A turning point for housing's bull markets

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The US housing slowdown

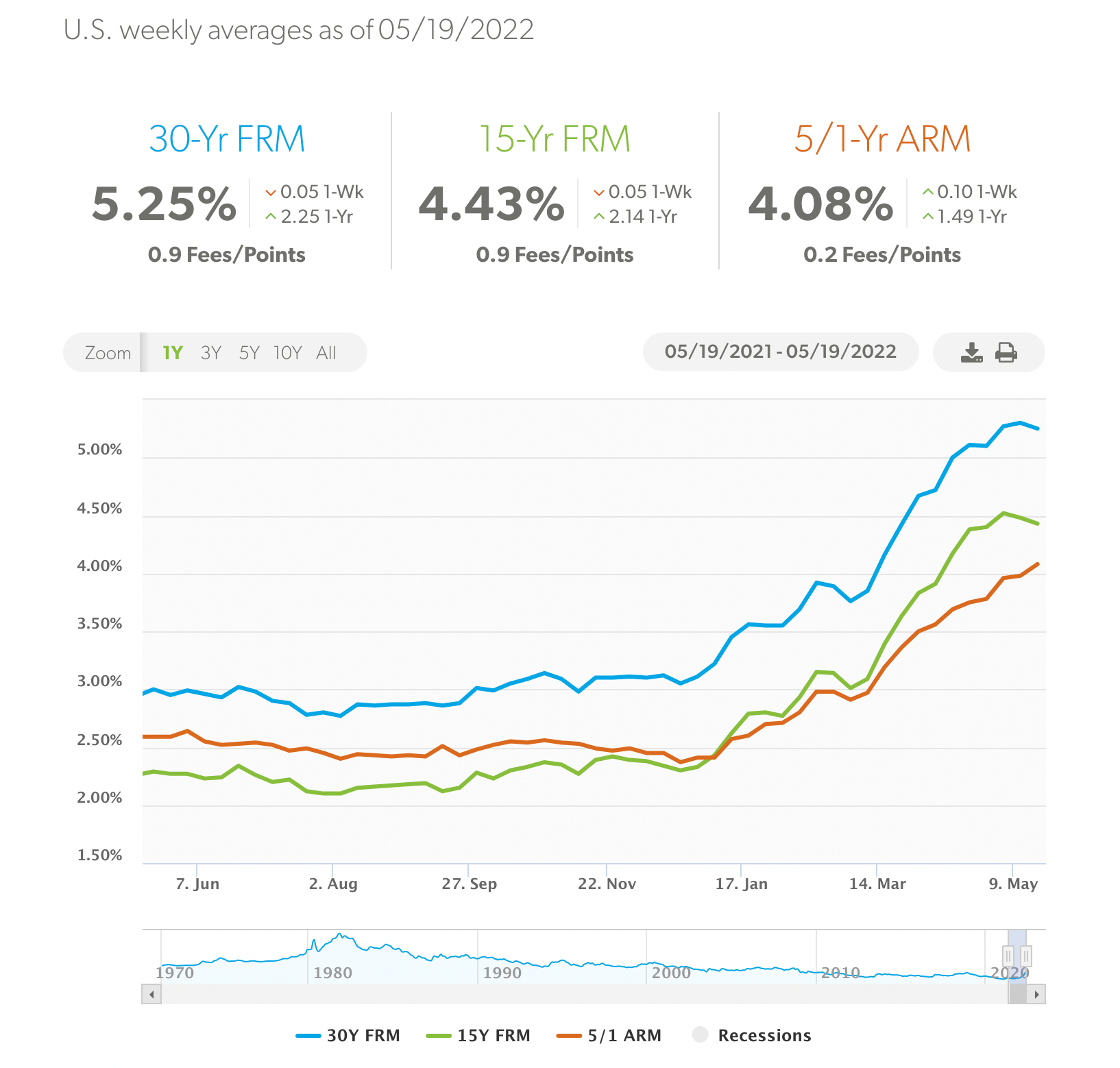

The Federal Reserve's half a point interest rate hike on May 4th swiftly pushed the average rate on US 30-year mortgages to the highest level since 2009 - see chart below from Freddie Mac.

