What does the 2021 Census tell us about the need for Seniors Housing?

There remains a compelling investment case for assets that benefit from changing ways of living, and long-term shifts in demography, such as seniors housing.

2 minutes to read

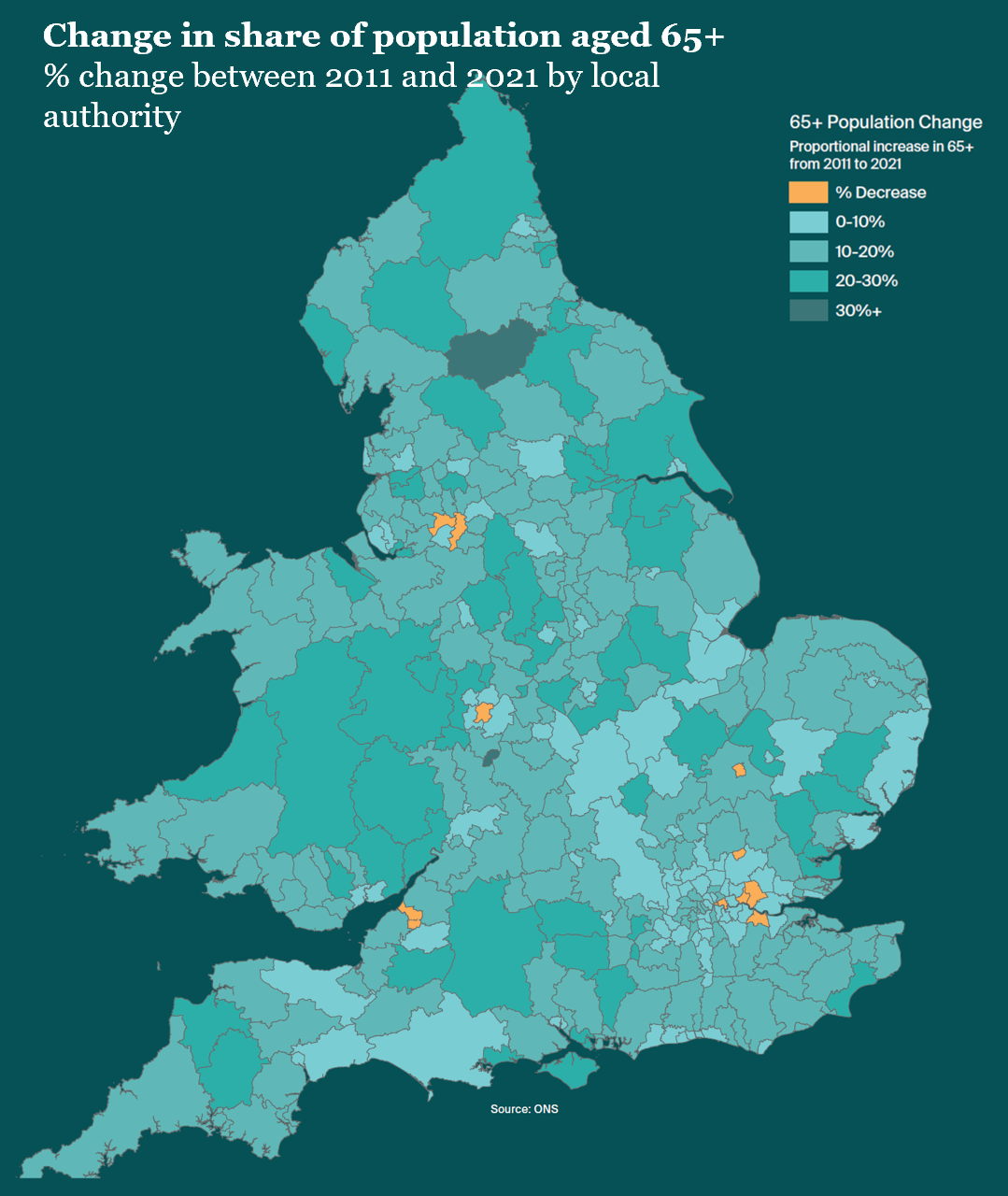

Data from the 2021 Census confirmed that nearly one in five people in England and Wales is aged 65 or older, the highest proportion ever recorded.

In total, there were 11.1 million over 65s, up 20% from 9.2 million in 2011. The number of people aged over 75 increased by 18% over the same period.

That the UK has an ageing population is not new, but the official figures reinforce the need for more dedicated housing for seniors in nearly every location. Over 95% of local authorities saw an increase in their share of population aged 65 and above.

