UK Property Market Outlook: Week Beginning 11 January

We have revised our forecasts down for 2021 in light of the third national lockdown and the prospect of travel restrictions that remain tighter for longer.

3 minutes to read

You won’t see many straight lines if you look at a graph of how the UK housing market performed during 2020.

The tumultuous backdrop of a global pandemic means the same will be true in 2021, a fact exacerbated by a third UK national lockdown.

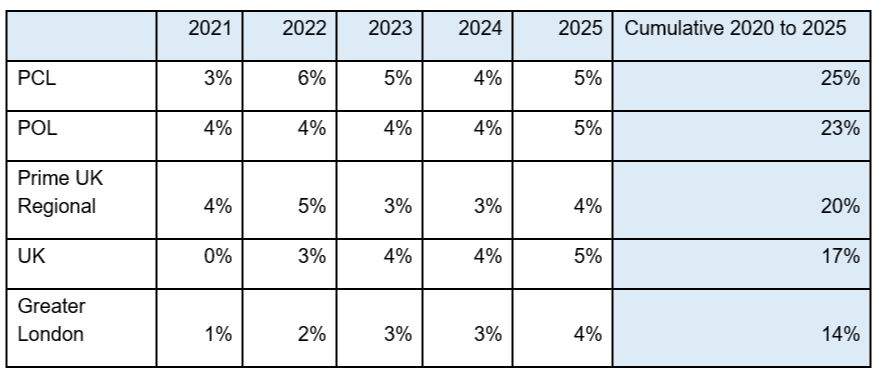

In light of the current measures, which may remain in place until March, we have revised our price forecasts for 2021, see below.

We expect UK prices to be flat over the course of this year (the previous figure was +1%) and have also removed a percentage point from our forecasts for prime central and prime outer London. To put this in context, two leading indexes showed UK prices up by between 6% and 7% in the year to December 2020.

The difference between the first and second half of the year will be starker for the property market as a result of tougher measures designed to combat the new variants of Covid-19.

While the short-term economic outlook has deteriorated, the end of the furlough scheme will not necessarily have a negative impact on house prices by itself, as we have previously analysed.

There is also speculation the government will extend the scheme again, underlining its belief that the early removal of support measures would be economically self-defeating.

Against the backdrop of a strong housing market, there has been no indication the government will extend the stamp duty holiday, despite its wider economic benefits.

However, a third national lockdown will increase pressure on the conveyancing system and as a number of deals fall through or look like they will miss the 31 March deadline, pressure on the government to extend or taper the holiday will intensify.

Although the end of the stamp duty holiday will curb demand, the vaccine rollout means any cliff-edge will feel less precipitous by the start of April.

Another reason for the reassessment of prices in 2021 is the subtle shift in the supply/demand dynamics in recent weeks as more sellers hold off due to Covid-related uncertainty.

The number of new prospective buyers was 10% higher in December than the same month in 2019 across the UK. Meanwhile, the total number of sellers having their property valued for sale fell by the same amount. Should this trend continue, any subsequent spike in supply this spring, as an element of seasonality combines with a wider vaccine rollout, will increase downwards pressure on prices in Q2.

In Greater London, we expect prices to be broadly flat this year, with a forecast of 1% growth reflecting the greater resilience of the economy in the capital as support measures are unwound. Beyond this year, we expect the UK to outperform due to affordability constraints in London as demand is pushed further into the regions.

The potential for an uptick in supply in Q2, combined with tighter restrictions around international travel, means we have reduced our forecasts for prime London markets. However, it remains true that a period of price inflation is overdue, despite the introduction of a 2% stamp duty surcharge in April.

We believe prime regional markets will be less affected by the third national lockdown and have revised our forecast upwards for 2022 up as the ‘escape to the country’ trend is prolonged by tougher lockdown measures at the start of this year.

The broad trajectory of property markets in 2021 remains the same but assessing how short-term sentiment will change remains complex. While the third lockdown may remain in place until March and restrictions may tighten further, any evidence that the vaccination programme is limiting the impact of Covid-19 may begin to encourage more activity and we will keep the forecasts under review.