Chinese Mainland Insights by Ying Shin Lee

Ying Shin Lee, Managing Director, Knight Frank Chinese Mainland, shares with us her views on the outlook for China's real estate market in 2023.

3 minutes to read

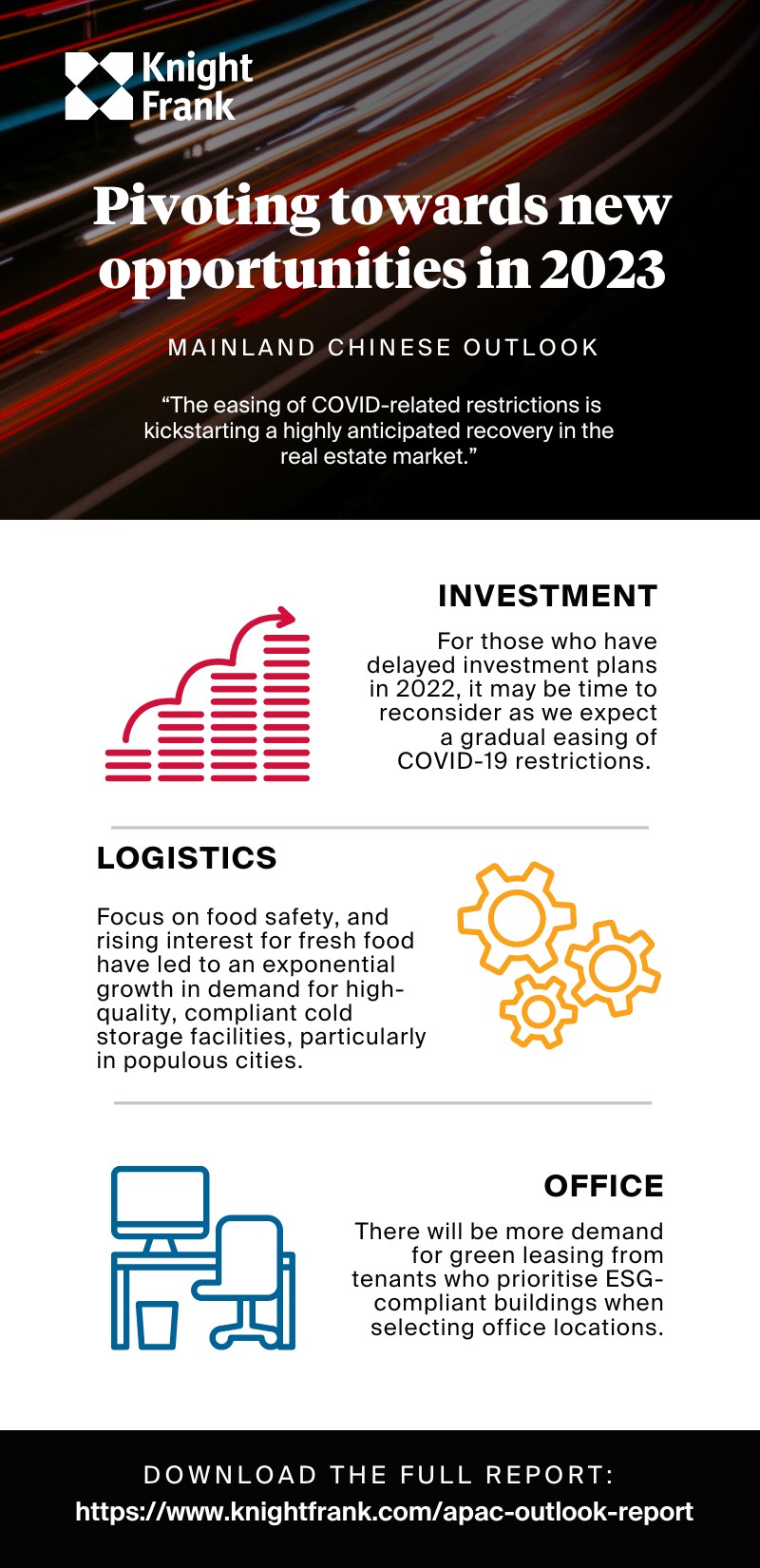

Overall, in 2023, we expect a gradual easing of the Covid-related restrictions, bringing about a recovery much awaited from the depressed market activities in 2022. Across the board, the speed of this recovery very much depends on the industry-specific policies.

Here are some bright sparks we are anticipating.

Growing awareness of ESG agenda

Carbon emissions reduction and pollution control are key areas in the Chinese Mainland. This drive is felt even more strongly in Tier 1 cities such as Beijing, Shanghai, Guangzhou and Shenzhen. Contributing to slowing down climate change is a commitment that requires all aspects of social activities as more occupiers have started to set tangible corporate carbon reduction goals.

Green buildings become a priority for many occupiers when choosing a new location, and this trend will continue to gain momentum.

Green leasing can better align financial incentives and sustainability goals between landlords and tenants in the long run. Green leasing also allows landlords and tenants to reap the benefits of energy efficiency investments and incentivise or obligate both parties to work together to ensure that buildings are leased, operated and managed in a sustainable manner.

A world-class innovative biomedical industry cluster to be established

The Covid-19 pandemic highlighted the need for the world’s largest population to accelerate its innovation in its biomedical R&D capabilities. The fast-growing biomedical industry has helped to accelerate the demand for business park space from a wide range of industry participants, such as pharmaceutical, drug distribution and R&D organisations.

As the country demands higher quality research and development capabilities, so do R&D occupiers for higher quality space. Landlords with high-quality spaces and relevant asset management capabilities now command a significant premium in rents over the general market stock.

While the location is important, it is equally important to build high-quality facilities with strong management expertise to ensure rental rate maximisation. We also advise tenants to look for the same qualities when selecting their space to ensure unhindered occupation.

Quality cold chain storage space

The growing focus on food safety and the growth in online fresh food retail catalysed by the pandemic control measures have led to an exponential increase in demand for high-quality, compliant cold storage facilities, particularly in populous cities. As the pandemic control measures are lifted across the country, the hospitality industry will be able to recover with higher levels of activities, pushing demand for such spaces upward.

Demand for high-quality cold chain storage will continue to trend strong, leading to a landlord-favourable market for this sub-segment. We expect more leasing and investment demand for cold chain storage space coming to the market in 2023.

Tenants should consider strategic footprint distribution in key cities to avoid potential disruptions in the supply chain due to the tight supply of new cold storage facilities. This is a favourable investment market as the underlying driver of this sector is largely domestic demand outstripping supply with few alternatives to resolve the gap. Landlords looking to maximise yields can consider converting ambient warehouses to compliant cold storage facilities, particularly in locations well-suited for urban distribution.

Trends for 2023

For those who have paused any investment plans in 2023, it may be time to start relooking into them as the Covid-related restrictions are lifted. Past uncertainty around the political climate has been addressed as the country successfully completed its 20th People’s Congress. We look forward to a steady and sustainable recovery from the disruptions in the past years.