Housing supply begins to normalise

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Slowing global growth

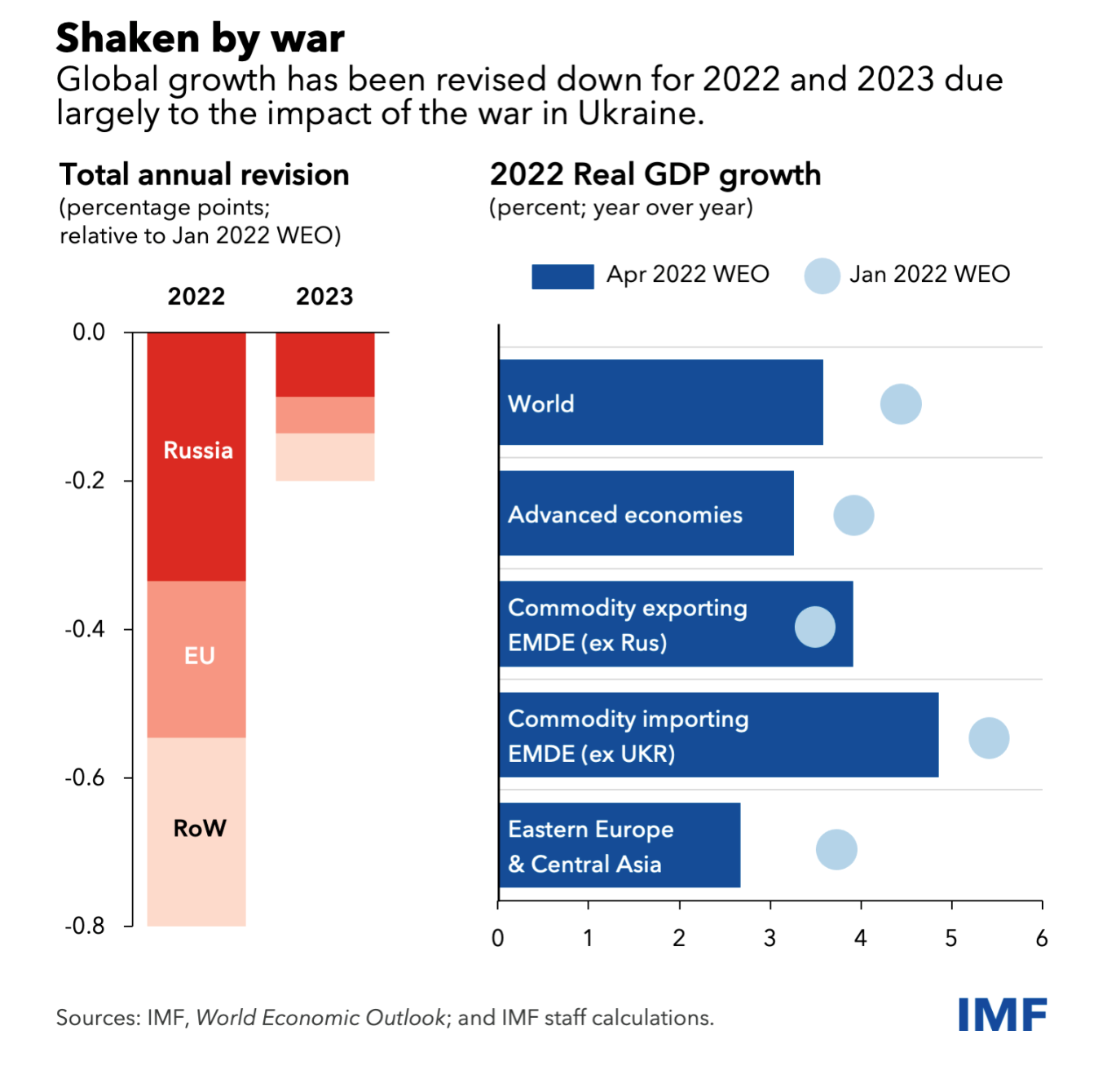

Economic damage caused by Russia's invasion of Ukraine will contribute to a significant slowdown in global growth this year and beyond, according to a downbeat assessment from the International Monetary Fund.

