Pent-up Covid demand boosts super-prime activity in London

Sales volumes above £10 million remain high as international travel resumes, while cash buyers and a weak pound support activity.

4 minutes to read

The release of pent-up demand following the uncertainty of Brexit and the frustration of Covid travel restrictions has boosted activity in London’s £10 million-plus property market.

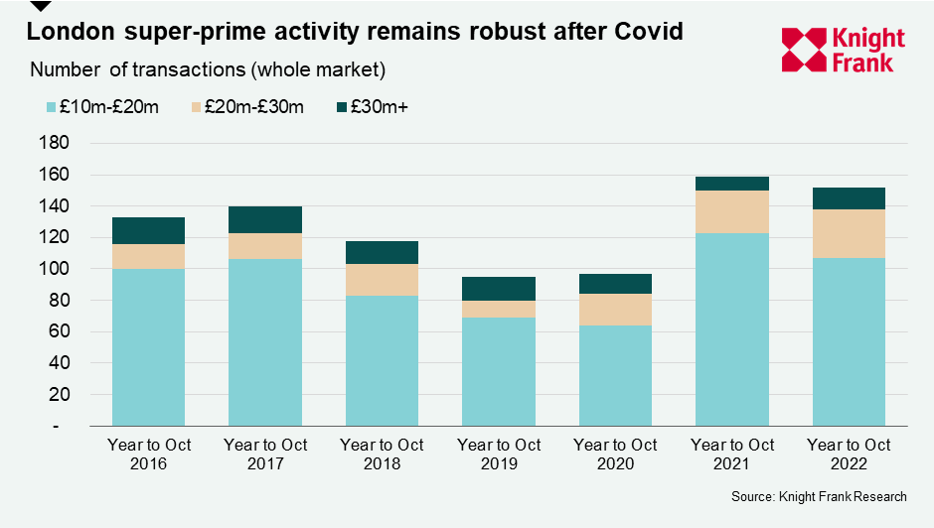

There were 152 super-prime sales in the year to October 2022, whole-market data shows. The figure was down slightly on the previous 12 months (159), though it may rise as Land Registry records update.

Either way, the figure was higher than any of the previous five years, as the graph shows. A total of £2.8 billion was spent in the latest 12-month period, which was the most in seven years.

“Brexit made buyers hesitate and Covid forced them to stay at home, so frustrated demand is still working its way through the system,” said Paddy Dring, global head of prime sales at Knight Frank. “However, other risks are now on the horizon, including rising mortgage rates and speculation that house prices will fall. It can lead to expectation gaps, however marginal, between what buyers and sellers perceive as fair value.”

We forecast that UK prices will fall by around 10% over the next two years as the lending landscape becomes tougher after 13 years of ultra-low rates.

