A transformed outlook for global interest rates

Making sense of the latest trends in property and economics from around the globe

2 minutes to read

Prime rents

Global prime rents surged in the wake of the pandemic. Stock levels plummeted as landlords sold into strong sales markets. The revival of city living swelled demand for a shrinking number of available homes.

The frenetic pace of growth is now beginning to ease. Our Prime Global Rental Index increased 10.3% in the year to December 2022, down from a peak of 11.8% in March 2022.

Singapore, where stock levels are particularly constrained, leads the Q4 2022 rankings. Annual rental growth hit 28% during the period, up from 23% in Q3. New visa rules introduced in January 2023 offer a five-year work visa for specific tech-based professionals who earn over S$30,000 per month, which is likely to fuel more growth.

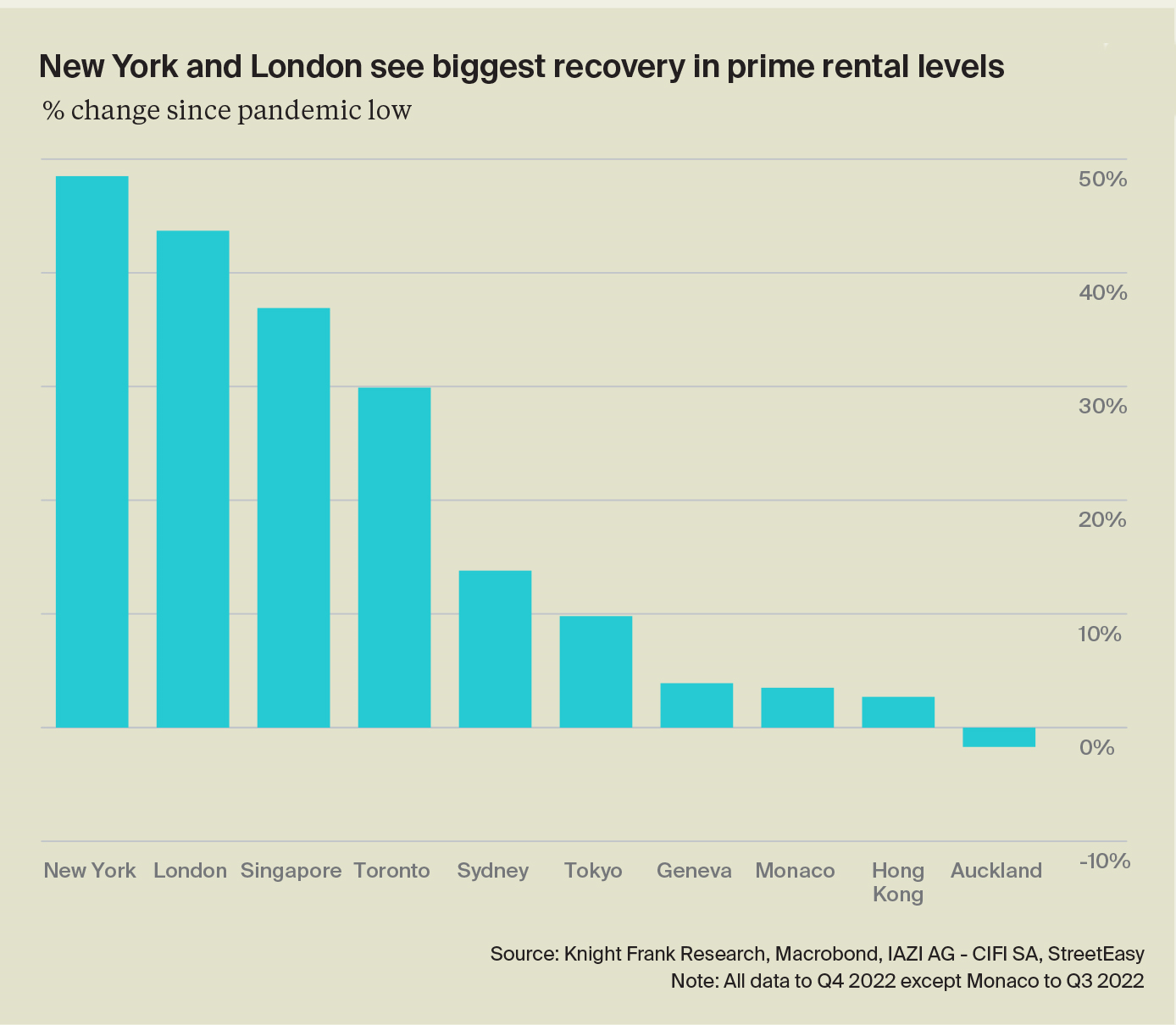

New York has been knocked into second spot. Rents are now up 48% since their pandemic low in Q4 2020 (see chart). You can read more here.

Lower inflation or financial stability - pick one

On the face of it, the collapse of Silicon Valley Bank has transformed the outlook for interest rates.

On March 8th, two days before SVB toppled, market pricing implied a roughly 80% chance of a 50bps hike at this month's Federal Reserve meeting. That dropped to zero during the subsequent days. The latest tally from CME implies a roughly 82% chance of a 25bps move and a 18% chance of a hold.

Imminent peak rates and even the prospect of rate cuts this year would be transformative for real estate market activity, but also high risk in terms of inflation. The Fed's apparent choice between prioritising lower inflation or guaranteeing financial stability is an unenviable one.

That choice was encapsulated by yesterday's Consumer Price Index Report, which largely reinforced themes from last month. Core CPI rose 0.5% in February and 5.5% on a 12-month basis - far too high for talk of a dovish pivot - yet here we are.

Peak rates

Bets on peak rates at both the Bank of England and European Central Bank have also been easing, as Will Matthews notes here.

The SVB situation is the major factor, but various indicators published in recent weeks suggest inflation is moving in the right direction. Input cost inflation in the latest S&P Global construction PMI was the lowest since November 2020, for example. Meanwhile, figures published by the ONS yesterday showed that basic pay excluding bonuses rose 6.5% in Q1, down from 6.7% in Q4. That's the first slowdown in that measure since late 2021.

Investors are putting the chance of the BoE pausing its rate hikes next week at about 40%. Investors now expect 50 basis points of tightening over the next four meetings, half of what was baked in last week.

In other news...

Claire Williams on positive signals for Industrial and Logistics, despite the downside risks.

Mark Topliff on future proofing the rural scene.

Elsewhere - Hunt sets out 'investment zones' ahead of budget (Reuters), and finally, China’s consumer spending rebounds after end of Covid curbs (FT)