Global economic growth is projected to slow from an estimated 6.1% in 2021 to 3.6% in both 2022 and 2023. That's a cut of 0.8% for 2022 and 0.2% for 2023 compared to its January projection. Beyond 2023, the global economic expansion is forecast to settle at about 3.3% over the medium term.

The IMF cut the European Union's outlook for 2022 by 1.1% due to the indirect effects of the war, making it the second largest contributor to the overall downward revision after Russia (see chart). The UK received a 1% downward revision due to the impact that "tighter financial conditions" are having on consumers. The UK will be the worst performing economy in the G7 next year, according to the outlook.

The divergence

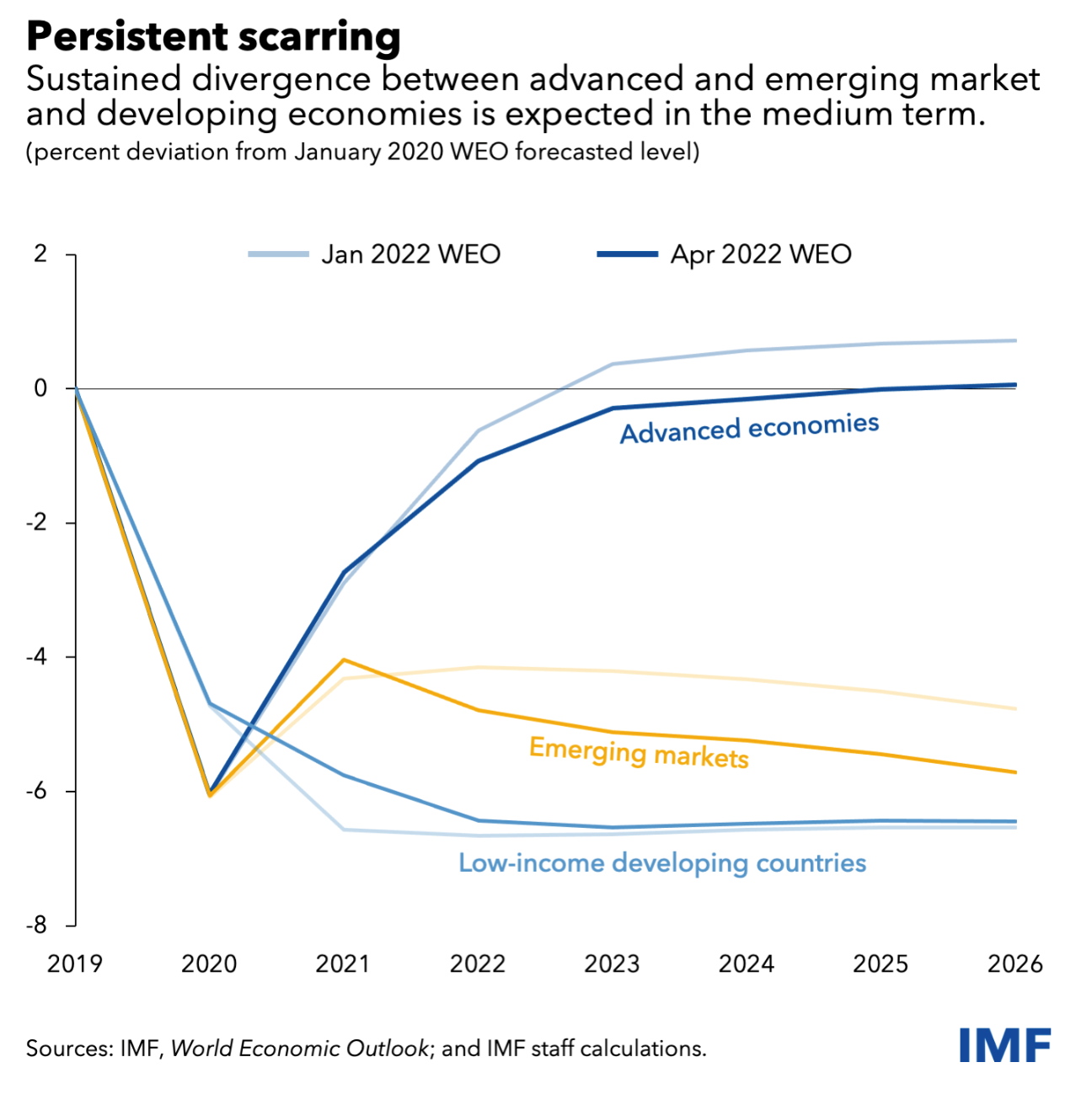

The IMF's economic outlook and accompanying financial stability report paint a stark picture of the diverging fortunes of advanced and emerging economies.

Emerging markets will be at the sharp end as global interest rates rise to tame inflation, driving down local currencies and squeezing inward investment. That's likely to trigger both debt distress and social unrest.

Every year the World Economic Forum interviews 1,000 risk experts and global leaders in business and government to better understand where and why the next crisis might arise. We talked back in January about the latest edition, which is looking increasingly prescient. Climate action failure, extreme weather events, and biodiversity loss and ecosystem collapse were considered the top global risks by severity over the next 10 years, but the divergence in fortunes between advanced and developing economies was the next big theme.

Societal risks made up a third of the top 10 risks, with societal cohesion erosion and livelihood crises completing the top five.

