Daily Economics Dashboard - 19 February 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 19 February 2021 2020.

Equities: In Europe, stock are higher this morning, with gains recorded by the FTSE 250 (+0.6%), CAC 40 (+0.5%), DAX (+0.4%) and STOXX 600 (+0.2%). In Asia, the KOSPI (+0.7%), Hang Seng and CSI 300 (both +0.2%) all closed higher, while the S&P / ASX 200 (-1.3%) and TOPIX (-0.7%) were both down on close. In the US, futures for the S&P 500 are +0.3% this morning.

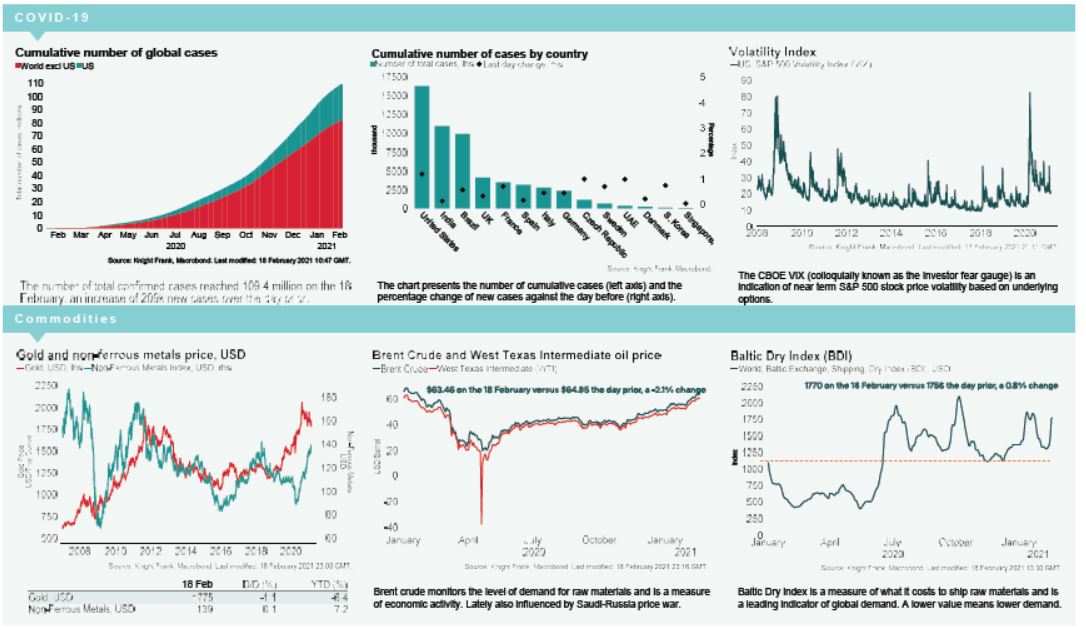

VIX: While the CBOE market volatility index increased +5% over yesterday, this morning it is down -1.2% to 22.2, above its long term average (LTA) of 19.9. The Euro Stoxx 50 volatility index is also lower over the morning, down -3.7% to 21.7, remaining below its LTA of 23.9.

Bonds: The UK 10-year gilt yield and German 10-year bund yield have both softened +2bps to 0.65% and -0.33%, while the US 10-year treasury yield is up +1bp to 1.31%. The UK gilt yield is at its highest level since March 2020.

Currency: Sterling has appreciated to $1.40, its highest level since March 2018, while the euro is currently $1.21. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.49% and 1.42% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased for the seventh consecutive session on Thursday, up +0.8% to 1770, the highest it has been since 22nd January 2021.

Oil: The West Texas Intermediate (WTI) has declined below $60 per barrel this morning, down -1.5% to $59.60. Brent Crude is also lower, down -1.0% to $63.27.

US Unemployment: There were 861k new unemployment applications in the week to 13th February, above market expectations of 765k and higher than 848k in the week prior.

UK Borrowing: UK public sector net borrowing reached £8.8 billion in January, £18.4 billion more than in January 2020. This is the highest January figure since records began in 1993 and the first January deficit in 10 years. In the first 10 months of this financial year, government borrowing reached £270.6 billion, £222 billion more than one year ago and the highest public sector borrowing in any April to January period since records began in 1993.