UK retail: riding out the storm

Retail sales have held up far better than virtually anyone anticipated – and are likely to continue to do so for the rest of the year, despite the macro-economic backdrop.

4 minutes to read

As all-consuming as the cost-of-living-crisis narrative is, it fails to fully reflect a consumer market that is highly complex, with an intricate network of moving parts.

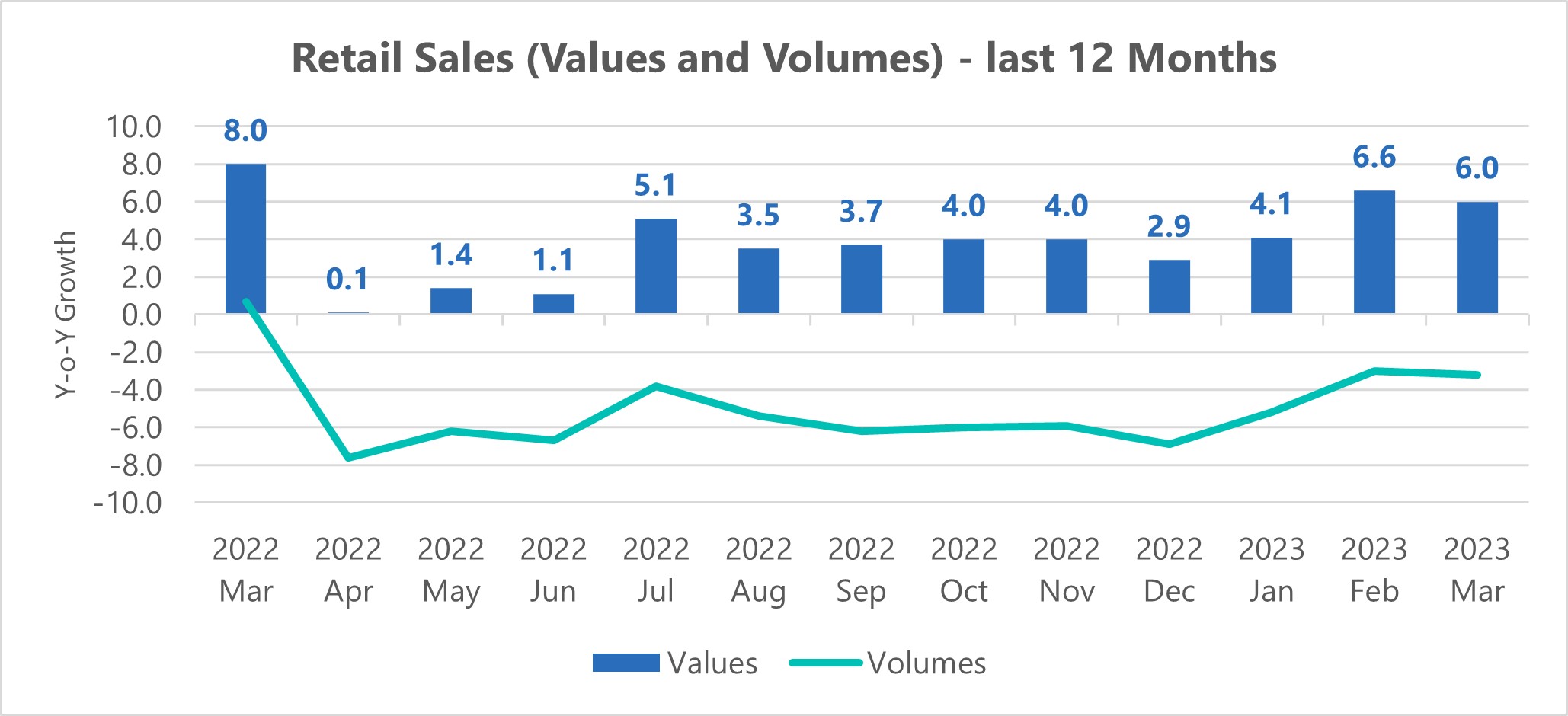

The widely-anticipated slowdown at Christmas simply did not materialise (Q4 2022 retail sales values in fact grew +3.6% y-o-y), nor was this a “last hurrah” as many economists lazily concluded (Q1 2023 retail sales value growth accelerating to +5.6%).

