Race for space propels Edinburgh City to record fourth quarter

House 109.9 / Flat 126.7 / Index 113.2

2 minutes to read

Property values in Edinburgh increased by 1.7% in the three months to December. This was the strongest fourth-quarter performance in more than ten years.

It took the annual change to 5.8%, capping a year in which buyers’ appetite for more space has driven demand for large, family homes.

Continuing the strong performance from the third quarter, properties valued over £2m were the top performer in the fourth quarter, rising 5.6% and taking the annual change to 14%. Properties valued between £1.5m and £2m saw the second strongest rate of growth, with prices up 4.1% in the fourth quarter, taking the annual increase to 11.1%. This has been due to a mix of wealthy buyers leaving London and domestic buyers upsizing.

“Houses have been the hot ticket with buyers from London, as well as local residents looking to upsize, which has driven the prime market,” said Edward Douglas-Home, head of Scotland residential at Knight Frank.

The number of new prospective buyers registering in October and November were, respectively, the fifth and sixth highest monthly totals on record, underlying the strength of demand.

The prime suburban market, predominately Victorian-era homes outside the city centre, has benefitted from people’s pursuit of more space since lockdown ended on 29 June in Scotland.

Average values in residential south Edinburgh, including the areas of Morningside and Merchiston, rose 2.3% in the three months to December, taking annual price growth to 7.1%, making it the best performing area of the city.

The New Town/West End area at the heart of Edinburgh’s commercial district saw values increase 5.4% over the twelve months to December.

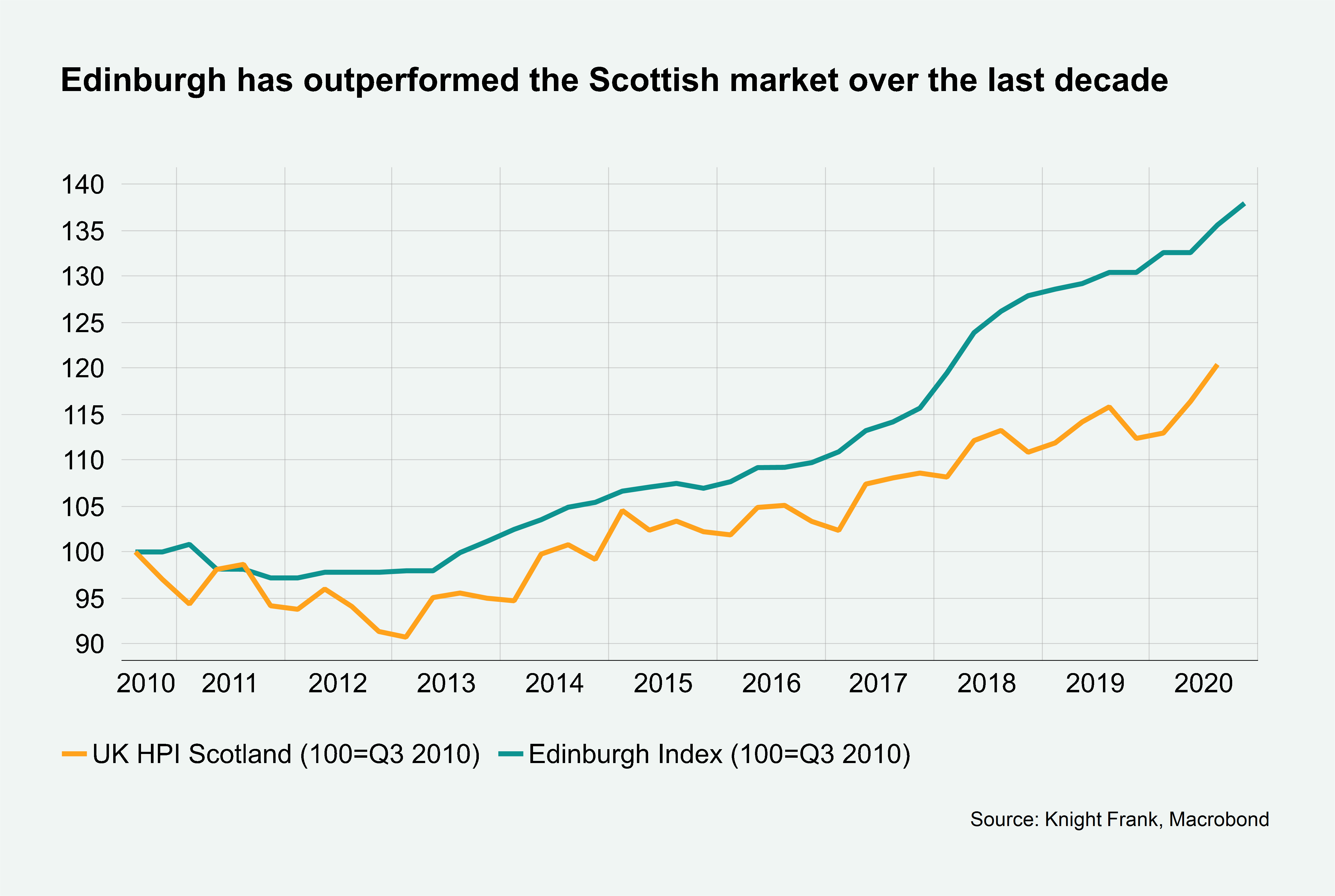

In the past ten years prices in Edinburgh have increased by 33%, which, along with the Midlothian region, has made it the fastest growing area in Scotland (2009 to 2019) according to the National Records of Scotland.

As in England, Scotland has a transaction tax holiday in place, with the Land and Buildings Transaction Tax suspended on the first £250,000 of a property purchase until 31 March 2021, and this should support activity into the new year.