How can rural landowners battle the energy crunch?

With fuel prices soaring, we ask a panel of experts from across Knight Frank’s network what the implications and solutions are for rural property owners.

6 minutes to read

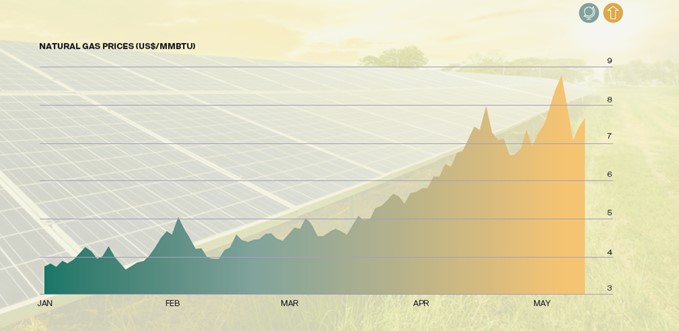

On February 24th shortly after 5am local time, Russian tanks began rolling over the border into Ukraine. Later that day, European natural gas prices soared almost 70% to hit a peak of €142 per megawatt hour.

Dramatic swings in energy prices endured through the subsequent months and governments across Europe have doubled down or accelerated pledges to wean economies off fossil fuels.

The implications for landowners are far-reaching. Growing demand for renewables is creating new opportunities for farmers to diversify income streams and the soaring price of fossil fuels is fundamentally rebalancing the costs and benefits of carrying out capital-intensive works to improve the energy efficiency of estates.

“The good news, if there is good news, is that the cost of renewable energy is going to be coming down, so the capital outlay relative and the time it takes to repay itself is changing rapidly,” says Cate Statham, Senior Chartered Building Surveyor at Knight Frank. “Unfortunately construction costs are rising, which offsets the benefits to some extent, but the payback time will still almost certainly come down just because the cost of energy is rising so quickly.”

Many estate owners are several years into strategies to ‘green’ their estates, while others have been hesitant over making green upgrades, often due to costs or complexity. It has long been thought that heat pumps, often one of the most effective upgrades for properties built pre-1930s, can take as long as seven to 11 years before energy savings repay the investment, according to Cate.

How far that payback period will reduce in the long run remains uncertain. The cost of the electricity used to power the pumps is rising and installation can be tricky, whether that’s due to obtaining consents, the disruption of construction works, or the amount of retrofitting required to get them to work efficiently.

“All of us are going to have to look at hybrid solutions to suit individual circumstances,” says Alexander Macfarlane, a Building Surveyor at Knight Frank. “You really do have to consider each property or each situation within its own context and balance it against the merits of each technology as it emerges.”

Heat pumps

There are straightforward upgrades that property owners should consider first, he adds. “Improving insulation and switching to more efficient lighting and radiators can have an immediate impact. Then it’s a question of which method will supply green energy cheaply over the long term. That’s not always heat pumps – for larger estates, biomass pellet boilers are highly efficient, provided there are nearby resources to supply the pellets necessary to power them”, Alexander adds.

The time available to make these choices is falling. While the rising cost of fossil fuels provides a strong incentive to act, a raft of new legislation aimed at cutting emissions from property is due to come into force, underpinned by the government’s 2050 net zero target.

All properties must have an EPC rating of ‘C’ or higher if they are to secure new tenancies by 2025, according to proposals making their way through parliament at the time of writing. By 2028 the rule will be extended to existing tenancies. The same bill contains proposals that would require lenders to achieve an average EPC rating of ‘C’ across all the properties on their books by the end of 2030, likely impacting the cost of debt for property of all types.

Ultimately, for owners’ let portfolios, it’s important to meet difficult choices head on, says Jess Waddington, a partner in the Rural Asset Management team at Knight Frank.

“It might be that you’ve got a core estate, so you’ve got ring-fenced properties, but your non-core properties aren’t performing particularly well from an EPC perspective,” Jess says. “They might have old boilers, or they might have wiring that needs replacing – in these cases it’s time to consider whether it’s worth spending the £10,000 it can take to upgrade each property or whether you should sell them and reinvest that money into upgrading the core estate?”

Spiking fossil fuel energy prices could encourage more renewable generation

Energy strategy

New opportunities to diversify income streams can offset these costs. The government’s energy strategy, published in the wake of Russia’s invasion of Ukraine, aims to “reduce our dependence on power sources exposed to volatile international prices we cannot control, so we can enjoy greater energy self-sufficiency with cheaper bills,” Prime Minister Boris Johnson said at the launch on April 6th.

The document includes significant commitments to increase the UK’s current 14GW of solar capacity, which officials believe could expand five-fold by 2035. Forecasts from industry bodies including the Climate Change Commission suggest the UK’s solar capacity could reach 85GW by 2050.

“National policy has been favourable to solar for several years, which has slowly trickled through to local planners, but the energy strategy is hugely important,” says Robert Blake, Senior Consultant on Renewable Energy at Knight Frank. “The government has effectively doubled down on solar and we expect national policy to be strengthened as a result.”

Favourable policy is fuelling demand from solar developers, who are increasingly willing to consider green belt land or sites in designated Areas of Outstanding Natural Beauty (AONB). Rents for solar installations have risen to approximately £1,300/acre, from about £1,000 a year ago. Locations able to accommodate battery storage can command “substantial” premiums, Robert adds.

Developers in many cases will fund the installation, with a private wire supplying energy to the landowner, avoiding both capital expenditure and exposure to fluctuations in grid energy prices for 25 years or more.

The planning process for solar depends on size of the installation. Solar installations of up to one megawatt can be approved via permitted development rights, which avoid the need to seek planning permission. Up to 50 megawatts are decided at a local level, while over 50 megawatts must be approved nationally. Landowners with 150 acres could be suitable for 50 megawatt projects, though battery storage can be installed on sites as small as two or three acres, says Blake.

Younger estate owners tend to look favourably on solar and a growing body of research suggests there are numerous biodiversity benefits to letting land “rest” for the 25-40-year lifecycles of solar installations. Where installations have drawn local opposition in the past, in many cases the energy crisis is shifting public opinion on the issue, according to Robert.

When it comes to energy, “it has hit home that we are subject to global events,” he reckons. “We need to be producing our own energy and doing it quickly, and there is growing acceptance that renewables have to play a central role.”

Contact our experts

Learn more from our expert teams:

Building consultancy

Cate Statham: cate.statham@knightfrank.com

Alexander MacFarlane: alex.macfarlane@knightfrank.com

Rural asset management

Jess Waddington: jessica.waddington@knightfrank.com

Renewable energy

Robert Blake: robert.blake@knightfrank.com