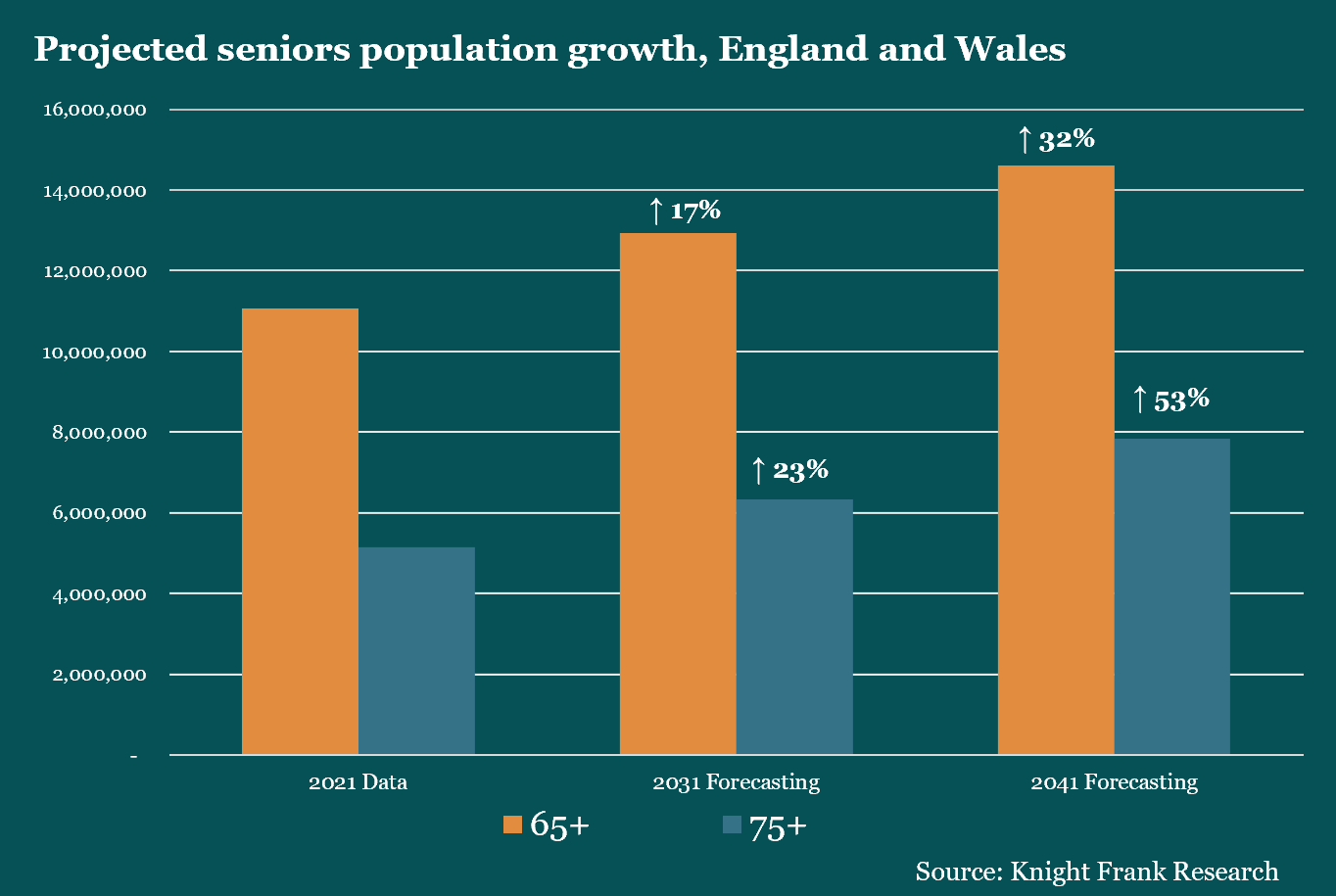

Growth in seniors population expected to continue

Our forecasting, based off the new Census figures, suggest these increases are only going to accelerate. We anticipate a 24% increase in the number of over 65s between 2021 and 2031, equating to an additional 2.5 million people. The number of people aged over 75 is expected to grow by 11%.

