UK Property Market Outlook: Week Beginning 1 February

January was arguably the most uncertain month of the whole pandemic for the UK property market. What does the data tell us about how 2021 is unfolding and what are the two key things to watch when attempting to guess if the stamp duty holiday will be extended?

3 minutes to read

Even by the standards of a global pandemic, the early weeks of 2021 have been marked by a high level of uncertainty for the UK housing market.

New Covid-19 variants have raised questions about the effectiveness of the vaccination programme, albeit with largely satisfactory answers so far.

On top of that, speculation has been building that the government may extend the stamp duty holiday beyond 31 March. The exemption applies below £500,000 and represents a maximum saving of £15,000.

If there wasn’t enough guesswork already taking place, a third national lockdown means buyers and sellers are approaching the moving process with added caution.

More sellers than buyers have been holding off, as we showed last month, which has been compounded by school closures. Selling your home is a less straightforward exercise when you are trying to home-school at the same time.

As Parliament prepares to debate a petition to extend the holiday by six months today, sentiment will play a particularly crucial role in the first quarter of this year.

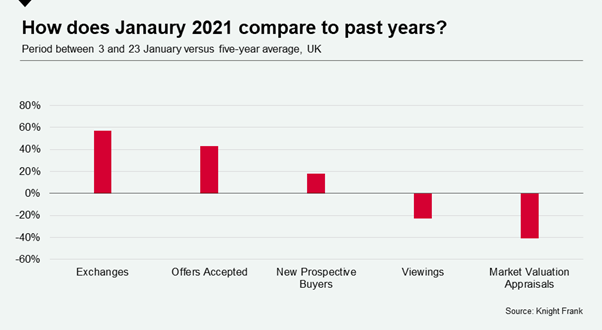

As a result of these multiple uncertainties, January was marked by stronger lagging than leading indicators of activity in the housing market, as shown below by the 57% increase in the number of exchanges.

However, a 43% increase in the number of offers accepted and an 18% rise in new prospective buyers shows there is still momentum in the market, no doubt spurred on by the closing window of the stamp duty holiday.

Web traffic to Knight Frank’s stamp duty calculator page shows how much of a focus the tax was in the first month of the year. Unique visits rose 118% between December and January.

Is today’s Parliamentary debate likely to sway the government’s thinking? Unlikely, according to Sean Randall, a partner at Blick Rothenberg and chair of the Stamp Taxes Practitioners Group.

“My sense is that it was considered but won’t happen, especially if the housing market stays open,” said Sean. “I would always allow for a last-minute U-turn but it is helpful to think of the holiday as one part of a package of measures to help the economy not just the housing market. Some deals will be impacted but a lot of people will just renegotiate.”

To quantify the benefit for the wider economy, Knight Frank calculated that for every 100,000 housing transactions, there is a boost to the economy of almost a billion pounds.

When guessing whether the holiday will be extended, it is therefore worth looking at two pieces of data.

First, the unemployment rate. If the UK avoids a huge spike in its jobless numbers, there is less chance of an extension because the evidence is that the economy doesn’t need it. Last week, the unemployment rate hit 5%, which is still far from the worst case scenario.

Sean Randall believes there may not be time for any meaningful deterioration before the Budget on 3 March. “Realistically it’s now too late. The holiday was about protecting jobs and the expected rise in unemployment will not happen before Budget,” he said.

The second thing to watch is the rate of Covid infections. If numbers rose and restrictions needed to be tightened that included the partial or full closure of the housing market, the government would presumably be forced to re-think the holiday. It is too early to say we are past the worst, but infection rates are on a clear downwards trajectory.

Stamp duty accounts for around £12 billion of the government’s £635 billion annual tax revenues. It is not a huge slice but every bit of revenue is significant as the government attempts to re-balance the books. The bandwidth for a wider re-think of property taxes is unlikely to exist at present.

However, there is some pressure to extend the holiday from the so-called ‘red wall’ group of Tory MPs. Furthermore, the conveyancing system is creaking under the pressure of high deal volumes and stories of transactions collapsing at a time when labour market mobility is under scrutiny may increase the pressure on the Treasury.

That said, two months from the end of the holiday, it feels like any government U-turn would need to be particularly sharp.