Midweek property news update - 17th March

Inflation takes the worry crown, Europe's struggle and ESG moves into build-to-rent

5 minutes to read

Rearranging worries

In a milestone that illustrates the seismic shift in the world's economic fortunes, inflation has replaced Covid-19 as the key risk concerning investors. A Bank of America survey of investors with $597 billion in assets under management points to the risk of an unruly rise in borrowing costs, last seen during the 2013 “taper tantrum”.

With inflation creeping into some corners of the world already, investors are increasingly betting that central banks, particularly the US Federal Reserve, may have to raise interest rates sooner than they had planned. That has triggered a sell-off in government bond markets. With inflation reducing the value of future payments from bonds, bond prices tend to fall as expectations of inflation rise. In addition during a recovery phase, government bonds as a safe investments tend to be less appealing.

We're seeing the same theme in the UK. The yield on 10-year British government debt is trading close to its highest level since the onset of the pandemic. In an interview with the BBC, Bank of England governor Andrew Bailey played down concerns over rising yields, adding that the British economy would get back to its late 2019 level around the end of this year, rather than Q1 2022 as the BOE predicted a month ago, and that the BoE’s next economic forecasts would show unemployment peaking at a lower level than the 7.75% rate it predicted in February.

The challenge in Europe

Conditions in Europe paint a starkly different picture. Covid-19 cases are still rising across much of the mainland, the EU is struggling to remain on target to inoculate 70% of adults by September and the ECB last week pledged to accelerate money printing.

As large swathes of Italy prepare to go back into lockdown, Erik Nielsen, chief economist at the Italian bank UniCredit, tells the FT that while the US is now likely to catch up with its pre-pandemic forecast path of growth next year, there is no realistic chance of that happening for several years in Europe.

Meanwhile, Brussels will propose the creation of a Covid-19 certificate to allow EU citizens to travel inside the bloc if they either have proof of vaccination, a negative test or proof of recovery from the virus.

