Implications of the conflict in Ukraine

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

What might the Ukraine/Russia conflict mean for CRE?

While a grave and sensitive situation in all respects, the direct implications on commercial real estate will likely be minimal. Russian cross-border investment into commercial real estate totalled just $145m last year and accounts for only 0.9% of global cross border capital flows on average, so a withdrawal of Russian capital is likely to have modest direct impact.

Multiple indirect impacts emerge

Property related implications are likely to arise via indirect channels, including supply chain constraints (read more here), higher commodity prices, higher overall inflation and lower economic growth. Higher energy prices will lead to greater electricity costs for manufacturers, distribution firms and retailers that rely on this energy to power warehouse facilities. We’re already seeing the impact on commodity prices play out - Brent crude topped $105 per barrel last week, while German gas prices grew 58%.

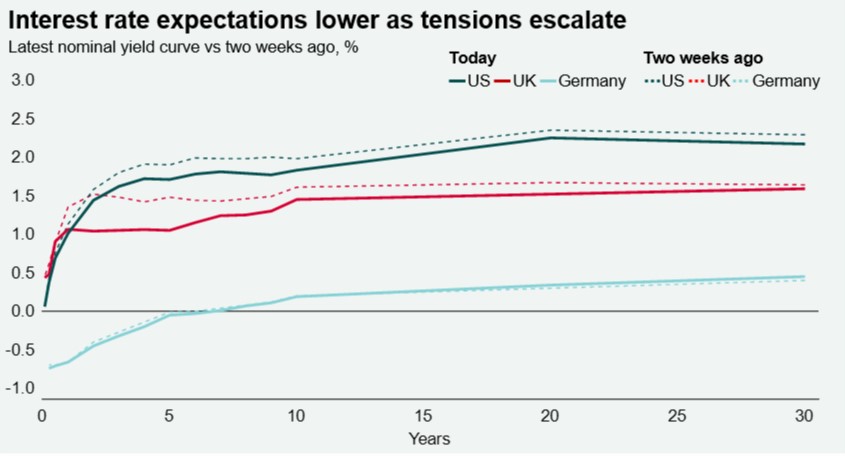

Central banks to proceed with caution

Markets are signalling that the conflict in Ukraine is likely to delay the tightening of monetary policy. Central banks now face the challenge of keeping policy supportive of growth while quelling rising inflation. The European Central Bank is unlikely to end its bond buying programme and will most likely not implement a rate hike at its next meeting on 10th March, in an effort to mitigate the negative economic impact of the conflict.

Download the latest dashboard