UK inflation and wage growth surprises again

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Inflation

The UK's annual rate of Consumer Price Inflation slowed to 10.1% in March, down from 10.4% in February, according to official figures out this morning. That's a little above expectations – economists had expected the rate to slip into single digits for the first time since August.

While the prices of some fuels are falling, the cost of clothing, furniture and household goods continue to rise, though more slowly than a year ago. That's being partially offset by the cost of food, which continues to climb steeply.

Bringing inflation back to target is proving to be a frustratingly slow process, having only eased from the peak of 11.1% in October. However, the figures will start to look much better from next month, when annual comparisons no longer pre-date the energy crisis.

On that front, conditions are improving far quicker than looked likely during winter. Gas storage is running well ahead of levels seen this time last year and the EU's target of hitting 90% capacity by November could be hit by July or August, according to analysts quoted by the FT. Easing energy costs will seep slowly into the cost of other goods. Energy costs are partly to blame for high food prices, for example.

Wages

Today's inflation reading - plus pay data out yesterday - increases the likelihood that the Bank of England will opt to raise the base rate again on May 11th. We'll cover the market's reaction on Friday.

Annual pay growth for the three months to January was revised up to 5.9% and held at that level for the three months to February - above all forecasts of economists polled by Reuters, which had pointed to a drop to 5.1%.

The performance of the UK economy, while by no means stellar, keeps surprising on the upside. That, plus the likelihood we'll see more tightening of monetary policy, is pushing sterling higher. The pound is hovering around $1.24 and is 2023's best performing G-10 currency.

Optimism

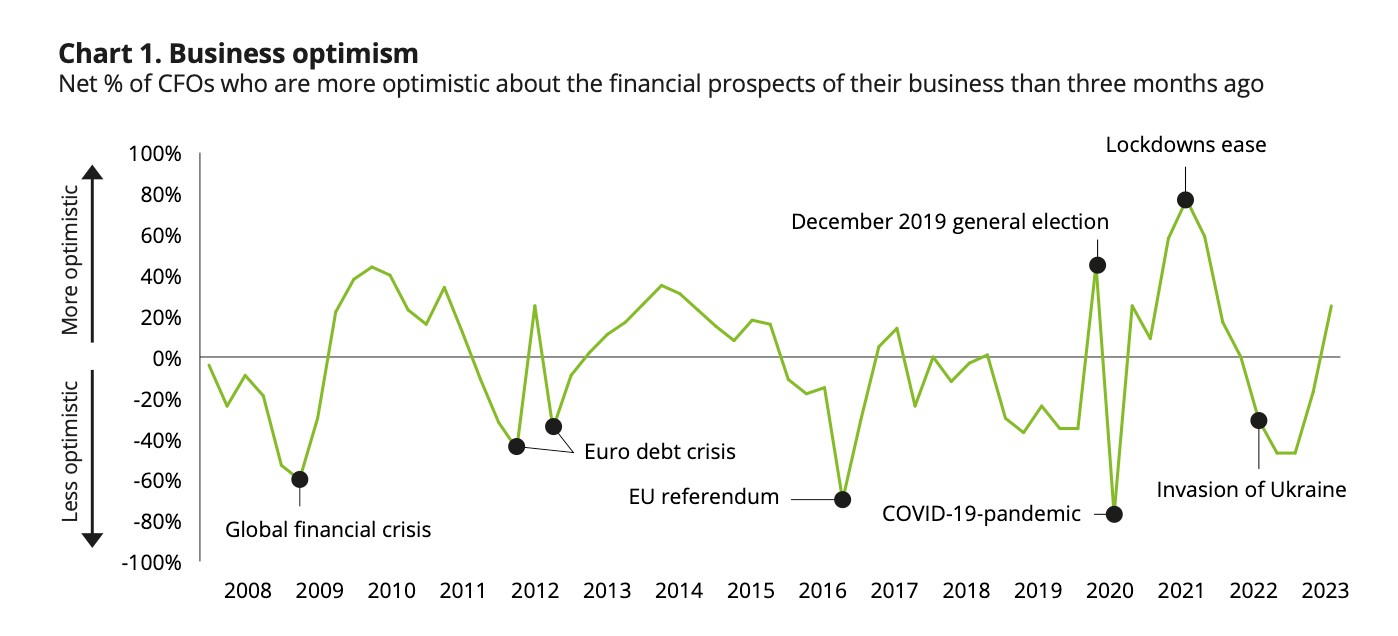

Deloitte's latest survey of 64 chief financial officers of the UK's largest firms builds on that theme. Sentiment has improved significantly since the start of the year - in fact, the survey conducted between 21 March and 3 April registered the largest increase in confidence since the rollout of the Covid-19 vaccines.

Optimism is now running well above the long-run average and the failure of Silicon Valley Bank on March 10th seems "to have had little if any impact" on sentiment. CFOs’ perceptions of external financial and economic uncertainty fell at the fastest rate since Deloitte first asked the question more than 12 years ago.

While sentiment has bounced back, respondents say they will maintain a defensive strategy. Risk appetite is below normal levels and CFOs are heavily focussed on cost control and building up cash. Although CFOs’ revenue expectations have jumped, almost two-thirds of respondents expect margins to shrink in the next 12 months, reflecting continued growth in input costs.

China

China's economy grew at a faster-than-expected annual rate of 4.5% in the first quarter. Growth in exports, infrastructure investment, retail sales and property prices all contributed to the recovery.

Earlier this year, the Chinese government said it would target economic growth of about 5% this year - one of its lowest growth targets in decades. That should prove far too modest if current trends continue. JPMorgan raised its 2023 growth outlook to 6.4% this morning. Citi raised its forecast to 6.1%.

Nevertheless, the government said it is concerned about weak demand despite retail sales hitting a nearly two-year high. Officials are working on policies to support "big ticket", service and rural consumption.

In other news....

Tom Bill explains why you should handle house price data with care.

Elsewhere - migrations of the super rich (Bloomberg), tycoon to sell £75 million mansion that housed JPMorgan (Bloomberg), Landsec puts £20m into diversity drive (Times), UK insolvencies rise 16% in March (FT), and finally, buoyant European airlines shrug off economic gloom (FT).

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here