The shortage of residential development land

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

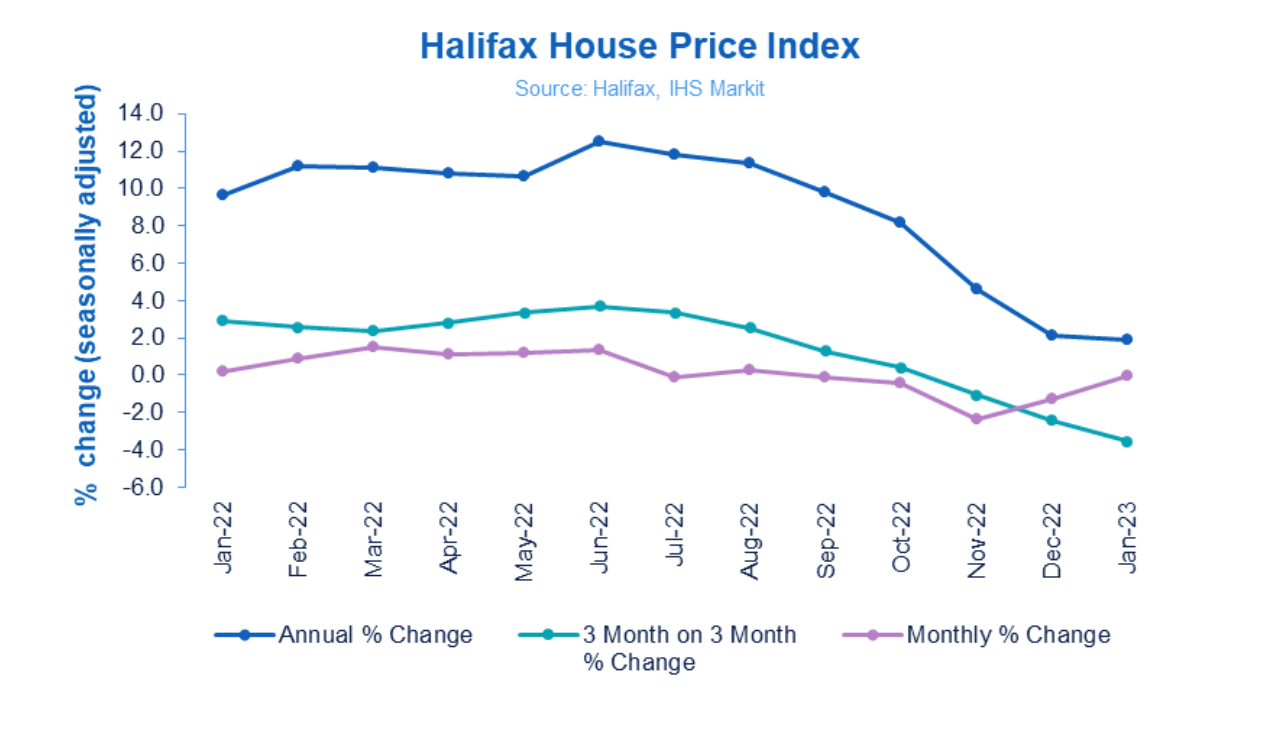

UK house prices

UK house prices stabalised in January following four monthly contractions, according to the Halifax House Price Index. The flat reading brings annual growth to 1.9%, from 2.1% a month earlier (see chart).

January can be a strange month for housing market data, but it's one of several readings that suggest activity has surprised on the upside since the new year. Here is Knight Frank head of UK residential research Tom Bill:

"Some discretionary demand has disappeared but most buyers need to move and have accepted the fact that a 13-year period of ultra-low rates is over. As budgets adjust to higher rates, we think prices will fall by 5% this year but offers are still exceeding the asking price in some areas. Unemployment remains low and inflation appears to have peaked, so you wouldn’t rule out the housing market surprising on the upside as it did during the pandemic.”