Normalisation

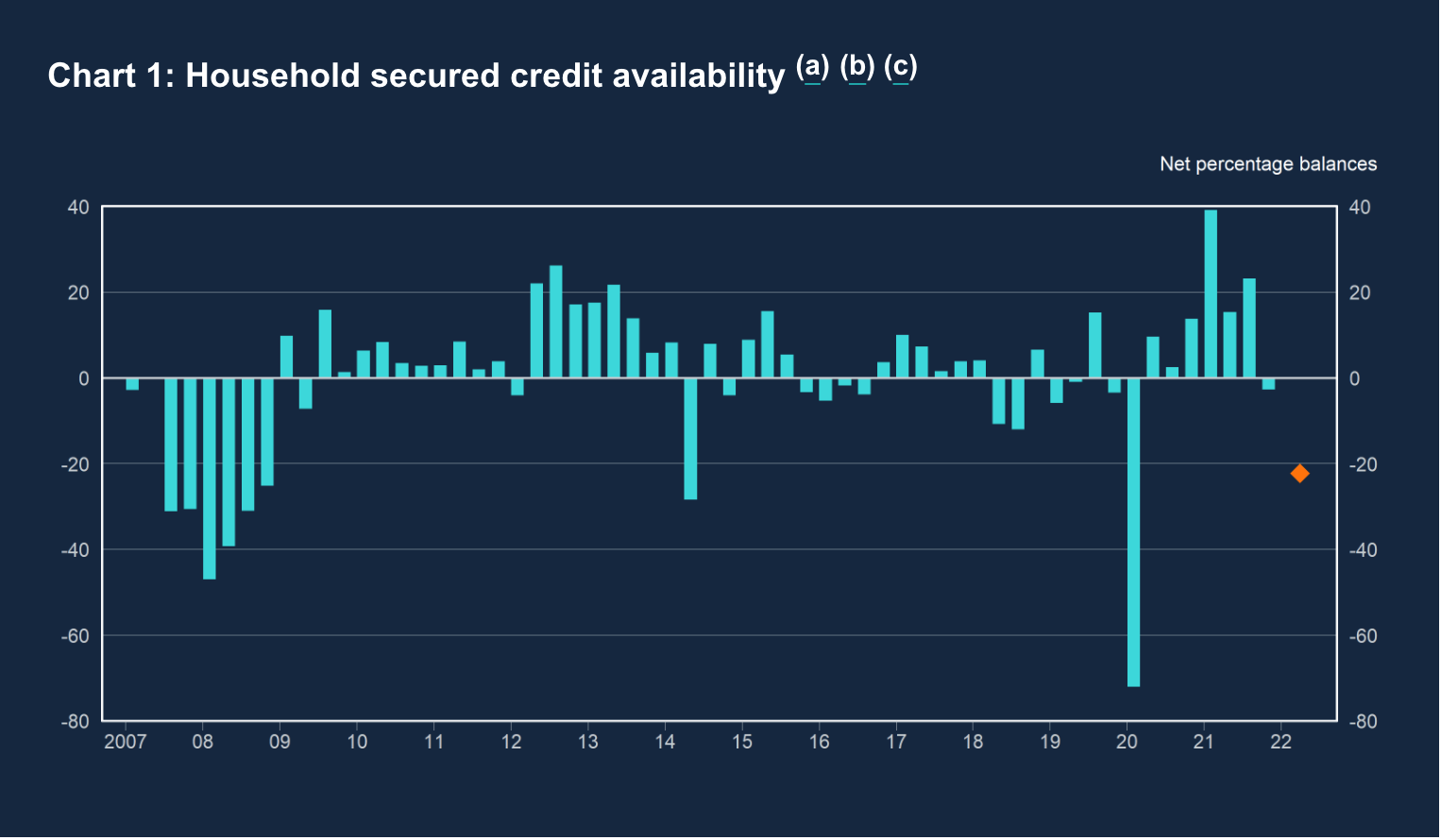

A lack of properties for sale relative to demand has underpinned double digit house price growth in the UK during recent months despite a worsening cost of living squeeze. We are, however, beginning to see signs of improvement.

The new instructions indicator in the latest RICS Residential Market Survey turned positive for the first time in twelve months in March. A net balance of +8% of surveyors reported a rise in the volume of fresh listings coming onto the sales market, while a net balance of +9% reported a rise in new buyer enquiries. That's the first time since the onset of the pandemic that the metrics for supply and demand have risen largely in line.

A separate survey of lenders conducted by the Bank of England reveals that banks intend to cut mortgage lending during the three months to the end of May - see the red diamond on the chart below. No reasons were given, though the survey was conducted during the weeks immediately after Russia's invasion of Ukraine. Lenders expect demand for new mortgages and remortgages to increase during Q2.

A reminder that you can read our five year forecasts for house prices and rents here.