Low rates and global house prices

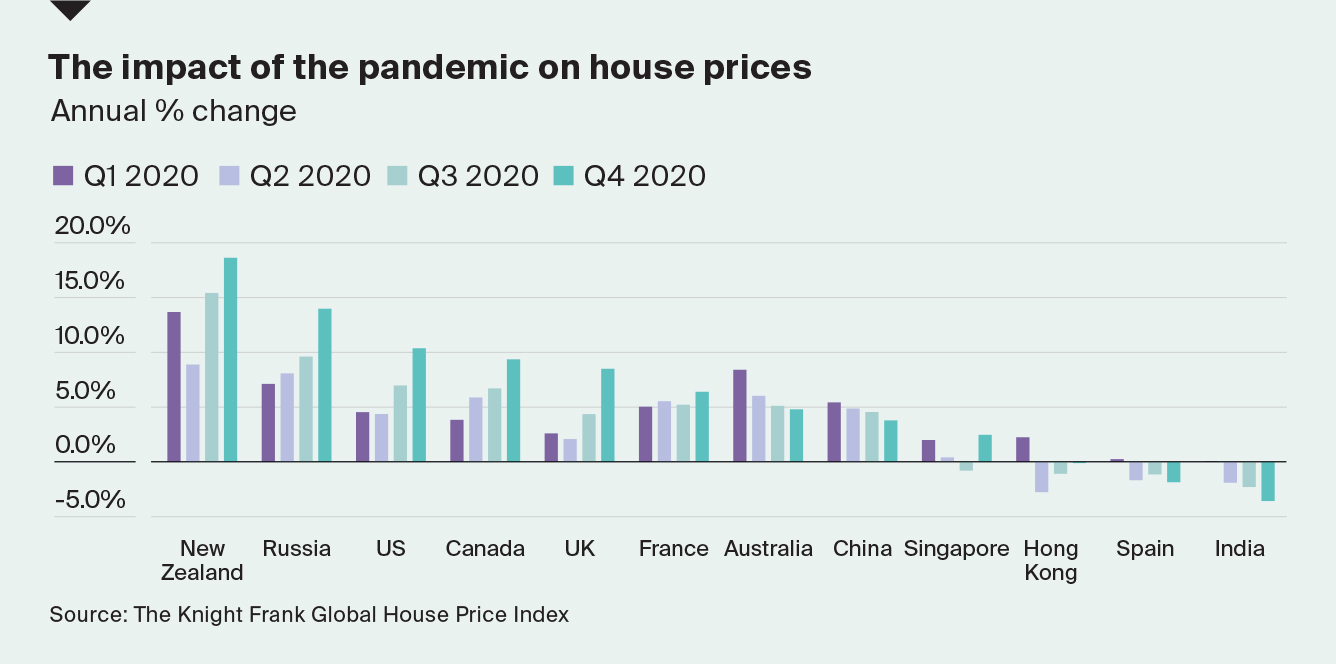

In a year dominated by the worst economic crisis in at least a century, house prices globally rose at their fastest pace in three years during 2020, according to new analysis of 50 global housing markets from Kate Everett-Allen.

Prices increased by 5.6% on average, up from 5.3% in 2019, and some 89% of countries and territories saw prices increase during the year. Turkey leads the index for the fourth consecutive quarter and several markets including New Zealand (19% annual growth), Russia (14%) the US (10%), Canada and the UK (both 9%) accelerated up the rankings in the last three months.

Low interest rates are fuelling demand whilst inventory levels are tight in some markets with sellers reluctant to market their property until they can identify their next home, according to Kate. We talked on Monday about rising asset prices fuelling inequality and governments from New Zealand to China searching for ways to intervene effectively. This is set to become a big theme for policy makers.

ESG moves into built-to-rent

I said back in December that the critical driver of ESG investment volumes in 2021 would be whether or not investors can get ahead of, or just keep up with sustainable legislation and regulations. Whether returns suffer or not as developers spend more constructing state of the art buildings or investors splash out buying them would, in the near-term at least, be somewhat academic.

Writing for React News, Nick Pleydell-Bouverie lays out how build-to-rent developers are increasingly future-proofing assets in order to ensure they retain maximum appeal to investors during the years ahead. Central to that is reducing risk of obsolescence triggered by future regulation change or shifts in tenant sentiment and preferences. According to Nick, the team has already seen an increase in the number of investors willing to pay a green premium.

What remains uncertain is whether all this moves the needle for tenants. Many investors remain unconvinced that this is high on tenant priority lists, or indeed that it will command increased rents or improved occupancy at present.

Therein lies the difference between residential and commercial markets on these issues. Whereas office developers, for example, face pressure from all sides to be green, whether that's from occupiers, investors or their own shareholders, it remains unclear to what extent homebuyers and renters are willing to pay premiums on any significant scale.

Wealth insights

Next week marks the start of our Wealth Report insight webinar series, and we’ll be kicking off with a deep dive into prime residential markets globally.

Our expert panel will discuss how wealth and investment trends are set to influence prime residential markets in 2021, they’ll explore the longevity of the rural and suburban market surge and assess which cities will be best placed to capture global demand as travel reopens

Register now to watch live on Tuesday 23rd March at 9am GMT or on demand.

In other news...

Britons' confidence in economy jumps by most on record, UK shopper numbers rise for seventh week out of eight, UK start-ups attract record $8bn in dash for growth, the art market shrank 22% last year, JPMorgan plans for NYC interns to be in the office this summer, Israelis hope lockdown is over — permanently, Toronto’s bubble in the ’burbs, big real estate owner pledges property overhaul to cull emissions, top 10 lender launches 95% mortgage, Hammerson plans homes on Leicester Debenhams site, and finally, Unite Group confident student halls will fill up again.

Photo by Robert Bye on Unsplash