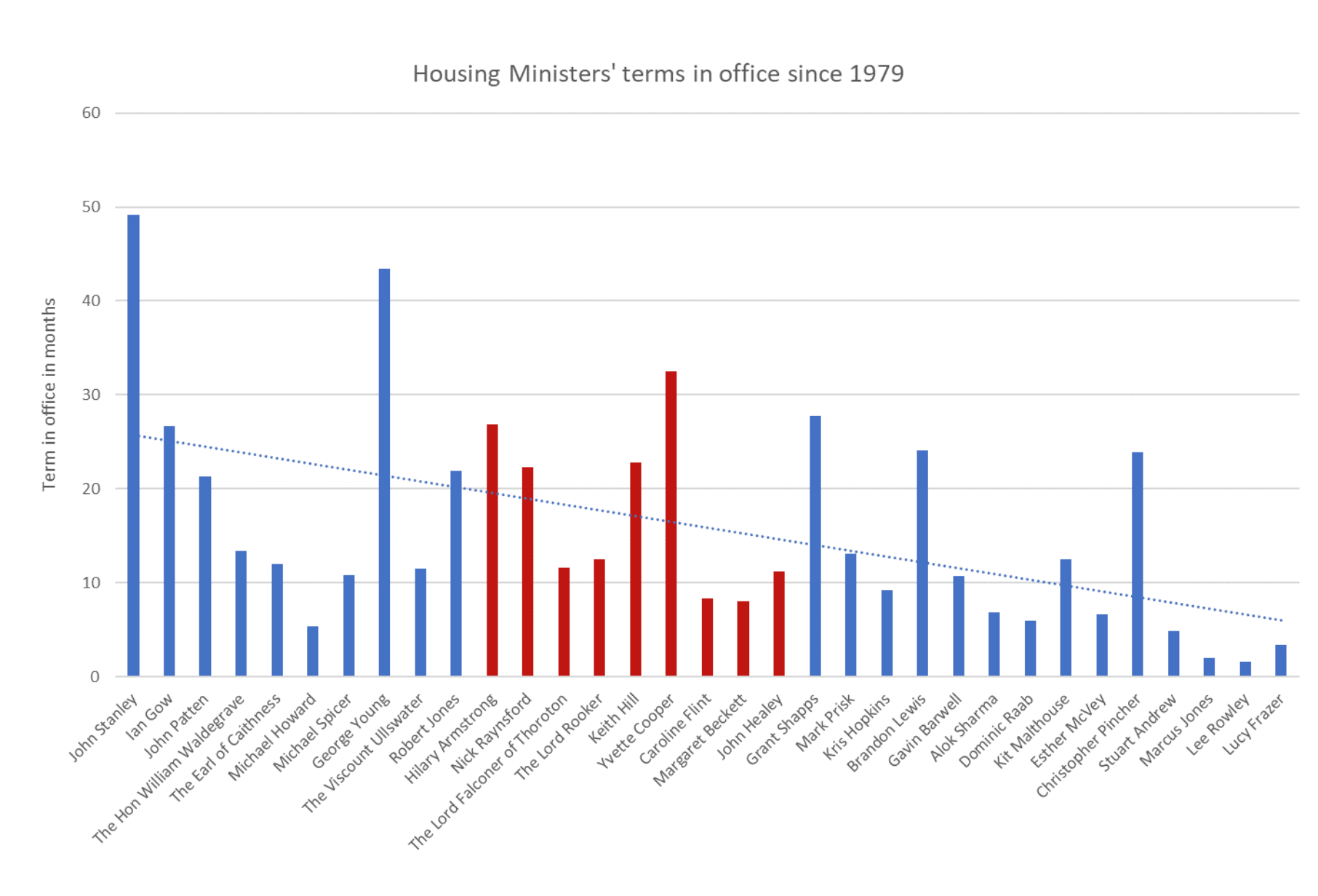

Reshuffling

Prime Minister Rishi Sunak created four new government departments yesterday as part of a reshuffle that the Times calls "the biggest shake up of Whitehall since Brexit". The new units include a department for science, technology and innovation and another for energy security and net zero.

Housing Minister Lucy Frazer will take the Culture Secretary brief. Rachel McLean becomes the fifth housing minister in the past year and the 15th since the Conservatives came to power in 2010 (see chart).

