edinburgh, activity has softened as domestic buyers hold-off their purchasing decisions,” said Edward Douglas-Home, head of Scotland residential at Knight Frank.

“However, in the New Town and West End areas of the city, which attract interest from young professionals as well as international and London-based buyers, the higher value end of the market remains busy,” he added.

Flat prices fell by 0.2% on a quarterly basis in the three months to September compared with a decline of 1.8% for houses.

Having been overlooked during Covid in favour of homes with outdoor space, the average price of a flat increased by 12.3% from June 2020 to September 2023. This compared with average growth of 21.9% for houses in the city. This has boosted the relative affordability of flats at a time when interest rates are at a 15-year high.

That said, higher borrowing costs have continued to supress overall demand. The number of offers made in Edinburgh declined by 18% in the third quarter of 2023 versus the five-year average (excluding 2020).

The uncertain economic backdrop in 2023 is one reason we revised our house price forecasts down this month. We expect UK prime regional prices to decline by 7% this year compared with 5% in March. We forecast prices will then fall by 3% next year before returning to growth after the next general election in 2025.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here