Beware of the bears

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Beware of the bears

A couple of weeks ago we touched on some promising signs on US inflation. Growth in the personal consumption expenditures (PCE) index slowed in April, registering its first deceleration since November 2020. That raised hopes that rising prices could soon peak, leaving the Federal Reserve able to take a more measured approach to tightening monetary policy - one that might avoid sending the economy into recession.

Friday's inflation report put an end to that. Annual growth in the Consumer Price Index accelerated to 8.6%, setting off speculation that the Fed will hike the key interest rate by 0.75% when it meets today. A round of carnage in stock markets followed unlike anything we've seen since the dark days of March 2020. The S&P 500 index of US stocks has fallen more than 20% from its January high, officially making it a bear market.

Nothing we've seen in the interim gives a contrary narrative to Friday's report. US producer prices surged again in May, according to data out this morning. The Fed will publish its decision at 2pm Eastern Time, or 7pm in London, so we don't have long to wait.

A bumper hike would be felt first in the residential market via increased borrowing costs and a hit to consumer sentiment. The longer term impacts of a recession are clear. The implications for commercial markets are less clear cut. Real estate investors are typically wary of rate hikes due to the perceived negative impact on pricing, but Knight Frank analysis suggests it can take up to three years to fully wash through - that's from my colleague Will Matthew's latest note, published yesterday.

UK mortgage rates

Would a bumper Fed raise put more pressure on the Bank of England to accelerate its own round of rate hikes on Thursday?

Possibly, but a contracting economy and some very tentative signs of loosening in the jobs market will act as counterbalances. All but one of The Times’ shadow monetary policy committee believe that the BoE should at least double the pace of its usual interest rate rises of 25 basis points this month. As of yesterday, financial markets were putting the chances of a 50bps hike at 43%.

Mortgage rates are already ticking up and leading indicators suggest there is more to come. Swap rates are a reliable barometer for the path of mortgage rates and the 5-year swap has moved from 2.15% at the end of March to 3.13% as of late last week (see chart).

For a global perspective on inflation and its impact on real estate markets, I recommend this piece by Flora Harley this morning.

Housebuilding

A trading update from Bellway and Crest Nicholson's half year results suggest that the industry's issues with cost inflation, from rising energy prices to global supply chain constraints and increasing wage costs, are being offset by gains in house prices.

Crest Nicholson upgraded its guidance for full year profits and Bellway said reservations per week are up about 6% compared to a year earlier. Bellway suggested new homes are an attractive proposition in light of rapidly rising energy costs.

The tapering off of Help to Buy, which is due to end in April 2023, "has had no measurable impact" on Crest Nicholson's sales rates. Likewise, Bellway said utilisation of the scheme is falling, however the availability of higher LTV mortgage lending - though more expensive - is improving.

Each quarter we survey volume and SME housebuilders to glean insights into output and land prices. You can read the latest here.

Country homes

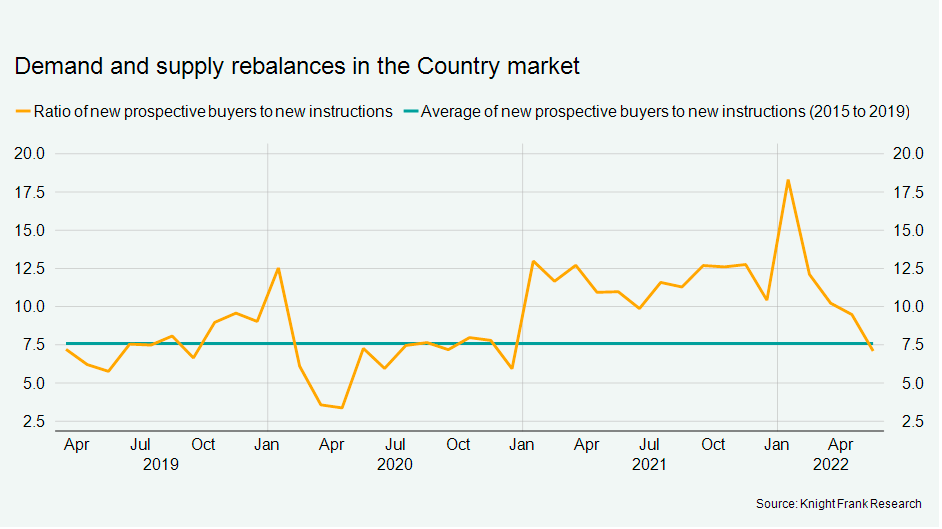

The "race for space" that underpinned a surge in country house prices is ebbing as supply improves relative to demand.

The ratio of new prospective buyers (demand) to new instructions (supply) was 7.1 in May outside of London, which was the lowest reading since December 2020. The shift was largely the result of growing supply. The number of new sales instructions outside of London in May was the sixth highest figure in a decade.

“Some of the heat has come out of the market. People are no longer prepared to make as many sacrifices for the property they want,” says William Ward-Jones, office head at Knight Frank Stratford upon Avon.

In other news...

London’s outer boroughs continue to see stronger price growth than central London zones. Demand has been particularly hot in Chiswick, writes Anna Ward.

The legal sector drove UK regional office take-up in Q1 2022, accounting for 13% of total take-up across ten key UK cities, writes Jennifer Townsend.

Elsewhere - farewell to the servant economy (FT), and finally, Bill Gates on crypto and the greater fools theory (Bloomberg).