The London Investor Bulletin

As we approach the end of a tumultuous year, news of the vaccine roll-out is boosting market sentiment, but in parallel, the world continues to grapple with rising COVID-19 infections and fatalities.

1 minute to read

The pandemic has delivered the economic uncertainty we expected, while also fueling the debate around the future of the office and while businesses reassess their occupational strategies, with a view to allowing greater remote working in the future, London’s leasing market has registered its lowest levels of lease deals on record during Q3.

London’s commercial property market has been supported by strong fundamentals since the EU referendum: a shortage of stock for occupation, diverse and robust demand from businesses, led by finance and banking, professional services, tech and flexible office providers and yields that outstrip most global bond offerings and indeed most major European gateway cities.

The ability of property to deliver longterm income, portfolio diversification and asset management opportunities, means it will remain the central pillar of investment portfolios. And London has been no different, with investment volumes rapidly climbing in the second half of 2020.

The increase in activity is evidenced by the rapid succession of big ticket deals at the start of October – 1 London Wall Place for £480m, 50% of the Nova

Estate for £450m and White City Place for £235m. These transactions show how the confidence towards the medium-term prospects for London that was emerging during Q2 and Q3 has grown, translating into heightened interest for London assets. This confidence in turn is helping to unlock a market that has experienced a dearth of stock for many years.

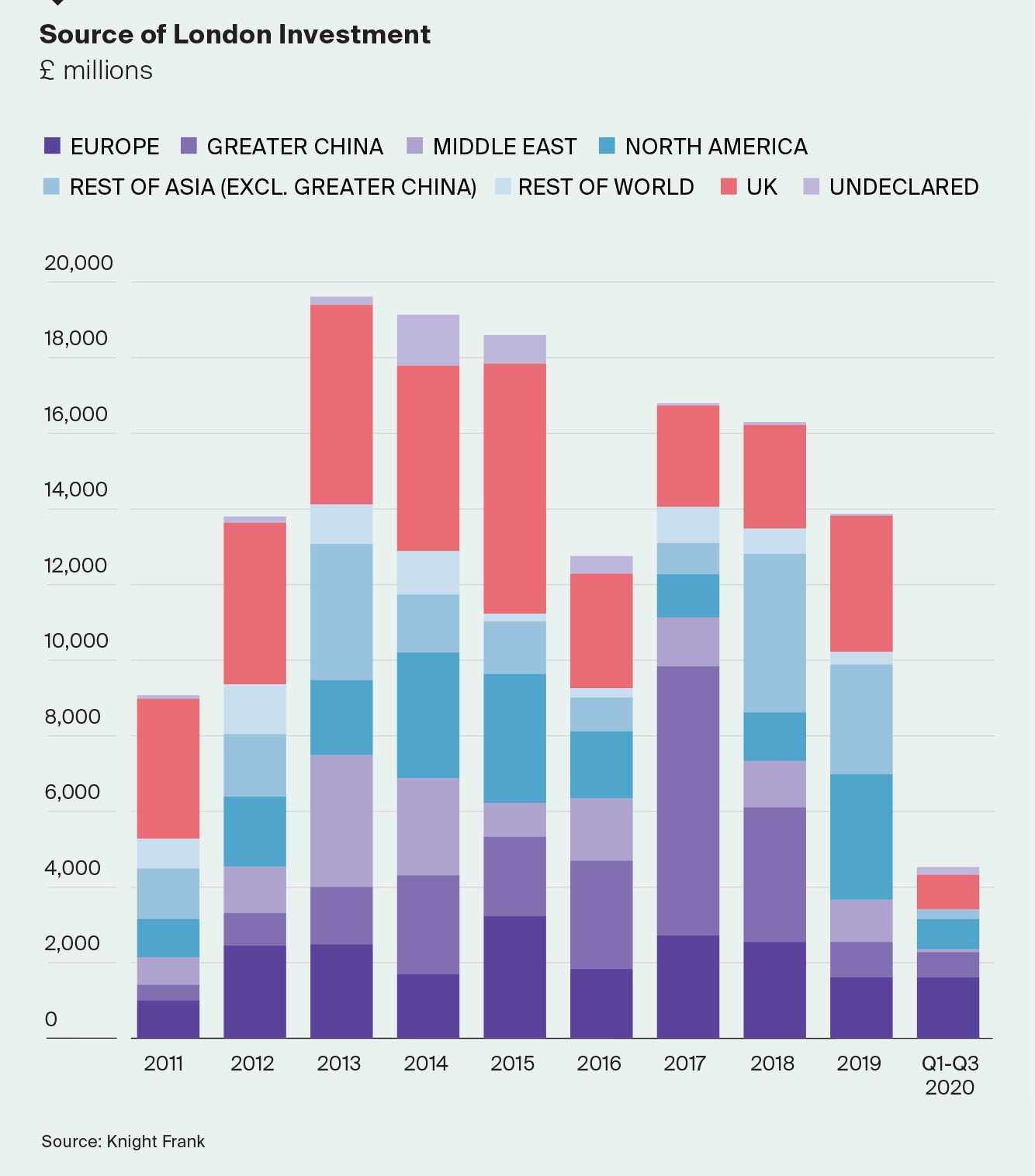

Year-to-date turnover stands at £8 bn across London. This compares to a longterm average of £12.5bn. To put this in context, turnover levels during the GFC in 2008 and 2009 were £6.8bn and £6bn, respectively.

As always, however, there are multiple factors at play. We take a look at three key trends shaping London’s office investment landscape.