A fragmented market continues in the UK Serviced Apartment sector

Whilst the depth of the fallout from the pandemic appears to have been less severe for the Serviced Apartment sector, adapting the business model has been critical for survival.

6 minutes to read

The serviced apartment sector has witnessed its share of closures. Some 2,300 units have permanently closed, with the appeal of the private rental market deemed for some, a more secure proposition during a time of crisis.

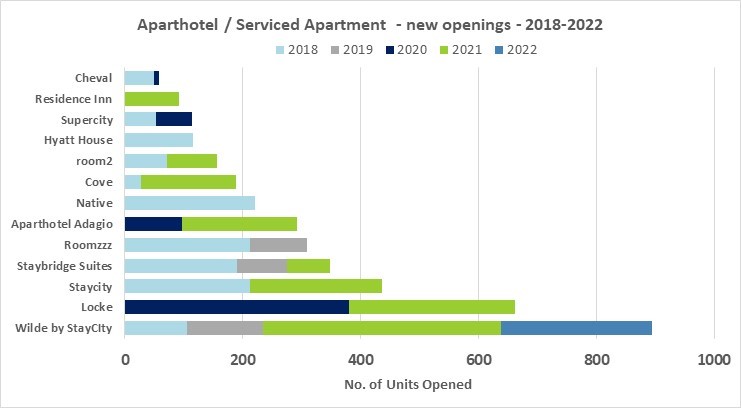

Despite an accelerated expansion post pandemic, the sector continues to remain highly fragmented, with independent operators accounting for over 40% of the supply. Yet, with greater brand proliferation, as key players seek to remain fresh and relevant in today’s competitive marketplace, much of the growth in supply since the start of 2020 has come from the major operators that operate exclusively in the aparthotel sector.

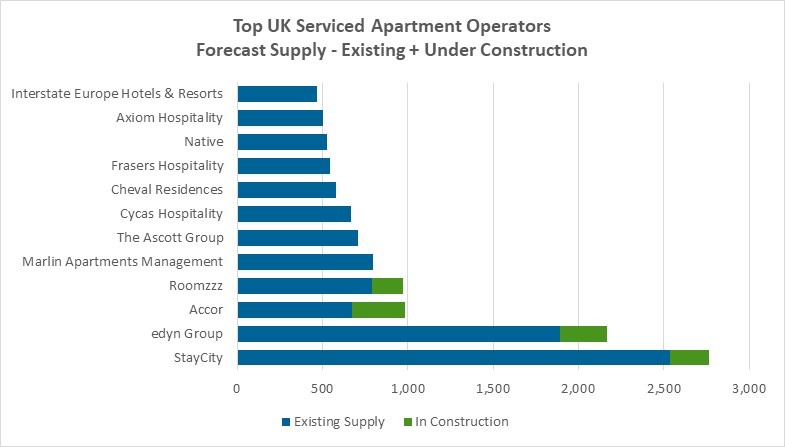

Some 3,200 new serviced apartment units have opened in the UK since the beginning of 2020, with Staycity Group, edyn Group and Adagio aparthotels accounting for almost 60% of this new supply. In 2021, the top 5 serviced apartment operators added almost 1,100 units, with annual supply growth of 20%, which followed 10% growth the previous year. As at the end of June 2022, serviced apartment operators with a unit count in excess of 400 units, represent some 45% of the total UK supply.

Source: Knight Frank research and analysis incorporating various sources including CoStar. Written consent required prior to republication of this data.

Growth Strategies and brand evolution

By the end of 2022, the UK serviced apartment / apart-hotel sector is forecast to grow to over 27,000 units, with annual growth in supply forecast at 5.7%, of which over 70% of the new supply is set to be delivered by independent operators.

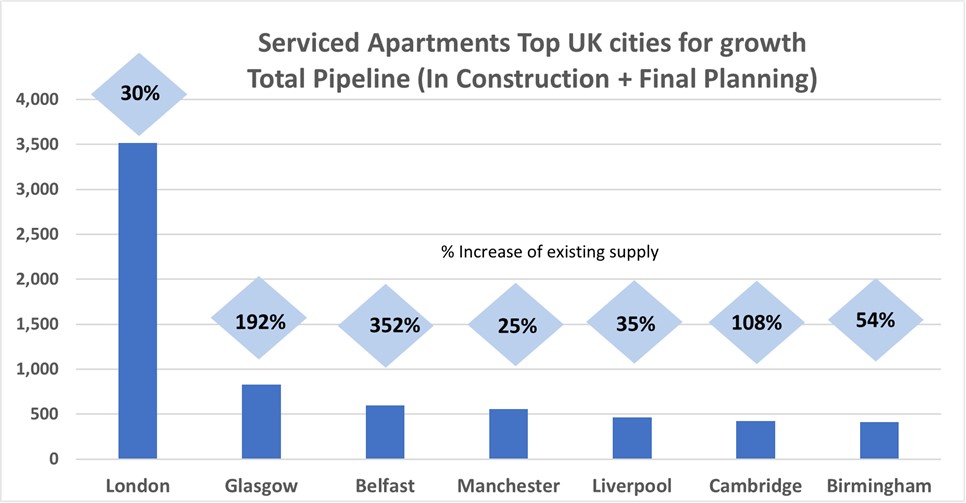

Following an extensive pipeline of recent, new apart-hotels opening, some of the leading branded operators are now prioritising their expansion throughout gateway cities in Europe. There are currently 3,000 new units under construction in the UK, of which only 40% of this new supply will be operated under a brand. With new brands being launched, the hybrid offering is becoming increasingly competitive and, with established operators reinventing or elevating their products, serviced apartments and aparthotels will continue to innovate and grow. A further 6,000 units have secured final planning, with London accounting for one-third of this pipeline. Yet, with rising construction costs we anticipate a significant number of projects to be put on hold or cancelled.