Retail sales volumes, on the other hand, do reflect the negative effects of inflation (Q4 2022: -6.3%, Q1 2023: -3.8%). Effectively, this means that consumers are tightening their belts in so far as they are buying less products, but are still spending more money.

Although far from ideal, this is infinitely more palatable for the retail industry than the situation during Covid when we were in the unprecedented position of both values and volumes collapsing (e.g. Q2 2022 values -7.9%, volumes -12.4%).

The experience of previous recessions is that, contrary to economic logic, retail sales actually remain robust, retail being one of the less discretionary consumer spending categories (and actually being a relief outlet for many consumers).

With the memory of lockdowns still fresh and a portion of “accidental savings” still accrued from this period, for many consumers there is both the means and propensity to continue spending.

For 2023 as a whole, Knight Frank forecasts that retail sales values will grow by +4% to +5%. Realistically, retail sales volumes will not return to positive growth territory until Q4 2023 when inflation eases to a tangible degree. For FY 2023, therefore, volumes are forecast to decline by -2% to -3%.

Source: ONS, Knight Frank

Occupier markets – battle hardened rather than brittle

No consumer meltdown and no occupier bloodbath – the doom mongers anticipating massive retailer fall-out in 2023 have been proved wrong.

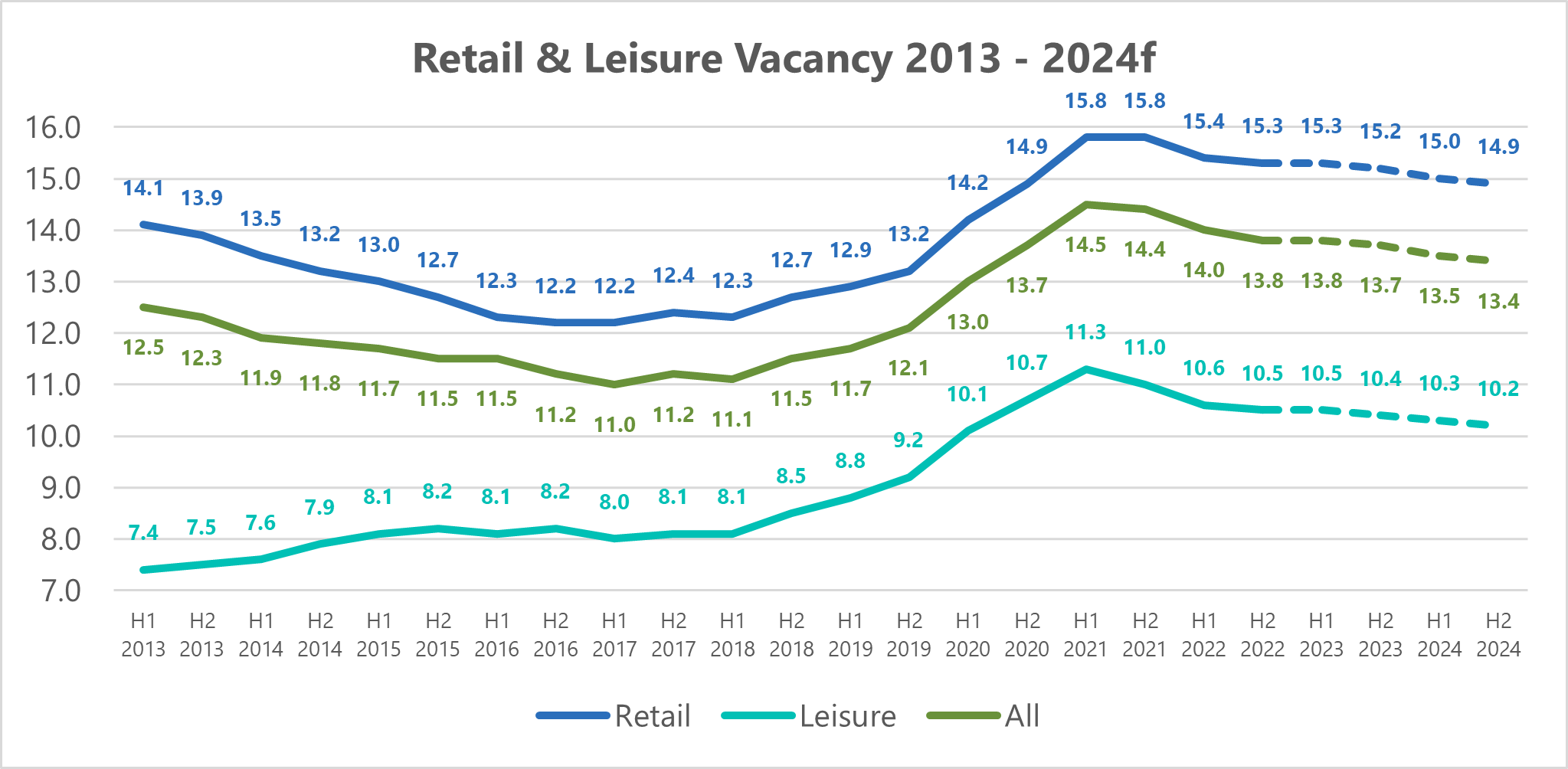