Seniors Housing delivery increasing, but not fast enough

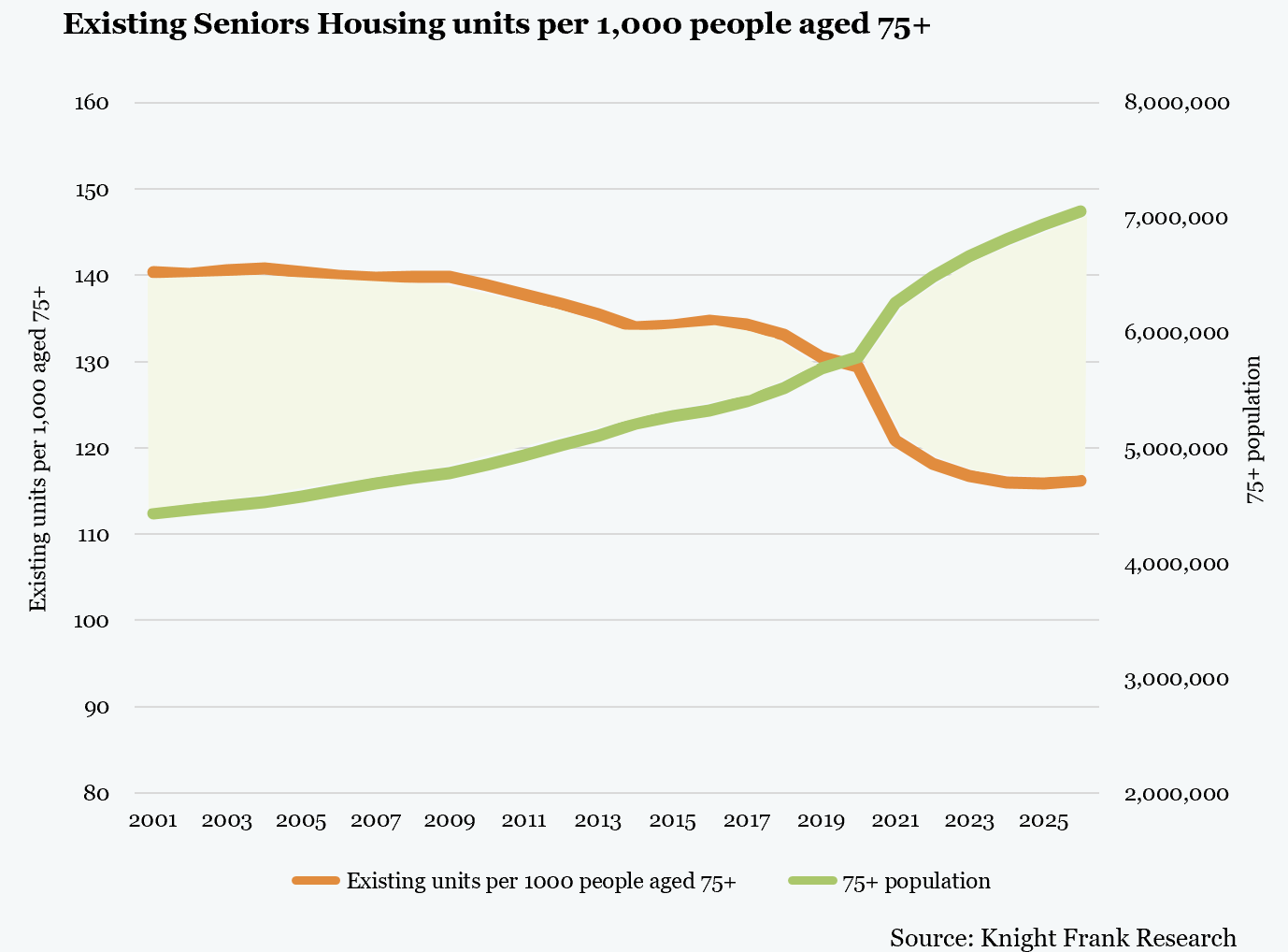

In recent years the rate of delivery of the private market has been accelerating due to increasing investment from institutions seeking long-term stable cashflows. The IRC pipeline has recently overtaken the Retirement Housing pipeline for the first time.

There are over 39,000 seniors housing units planned, up from 31,000 last year. The current inflationary environment may impact how quickly some of these sites are delivered. However, over the medium term, we forecast a trend of accelerated year-on-year delivery.

However, in real terms - and considering our expectation that the total number of specialist seniors housing units in the UK will grow by 8%, or around 64,000 units over the next five years - this would mean there would be 119 seniors housing units per 1,000 individuals aged 75 by 2026, down from 124 currently and from 137 back in 2012, underscoring the potential for significant growth in the sector across all tenures.

According to the English Housing Survey, there has been a 39% increase in the number of privately renting households in England where the household lead was aged over 65, while data from Knight Frank’s London lettings business shows 7.1% of tenancies agreed so far in 2022 have been to tenants aged 70 or above, up from a five-year average of 3.5%.

Build cost pressures

Build costs have risen by 16% over the last 12 months, according to data from the Build Cost Information Service, putting pressure on new delivery. Land prices have also risen steeply. Knight Frank’s latest Land Index shows that the price of English greenfield sites has increased by almost 14% over the last 12 months, principally driven by a shortage of supply.