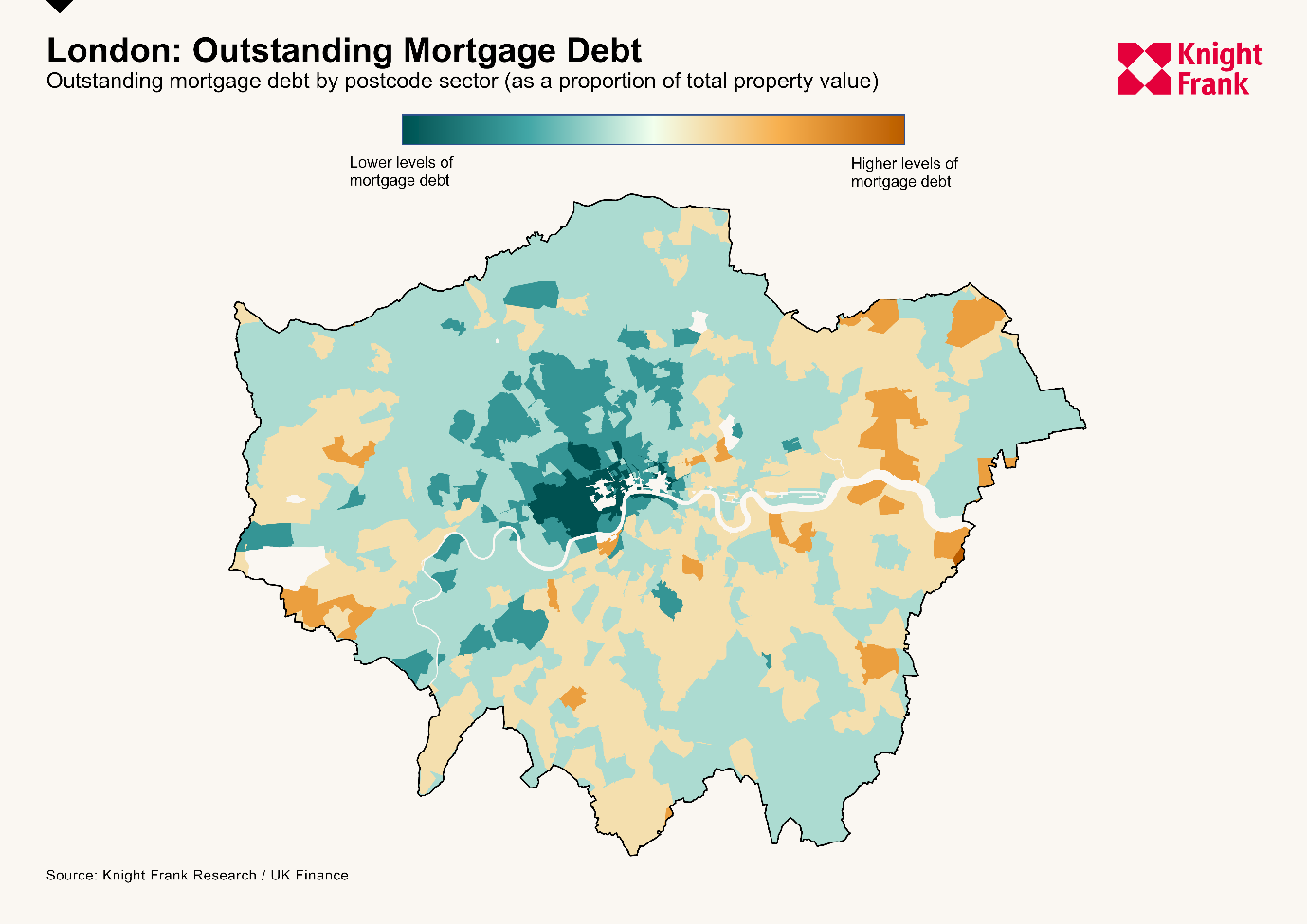

However, prime residential markets in the capital will be more insulated than the rest of the country from rising rates due to lower levels of mortgage debt, as the map shows.

Central London has one of the biggest proportions of cash buyers in the country, as we have previously explored. Above £10 million, 54% of buyers have used cash in the last five years, Knight Frank data shows.

We expect average prices in the second-hand market in prime central London (PCL) to fall by 3% next year, taking them back to the level of January this year. We forecast that prices will rise by 7.5% in the five years to 2026 in PCL. New-build values may not move at the same rate.

There are two other factors that will underpin demand in the short to medium term.

First, prices for £10 million-plus properties represent relative value compared to the last peak. Average prices in October were 12.2% lower than they were in September 2015.

Second, when you combine the price decline with the weakness of Sterling, discounts of around 50% are available for overseas buyers in some PCL postcodes, as we explored here.

“Combined with the impact of the strong dollar, the ‘Rishi effect’ has settled the market after the mini-Budget,” said Rory Penn, head of London sales at Knight Frank. “While the global economy may be slowing down, private wealth will continue to be created around the world that will find its way to London.”

Several high-quality new-build developments have pushed activity between £20 million and £30 million to a six-year high, said Rupert des Forges, head of prime central London developments at Knight Frank. There were a total of 31 sales between £20 million and £30 million in the year to October 2022.

“London remains a focus for high-net worth individuals as a relative safe haven due to global political and economic uncertainty as well as the attraction of a weak pound,” said Rupert. “October was the strongest month on record in terms of business transacted by our PCL development team. The supply of large spaces in the West End is now reduced, an apartment over 300 square metres is increasingly difficult to secure.”

The pipeline of £10 million-plus new homes has dipped for reasons that include increased land, labour and construction costs.

Another uncertainty facing the market is the prospect of a general election before January 2025. Following the Autumn Statement earlier this month, the opposition Labour Party criticised the government for its stance on affluent individuals who are non-domiciled for tax purposes.

While Chancellor Jeremy Hunt underlined the economic benefits to the UK of the non-dom regime, pressure may continue to build as we approach the election. As we saw with new rates of stamp duty introduced in 2014 for high-value property, ideas that start life on the opposition benches can influence government policy.

“We’re not quite in election countdown mode yet but some discretionary buyers are becoming more cautious about the political landscape,” said Rory. “For now, the super-prime market in London has very much found its feet again.”