New homes

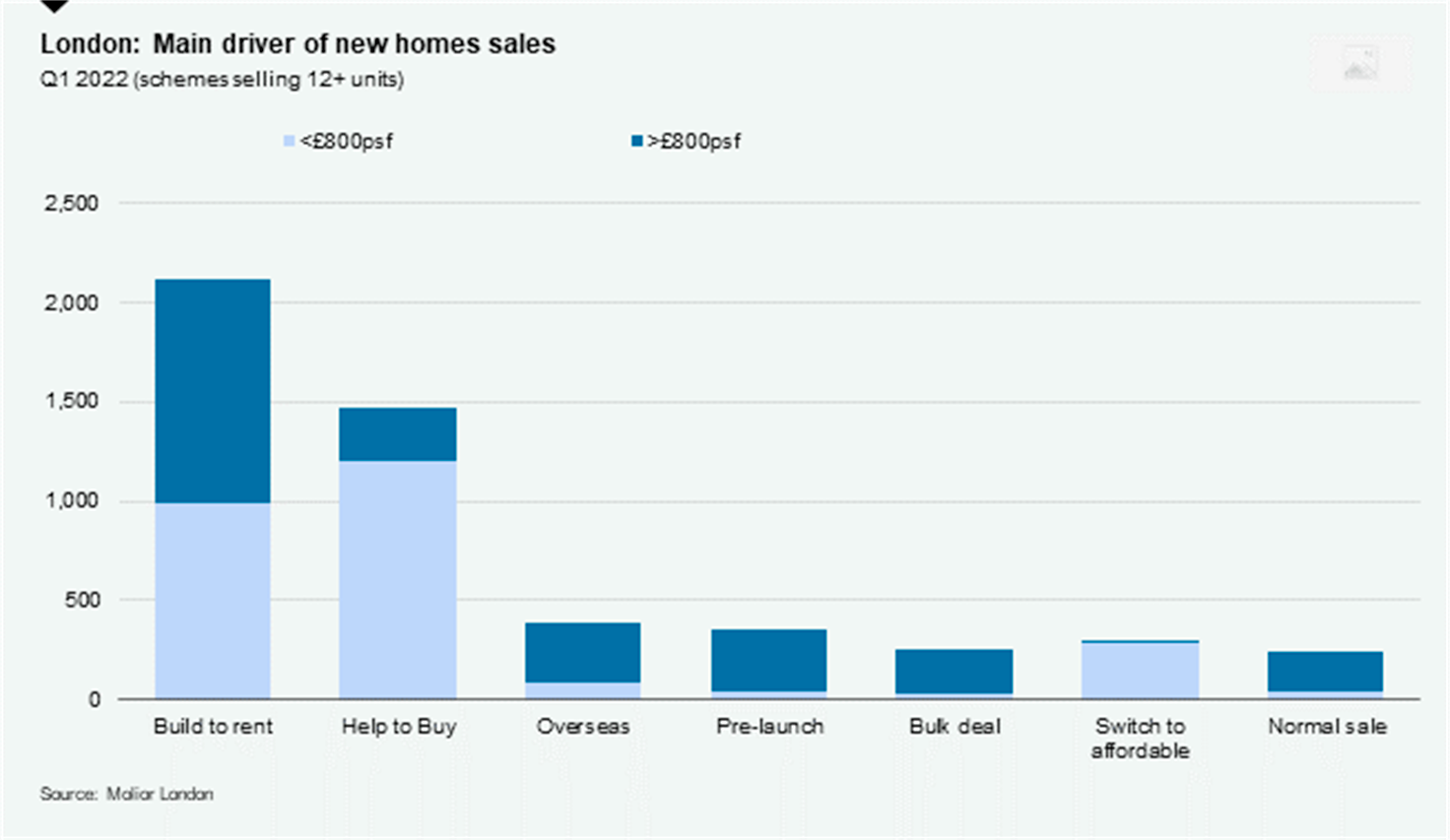

Developers in London sold 6,070 new homes during the first quarter, the most in any quarter since 2018 and the fifth highest quarterly figure since 2008, according to the latest quarterly report from Molior London.

Bulk deals with build-to-rent operators and Help to Buy continue to drive a significant proportion of sales (see chart). The prevalence of Help to Buy raises some questions as to how sections of the market will perform post the wind down of the scheme in 2023, though there are a number of strong drivers underpinning demand, particularly the continued return of employees to central London offices, increasing international travel, a lack of stock in the second hand market and a clamour to purchase the remaining available Help to Buy units.

Deposit Unlock, the industry-led alternative to Help to Buy, currently has 17 housebuilders and two lenders signed up, one of which is Nationwide.

Retail's journey back

Stephen Springham picks his way through the data to get a true tally of the state of retail sales two years on from the onset of the pandemic - a tally that takes into account the “black hole” of spend that was lost during the pandemic:

On a headline basis, total retail sales are higher than they would have been in a static market (+5% according to our data), but a little shy of where they probably should be (-1.7%), allowing for a degree of underlying market growth. But some key categories are still in deficit i.e. they have not fully recouped the “lost” spend during the pandemic. By our estimates, overall non-food spend is still -2.5% down (ca. -£4.5bn in absolute terms), with clothing (-16%, -£7bn) footwear (-19%, ca. £1bn), cosmetics (-10%, £540m) and PCs/Phones (-29%, -£1.4bn) some way adrift of where they should be.

All things being equal, only now are retail sales fully returning to “pre-pandemic levels”, but some categories still have ground to catch-up – expect a full equilibrium to be restored in the coming months.

In other news...

Tight supply and high demand lifts the value of UK country properties past the pre-Global Financial Crisis peak.

Elsewhere - UK executives expect high inflation to squeeze profits (Reuters), energy chiefs warn of ‘truly horrific’ autumn for British households (FT), Blackstone strikes $13bn deal for US student housing portfolio (FT), and finally, permanent staff in demand despite employers’ fears for future (Times).