Luxury Investments – crypto art paints interesting picture

2021 saw crypto art hit the headlines, ushering in a new era for investment in digital assets. The latest Knight Frank Luxury Investment Index (KFLII), explores these digital works of art along with more traditional asset classes to track their capital values.

2 minutes to read

"What is cyrpto art?" I hear you asking. The answer to that is: digital works of art encoded on a blockchain as NFTs, or non-fungible tokens. Expertly explained by Andrew Shirley, Editor of the Knight Frank Luxury Investment Index.

The reason for crypto art hitting the headlines is because almost US$600 million of on-demand generative content stored on the Ethereum blockchain was purchased via the Art Blocks platform in August, while Sotheby’s auctioned a collection of Bored Ape Yacht Club NFT collectibles for US$24.4 million in September. Whether it's your kind of thing or not, there is certainly a lot of investment and a growing buzz around this very unique art form.

Tangible assets

For those who prefer their collections to feel a little more tangible, wine, classic cars and watches have performed reassuringly well over the past 12 months. Investment-grade wine was, in fact, the top performer in KFLII over the 12 months to the end of June.

Dietrich Hatlapa of HAGI, which provides our classic car data, also says the market is in a good place with the value of a selection of the world’s rarest and most collectible vehicles rising 4% over the same period. “Stock markets have been flying so most of the interest at the moment is coming from experienced collectors and dealers who are prepared to pay top prices for the best cars. The market isn’t that broad. But our indices are in all-time-high territory so there is the potential to break out of the sideways trend we’ve seen for the past six years.”

Along with cars and wine, watches make the top-3 podium for this instalment of KFLII with Art Market Research’s basket of collectible timepieces showing annual growth of 5%. “The market remains very buoyant for Rolex with sport watch models continuing to dominate. But perhaps most notably in recent months there has been a big upswing in prices for the rarest and most unusually shaped Cartier models from the 1950s to 1970s with some remarkable results seen at some recent auctions,” points out AMR’s Sebastian Duthy.

Source: Art Market Research

Knight Frank Luxury Investment Index Q2 2021

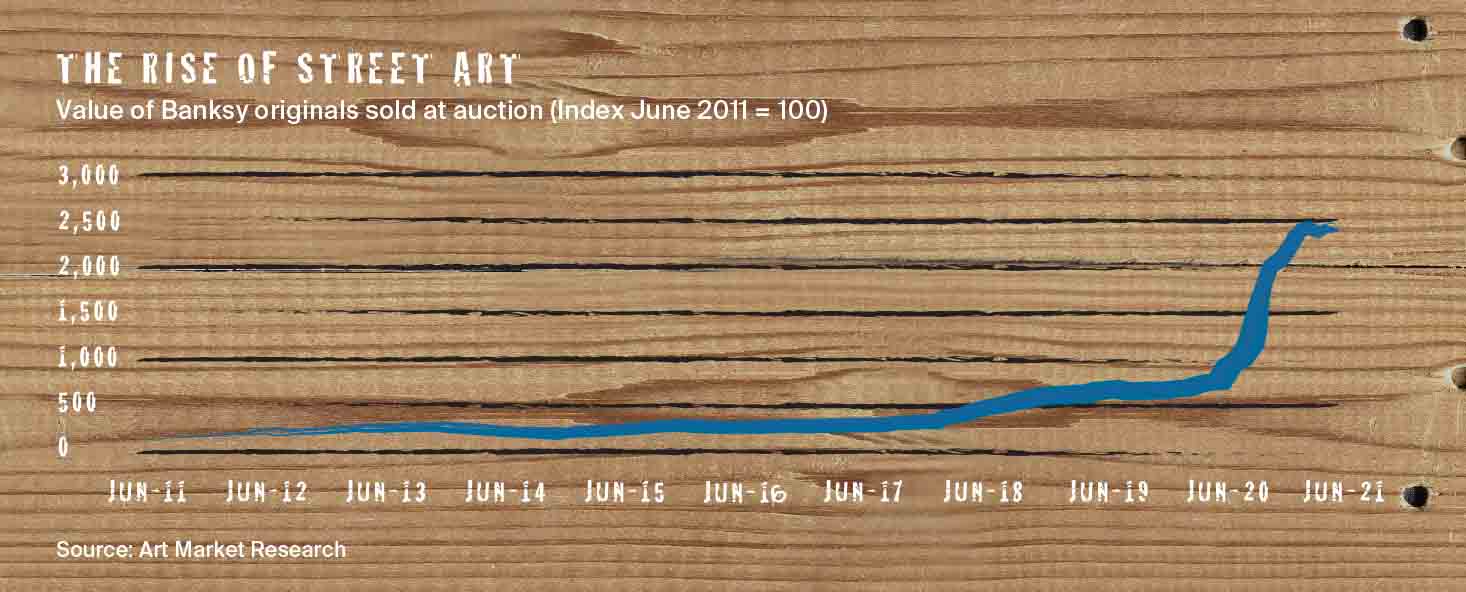

Alongside crypto art, Andrew looks at the rise of street art in this special edition of the Knight Frank Luxury Investment Index. With the help of a cross section of industry experts, he tracks the rise of street art from sacred caves, via the graffitied urban streetscapes of the US and Europe, to the studios of today’s agent provocateurs.

This report offers a unique perspective on modern art and investment, centred around an event displaying street art at Battersea Power Station, including an intriguing interview with a Banksy protégé named Mr. Brainwash.

Andrew also speaks with Meriam Lock-Necrews, head of residential at Battersea Power Station Development Company, who explains how the development mixes iconic architecture with art to benefit the wider community.

Main imagery: Double Decker, Mr. Brainwash

Thumbnail imagery: Bored Ape Yacht Club, Sotheby’s