Retail occupational markets are showing signs of stabilisation rather than distress. Data from LDC show that high street vacancy rates at 2022 year-end were 13.8%, a gradual improvement on the 14.4% reported at the end of 2021.

Despite current challenges to the market, this positive direction of travel is forecast to continue, with vacancy rates reducing to 13.4% by the end of 2024. There was a discernible slowdown in store closures (48,694) in 2022 and a distinct uptick in new openings (45,329) meaning the net reduction in units (-3.365) was the lowest since 2016.

CVA/administration activity has thankfully been very muted this year, for two key reasons.

Firstly, in 2022, the trading environment for retailers was fairly benign, a period of relative calm bookended by the chaos of Covid/lockdown and the mounting cost of living crisis.

Secondly, the wheat has effectively already been separated from the chaff during the pandemic, the weaker players already succumbing to leave a much fitter residual competitor set. The decks have already been cleared, to a certain degree.

The latter is a key factor in our conviction that the degree of occupier fall-out will be less severe in 2023 than in previous recessions. Trading will undoubtedly become far tougher in 2023 than it has been in 2022, particularly in terms of rising operating costs. But most retailers are much fitter than they were coming into previous recessions and while by no means immune to the storm, they at least have stronger defences. There will undoubtedly be casualties, but maybe fewer than the market is anticipating – and no bloodbath.

Source: LDC, Knight Frank

Retail property: an unlikely star?