Since the beginning of 2022, seven new apart-hotel openings have taken place, totalling over 650 new apartments, with London accounting for 48% of the new stock. Openings included, The Other House South Kensington - a 200-suite Resident’s Club and the 256-room Wilde Aparthotel by Staycity, St Peters Square, Manchester. Meanwhile, three new aparthotel brands have launched with the opening of the 74-room Dao by Dorsett West London, Aptel East and Bob W all launching their first sites in London, all with a strong focus on design, sustainability, high-tech and offer a tailored, custom-fit experience.

Later in the year, Roomzzz are adding two new properties, with openings in Liverpool and Edinburgh, and redevelopment of the Grade A listed Custom House in Glasgow will see the 162-room Aparthotel Adagio Glasgow open in the summer.

Source: Knight Frank research and analysis incorporating various sources including CoStar. Written consent required prior to republication of this data.

Manchester – St Peter’s Square, Wilde Aparthotels by Staycity, opened February 2022

Changing consumer trends, such as demand for co-living and co-working space and eco-consciousness, are providing catalysts for new concepts, integrating modern amenities and stylish design. Through the launch of new brands, operators are evolving their portfolios to pursue their ambitious growth plans, as a means of extending the serviced apartment offering to a widening customer base.

The Cheval Collection’s launch of My Locanda, the company’s third brand, is an example of this, whereby, a new urban lifestyle accommodation concept is on offer. The new brand seeks to target guests of an independent, youthful mindset, seeking to be immersed in the heart of the local community. Longer stay residents could include students, individuals relocating for business or private reasons and who seek out spaces designed for co-working and co-living, through the provision of a range of quality, cosmopolitan retail and distinctive lifestyle offerings.

"The growth in demand for serviced apartments, coupled with a shortage in supply of quality product, particularly product which comes with a recognised brand, has encouraged us to pursue growth through management contracts with the launch of our MY Locanda flag, the first of which open in Glasgow. MY Locanda was launched as a response to demand from guests for stylish, design-led apartments where they can feel part of the local community. The brand is upscale to upper upscale with service levels customised to the needs of the modern, discerning traveller and longer-term resident, and representing a more affordable price point for guests."

Daniel Johansson, Director of Development and Acquisitions at Cheval Collection

MY Locanda Glasgow, set to open in 2024, comprising 168 apartments. Part of the Cheval Collection, under development in a joint venture with Chris Stewart Group.

Growth Opportunities

As awareness for aparthotels continues to grow, so will the consumer need for stratification, with budget, lifestyle and luxury concepts, targeting different types of consumers, likely to be the way forward for the sector - a trend already well advanced in the USA.

With the growing appeal for the apart-hotel product, current operators are keen to expand their estates. Submarkets within well-established larger cities are likely to benefit, but equally, strong growth targeting other large UK cities is expected to follow. Cities such as Leeds, Bristol, Cardiff, Oxford, Nottingham, York and Reading all likely to be targets for future expansion.

Source: Knight Frank research and analysis incorporating various sources including CoStar. Written consent required prior to republication of this data.

Beyond Urban

With the continued strength of the UK leisure market and structural shifts surrounding attitudes to health, wellbeing and experiences, the opportunity for the Serviced Apartment sector to grow beyond the urban environment is extensive. Hotels in coastal and country locations have performed strongly throughout the period of recovery, and in terms of the evolution of the serviced apartment sector, opportunity exists to tap into this market.

"The urban aparthotel and serviced apartment models are now well established and generating strong investor interest as they generate attractive returns and have proven their resilience. The next logical step, amidst a backdrop of continued foreign travel uncertainty, rising aviation fuel costs and an awareness of travel on climate change, is for these models to be applied to the leisure market in aspirational beach side locations. We are building on solid demand growth over the last decade and consolidating our learnings to deliver a new experience which blends the best of lifestyle hotels with the independence of a serviced apartment."

Ben Harper, group Managing Director at Watergate Bay Hotel

Image: The Dunes, Perranporth, Cornwall – part of Beach Retreats collection

With the resilience of the sector proven both in times of adversity and during the period of recovery, developer and investor awareness of the sector and its branded operators, is set to rise. Established brands have much to play for, with operators expanding their market share in both the corporate and leisure markets. With guests staying longer, supported by an appetite to combine work and leisure trips, it is these longer staying travellers that are likely to view serviced apartments more favourably.

A legacy of the pandemic will be to fully embrace themes such as sustainability, more flexible working patterns and a higher regard for well-being. The ESG credentials of a business are now increasingly under scrutiny and must have visibility if they are to add value. Adapting in order to embrace these changes will be key to the serviced apartment sector’s ongoing, resilience, thereby unlocking financing from which to accelerate, innovate, evolve and grow.