What impact are the new Help to Buy price caps likely to have?

Changes to Help to Buy are coming, but what impact will regional price caps have for buyers and developers?

2 minutes to read

This week, the government extended the completion deadline for the existing Help to Buy equity loan scheme by a further two months to May 31. The move grants extra time for the build and sales completion of homes that were reserved before mid-December.

It is the third such extension the government has granted, a nod to the impact the Covid-19 pandemic has had on construction output on sites around the country. However, the announcement also came with confirmation that this will be the final time an extension is granted before the full switch is made to the new Help to Buy scheme from April 1.

Under the terms of the new scheme, only first time buyers will be eligible for Help to Buy purchases, while regional maximum value caps will be introduced to better reflect regional variations in house prices, ranging from £600,000 in London to £186,100 in the North East.

But what will this switch mean for developers and buyers?

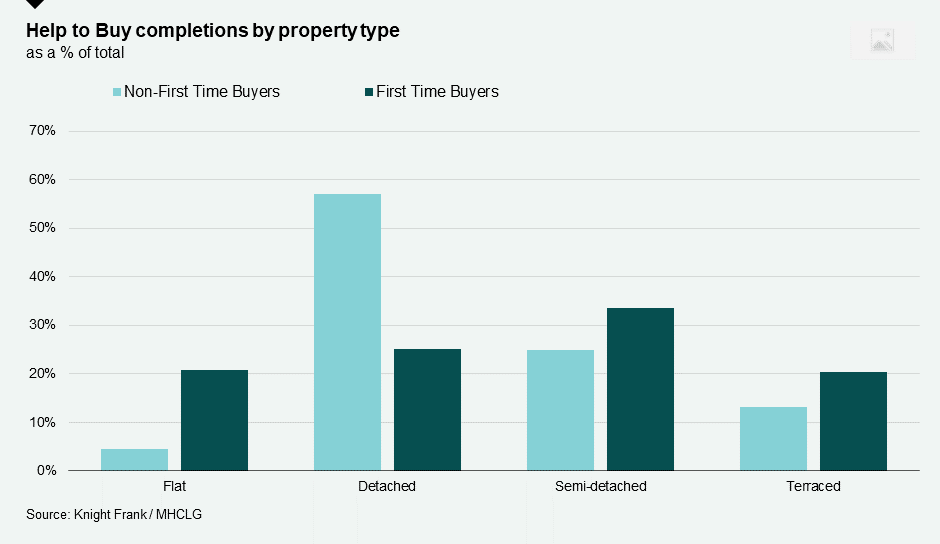

For buyers, the data suggests a fairly minimal impact. Since the loan was introduced in 2013, some 82% of H2B sales have been to first time purchasers. In London, more than 95% of loans were to first time purchasers.

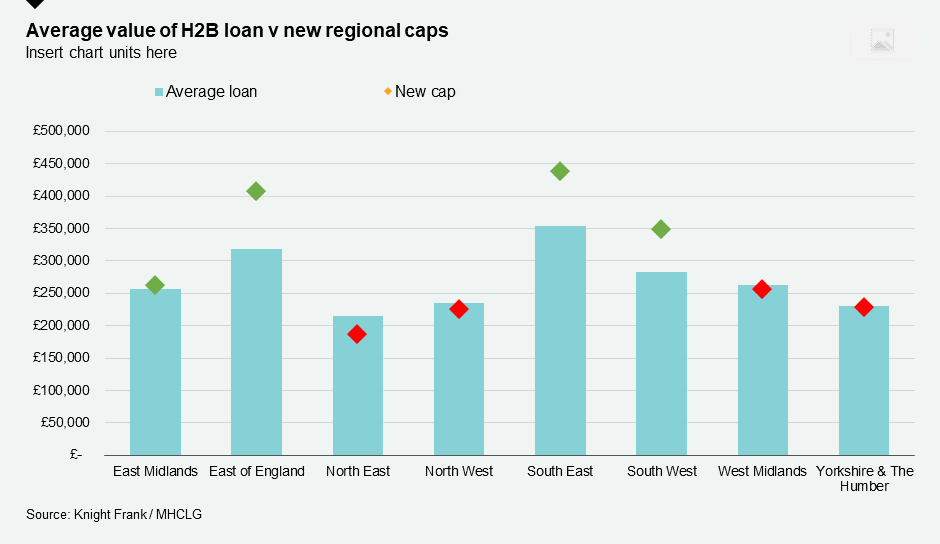

The impact of the new price caps are not as clear cut, however.

