New inflation figures muddy the waters

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

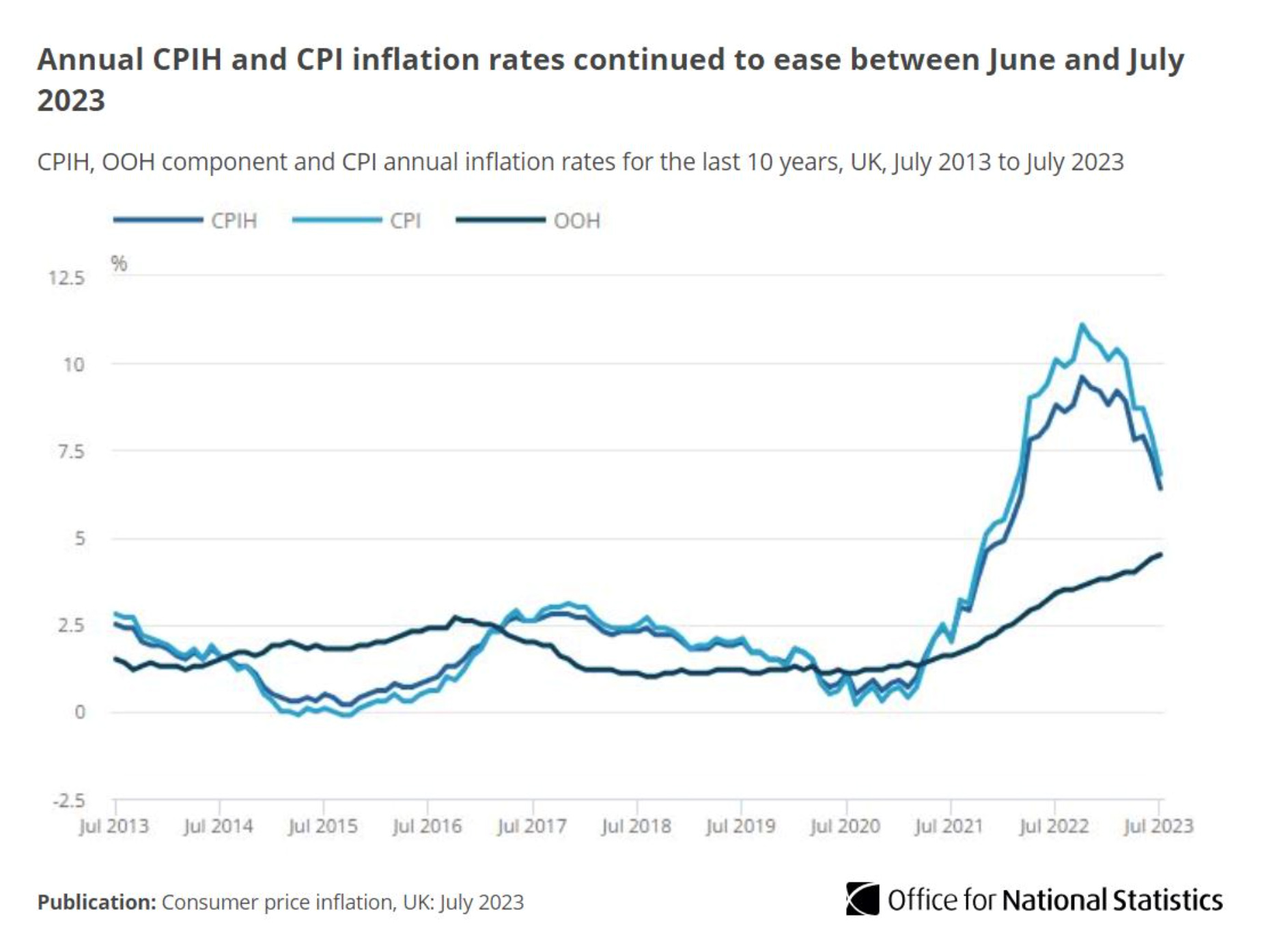

The annual rate of consumer price inflation slowed to 6.8% in July, down from 7.9% in June. Falling gas and electricity prices were the biggest contributors to the easing. Hotels and flights were the largest contributors pushing in the other direction (more on hotels shortly).

This is all broadly in-line with analyst expectations, which could be good news for mortgage rates, though it's far from clear cut. Core CPI and particularly services inflation continue to rise at stubborn rates. Core CPI, which excludes volatile aspects like energy and food, was unchanged at 6.9%. The CPI services annual rate actually rose to 7.4%, from 7.2% a month earlier. That may seem unsurprising given the hot wage data that came through yesterday, although as The Spectator team confirm those wage numbers ought to regarded as a one off blip.

UK CPI is now running 220 basis points above the G20 average, though the spread is now the smallest it's been for almost a year - it was 440 basis points back in March, according to Panmure Gordon chief economist and head of research Simon French.

The outlook for mortgage rates

Swap rates, instruments used by the lenders to price mortgages, crept up after publication of the wage data yesterday and it'll be interesting to see how they move over the course of the day.

Barclays, Natwest and Santander are among several high street lenders that have announced cuts to mortgage rates in recent days. This time last week I said that falling mortgage rates would soon reach a natural plateau. That plateau looks closer now than it did a few days ago.

The end of sub-2% mortgage rates has changed the outlook for many borrowers, but those used to paying interest-only have seen their monthly payments skyrocket. The Financial Conduct Authority yesterday published new research showing that the number of outstanding interest-only mortgages has fallen to 750,000. The number of outstanding part-interest-only mortgages has fallen to 245,000 - together that's about half of 2015 levels.

A little more than a third of respondents to the FCA survey now expect to be unable to repay the outstanding capital at the end of the mortgage term, though the group's modelling suggests that could be closer to half.

Prime house price forecasts

A lot has changed in the global economy since December 2022, when we last produced prime house price forecasts for 26 global cities.

Surging inflation and rising interest rates continued to challenge purchasers in the first half of the year, though so far sales volumes, rather than prices, have suffered the most. Meanwhile, New Zealand has seen four additional rate rises, taking their tally to 12. Canada has introduced a ban on foreign buyers. The Los Angeles Mansion Tax is up and running. Singapore has ramped up stamp duty for non-residents to 60%, from 30%.

You can find our updated forecasts here. Dubai still leads the rankings for 2023, although annual growth is expected to cool to a less frothy 14%, down from 44% last year. Tokyo, Paris, Madrid and Miami complete the top five, with forecast growth of 4% of the calendar year. Perhaps surprisingly, 20 of the 26 cities still expect to see flat or positive price growth in 2023.

The hotels recovery

Hotel revenues are rising amid a bounce back in demand, but inflation continues to weigh on profit margins, according to the latest figures from Philippa Goldstein.

London hotels achieved occupancy of 82% in June, a rise of 3.2 percentage points versus June-2022. Many hotel operators are choosing to prioritise higher rates over a full recovery in occupancy - London hotels recorded an 8.5% increase in the average daily rate (ADR) in June.

London’s Upper-Midscale and Upscale hotels outperformed with a 21-percentage point uplift in H1-2023 occupancy to 77% and 15% growth in ADR.

In other news...

Europe's Golden Visas are booming, despite calls to get rid of them (Bloomberg).