The reaction has been swift: data from the Mortgage Bankers Association published on Wednesday reveals mortgage applications fell 11% week-on-week. The decline in purchase applications at -12% was slightly steeper than refinancing at -10%. Various indicators show demand for home purchasing in decline - existing home sales dropped to the lowest level in nearly two years in April, for example. Homebuilder sentiment has dropped to the lowest level in nearly two years.

There is likely to be little let up over the summer. Federal Chairman Jerome Powell indicated that half-a-point moves might also be necessary at both June and July's meetings, though much will hinge on any signs of inflation peaking and the degree to which growth slows.

Bull markets cool

The US is not alone. Several of the world's hottest housing markets have reached inflection points, none more so than New Zealand.

Residential sales decreased 35.2% in April compared to a year earlier, according to the Real Estate Institute of New Zealand. Median price growth slowed to 8.8%, down from more than 20% late last year. ASB Bank expects rising mortgage rates to cut prices by 12% by mid-2023, which would be a 20% correction in real terms, before price growth returns.

Still, that would take house prices back to where they were in early 2021, with average prices 27% higher than the start of the pandemic.

Likewise, some of Canada's most active cities have turned into buyers markets. Sales fell 12.6% in April compared to a year earlier.

Retrofitting

We talk a lot about the government's lack of a credible plan when it comes to decarbonising the UK's stock of existing homes. Last year, the Climate Change Committee (CCC) - the government's advisor - lamented the gulf between ambition and a willingness to take tough decisions that affect people's lives.

The obstacles are numerous but few are more problematic than funding upgrades, starting with the initial outlay for retrofitting. The Times has seen a report by the Building Back Britain Commission that isolates the 2.3 million homes worth less than £162,000 as particularly problematic, as the average £10,000 cost of getting them to a band C is "a major disincentive".

The Commission recommends that the taxpayer should foot the bill for those upgrades, while suggesting owners of higher value homes should be able to access low-interest unsecured loans at similar rates to the cost of government borrowing, again with the cost passed on to the taxpayer. No.10 and the Treasury "are understood to be receptive" to the recommendations, according to the Times.

Central London

Updates on the central London office market within annual results came from British Land on Wednesday and GPE yesterday following those of Landsec earlier this week.

There are common themes. As British Land notes, "demand is clearly gravitating towards the very best space, with an emphasis on sustainability, wellness, shared and flexible space and excellent transport connections. This part of the market is achieving premium prices and vacancy is estimated at under 4% compared to c.8% for the whole market." The value of the company's campuses, which include Broadgate, Regent's Place and Paddington Central, climbed 5.4%. Across its wider portfolio, the company is leasing space at the fastest rate in a decade.

Similarly GPE reported record leasing volumes and had this to say about the outlook:

"London is substantially busier than this time last year with office workers and shoppers returning, Crossrail is about to open, job vacancies are rising and inward investment into income yielding real estate is up. Plus, we expect weaker sentiment and cost inflation in the short term, along with further tightening in the planning environment, to impact the appetite for development risk, choking off the supply of new office space, intensifying the already acute shortage as customers continue their flight to quality."

In other news...

What's behind Tuscany's 30% increase in house buyer enquiries?

Asia-Pacific investors step up outbound investment - more 60% of transactions were conducted beyond the region as investors retrace their pre-pandemic steps globally.

Elsewhere - ECB to force UK-based investment banks to relocate staff (Reuters), UK consumer morale hits lowest since records began in 1974 (Reuters), death notices for the city are premature (FT), China cuts mortgage lending rate by record as lockdowns hit economy (FT), and finally, Tesla poses awkward questions for ESG (Bloomberg).