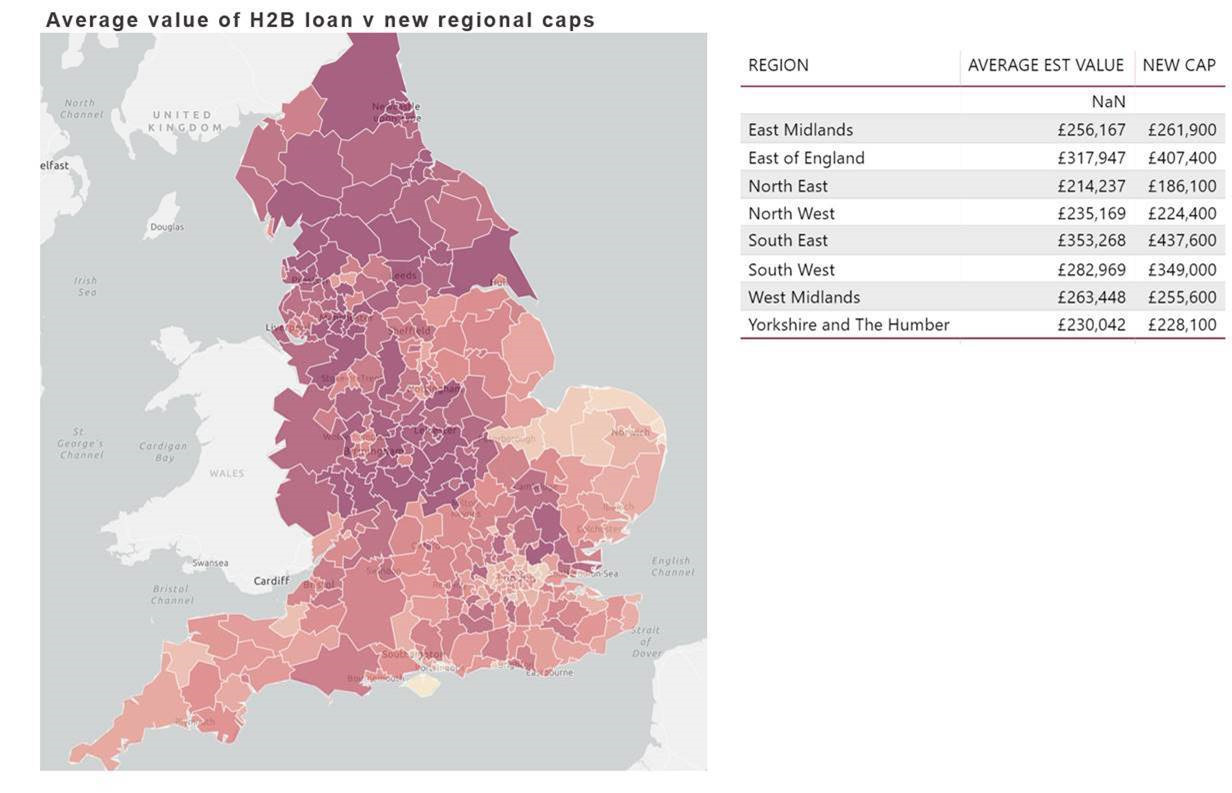

An analysis of average H2B loans, for example, shows that current average loan values in the North East, North West, Yorkshire and West Midlands exceed the incoming regional caps. This may impact the type and size of properties developers are able to sell through H2B in these areas.

The map below breaks this down further, with darker areas representing those local authorities where current average loan sizes are higher than the new regional caps. At first glance, there appears to be a pretty stark north/south divide, with the caps primarily impacting areas in the North of England, and a fairly limited impact in the South.

While that may be the case, though there are some locations – particularly in London’s commuter belt where values tend to be higher – which could be impacted.

In these, we may see future developments delivering smaller, lower priced homes in order to take advantage of the new scheme. Indeed, data from MHCLG shows non-first time buyers were far more likely to purchase a detached property using the loan compared with first time buyers.