The London money wall, Miami's sinking feeling and “don’t ask for a pay rise”

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Don't ask for a pay rise

Prepare for the biggest fall in living standards in three decades. That's the key message the Bank of England sought to communicate as it hiked the base rate to 0.5% yesterday.

Inflation could surpass 7% by April and real post tax labour incomes - which account for rising taxes and inflation - will fall by 2%, the biggest drop since 1990. BoE Governor Andrew Bailey's tour of the television studios following the release of the report led to some frankly weird moments, firstly at the BBC in which he asked workers to do their bit to curb inflation by not asking for a pay rise, before having the "you had one job" meme explained to him by Sky's Ed Conway.

The Monetary Policy Committee voted 5-4 to raise rates to 0.5%. Those four dissenters wanted to hike to 0.75% instead, which provides a clue as to what's likely to happen when the MPC reconvenes over the coming months. For a 15 minute assessment of what rising interest rates mean for house prices, see the latest edition of Intelligence Talks.

The money wall

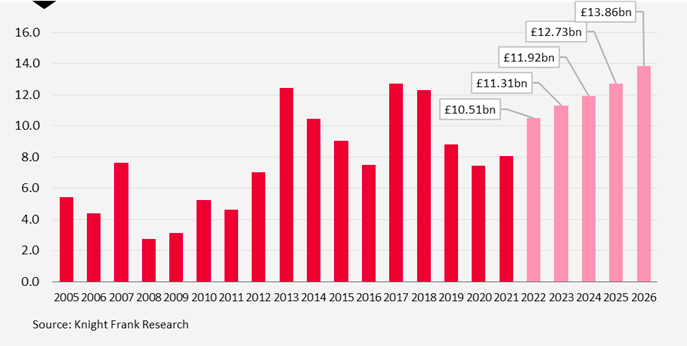

Investors will spend £10.5 billion on London offices during 2022, a rebound of 16.8% compared to a year earlier. Long-term factors like the capital's status as a key gateway city play a role, as do yields, but London's large and growing pool of green buildings will also prove to be a major pull for investors during the years ahead, according to the findings of Knight Frank's annual London Report.

London boasts 1,078 office buildings with a BREEAM rating of 'Good' or above, more than double any other European gateway city. Since the start of the pandemic our analysis shows that 40% of lettings deals have been for buildings with these ratings, compared to only 11% over the previous four years. Our recently published Active Capital highlighted how these buildings have achieved rental premiums ranging from 3.7% to 12.3%.

The cumulative total of international transactions in London over the next five years is forecast to hit £60.3 billion, the highest five-year total in more than fifteen years. North America is expected to be the region making the largest investment with just over £18 billion, or 30%, of transactions followed by Other South East Asia with £15.69 billion (26%) and Europe with £14.4 billion (24%). Flows from Greater China are forecast to reduce significantly over the same period, accounting for only £8.7 billion of transactions.

Build costs

Rapidly rising build costs have dogged the construction industry for the best part of two years and, though the worst has passed, the process is going to take many months to unwind.

This quarter Knight Frank surveyed 50 of England’s leading volume and SME housebuilders to gauge their sentiment and views on the market. A quarter said they think build costs will ‘increase significantly’ in 2022 compared to 2021, while 67% are expecting a 'slight increase'. That suggests that, while the market is expecting a price increase this year, most expect the high rate of build cost inflation to cool.

Nearly half of respondents to this quarter’s survey said build cost increases last year had already had a ‘significant’ impact on their businesses, while 56% said this was the number one factor adding pressure to their bottom line in Q4 2021. The Building Cost Information Service, which provides cost and price data for the UK construction industry, is forecasting that build costs will increase annually in January 2022 by 10.2% compared to January 2021 before easing off slightly.

Miami heat

Back in 2018, the Union of Concerned Scientists published a warning about the impact of rising sea levels on US coastal real estate.

The group found that more than 300,000 coastal homes, with a collective market value of about $117.5 billion back then, were at risk of chronic inundation in 2045—a timeframe that falls within the lifespan of a 30-year mortgage. Approximately 14,000 coastal commercial properties, assessed at a value of roughly $18.5 billion, were also at risk during that timeframe.

The FT yesterday published this long read on Miami, which touches on the city's preparation for a 2.5 foot rise in sea levels, from pumps on streets to backflow valves and adjustments to density. The piece includes an interview with Miami-Dade’s chief heat officer Jane Gilbert and it's fair to say she is concerned:

"When I ask her if Miami will still be around in 30 years, she tells me the answer always depends on her mood. Today, she’s feeling optimistic. She puts the odds at 50/50."

In other news...

With the rugby Six Nations tournament kicking off this weekend (5 February), we looked at the property form of the competing countries to see which is the top-performer off the pitch. Find out who leads the property pack.

Jennifer Townsend picks up on sentiment surveys emerging from the life sciences sector, and weighs up what the could mean for real estate.

Elsewhere - UK developer turns to urban mining to slash carbon footprint (Bloomberg), Christine Lagarde fuels investor bets on ECB rate rises with hawkish shift (FT), and finally, growth potential in the natural capital of farmland (FT).