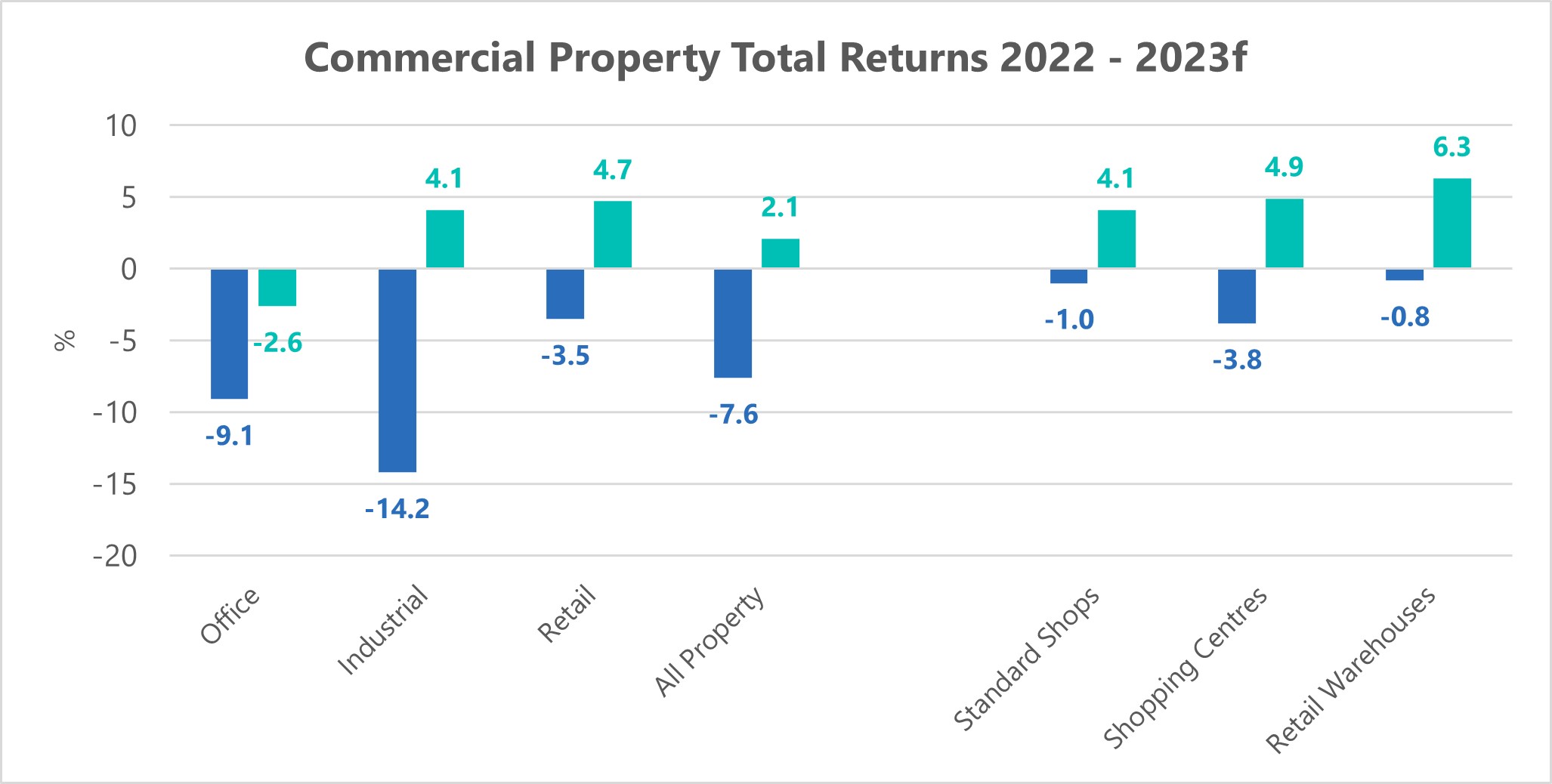

For many years the “ugly duckling” of the commercial real estate market, retail has recently emerged as the best (or rather least badly) performing sub-sector.

Retail delivered total returns of -3.5% in 2022, compared to -7.6% for all commercial property (vs. offices -9.1% and industrial -14.2%). Nor is this merely a flash in the pan, as a similar pattern is forecast for this year (retail +4.7% vs all property +2.1%).

This out-performance does, of course, need qualification. Retail has undergone many years of re-basing, so this performance is being leveraged off a dramatically re-defined starting point. And the recovery is largely being driven by retail warehousing, rather than the retail sub-sectors. And in 2022 at least, it was being driven purely by income return (+5.1%) rather than capital growth (-8.2%).

These caveats notwithstanding, the retail property market is at significant turning point, as underlined by more granular monthly data.

By March 2023, retail warehousing had cemented its place as the top performing CRE sub-sector, reporting both strong income return (+0.56%) and positive capital growth (+1.29%). Shopping centres continue to enjoy strong income return (+0.76%) and on current trajectory, are expected to return to positive capital growth in Q2 2023 – for the first time since 2016.

Source: Real Estate Forecasting, Knight Frank