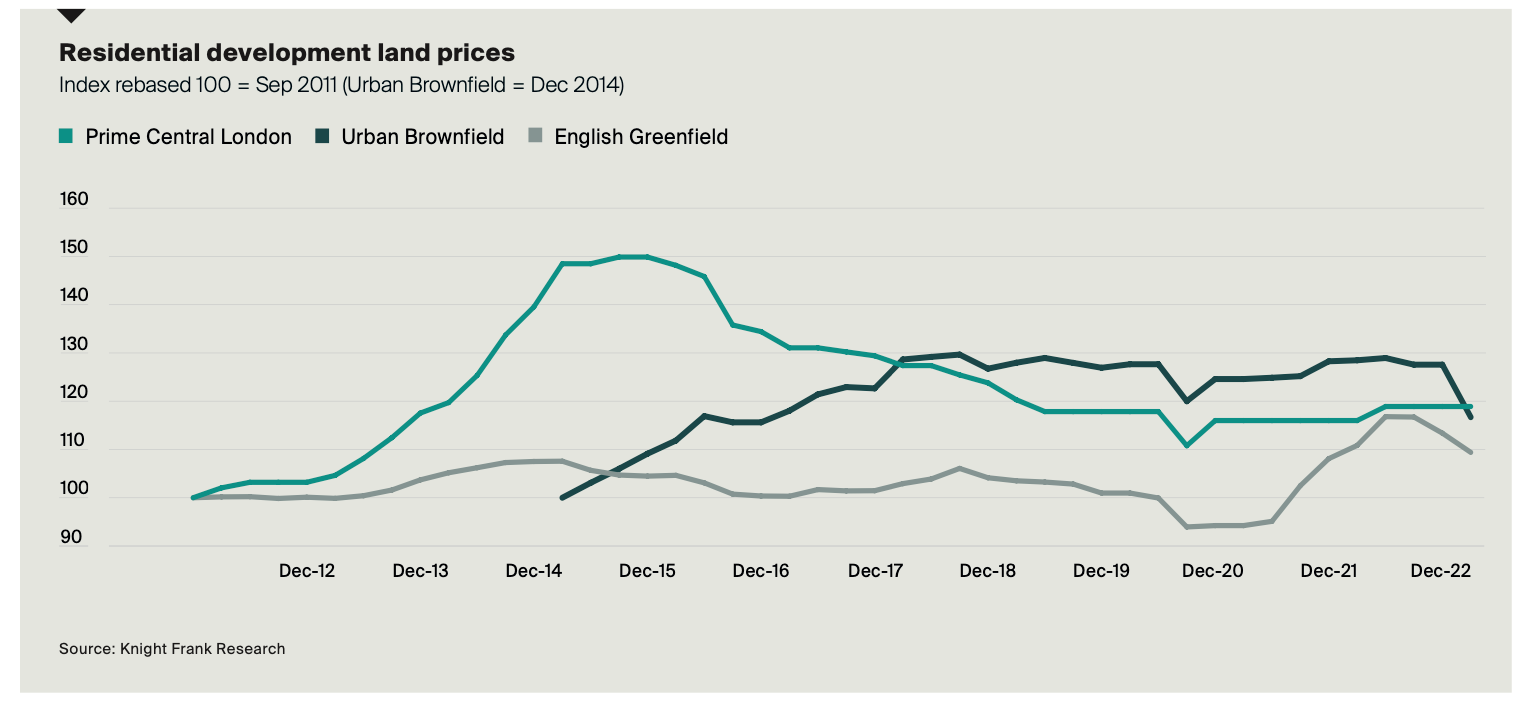

The land shortage

A slowdown in the private sales market and higher financing costs in the wake of September’s mini budget put downwards pressure on residential development land values in the final three months of 2022.

UK greenfield and urban brownfield values fell on average by 3.5% and 8.5% in Q4 2022, taking the annual change to -1.3% and -9.2% respectively, according to Knight Frank data. In prime central London an ongoing scarcity of sites for sale meant values bucked the national trend and were flat on a quarterly basis and up by 2.5% annually (see chart).

A lack of available land will mitigate falls in land values during the months ahead. Nearly 85% of respondents to our survey of volume and SME housebuilders across the UK reported that land availability was either limited or very limited. Land buyers becoming more selective, too, which we expect will lead to a more tiered land market. Allocated sites of between 100-250 units in core locations that are offered subject to planning are in highest demand. That said, there is evidence that some land deals are taking longer to complete, or having payment terms amended. You can read more in our Residential Development Land Index here.

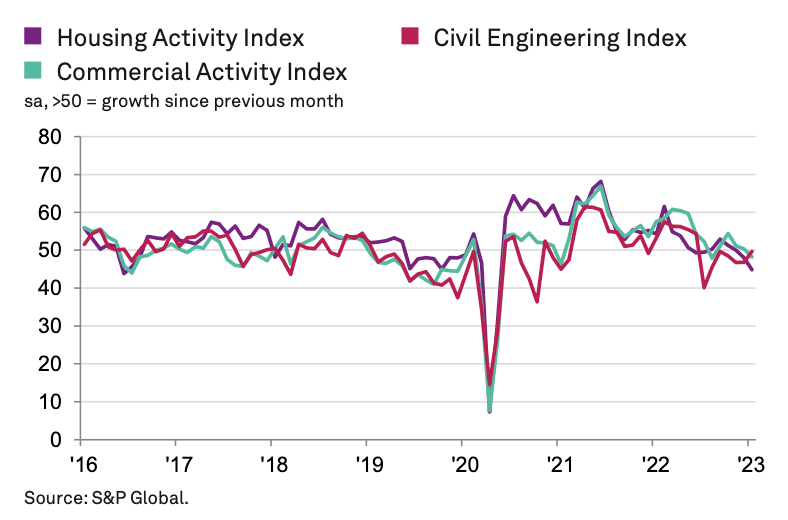

Construction sentiment improves

UK construction companies reported another downturn in activity during January, citing weaker client demand and fewer new project starts, according to the S&P Global / CIPS UK Construction PMI.

Housebuilding was the weakest-performing category of construction output in January, with the rate of contraction the steepest since May 2020 (see chart). Lower volumes of work were attributed to rising borrowing costs, unfavourable market conditions and greater caution among clients.

However, sentiment rebounded considerably during the month. The measure of business confidence hit its highest level for six months, with respondents noting that "the general economic outlook appeared to have improved, while some cited tentative signs of a turnaround in sales enquiries."

A separate survey from Deloitte showed that construction outside London held up pretty well last year.

In other news...

Get cracking on climate transition plans, UK watchdog tells firms (Reuters), UK pay grows at slowest pace in 21 months (Reuters), layoffs at Zoom (Telegraph), Wework's Adam Neumann is back (Bloomberg), and finally, London office landlord that timed the last crash is ready to build (Bloomberg).