Covid-19 Daily Dashboard - 25 November 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 25 November 2020.

Equities: In Europe, stocks are mostly lower this morning, with the FTSE 250 (-0.6%), DAX (-0.3%) and STOXX 600 (-0.2%) all lower. In Asia, the S&P / ASX 200 (+0.6%), Hang Seng and the Topix (both +0.3%) all closed higher, whereas the CSI 300 was -1.3% down on close. While the Kospi (-0.6%) also closed down, the index has seen year to date (YTD) gains of +18%, the highest of all other equity markets. In comparison, the US S&P 500 has seen YTD gains of +13%, while the Nikkei 225 and the SSE have both seen increases of +11% this year.

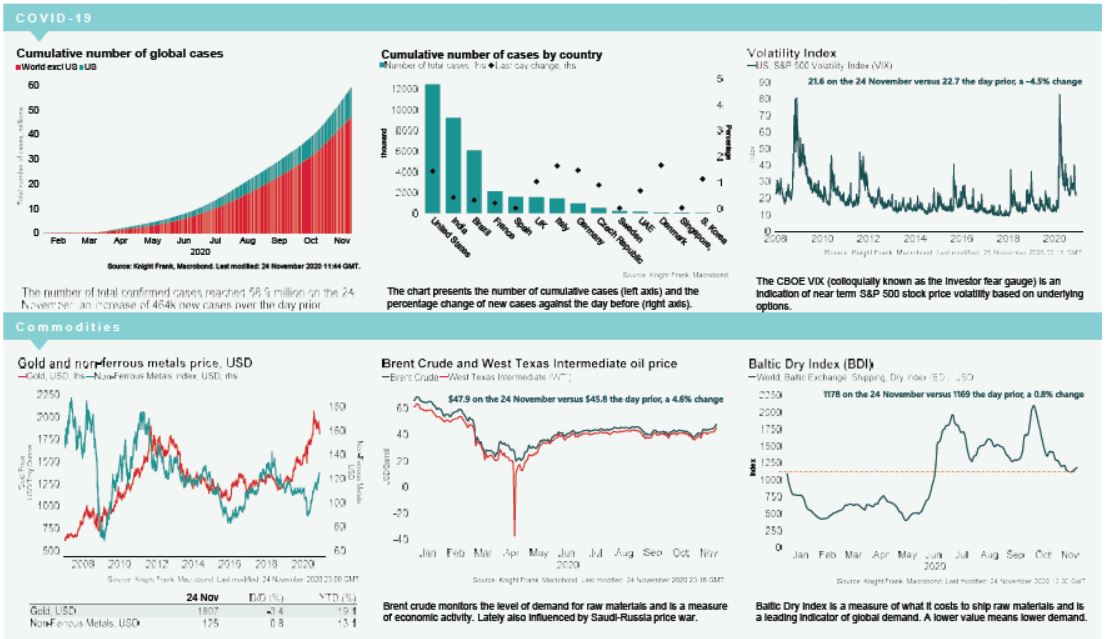

VIX: Following a -4.5% decrease over yesterday, the CBOE market volatility index has increased +0.2% this morning to 21.7, which remains above its long term average (LTA) of 19.9. Meanwhile, the Euro Stoxx 50 volatility index is flat at to 21.4, which remains below its LTA of 24.0.

Bonds: The UK 10-year gilt yield, US 10-year treasury yield and the German 10-year bund yield have all compressed -1bp to 0.31%, 0.87% and -0.57%, respectively.

Currency: Sterling has depreciated to $1.34, while the euro is currently $1.19. Hedging benefits for US dollar denominated investors into the UK and the eurozone are currently 0.39% and 1.27% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased for its sixth consecutive session on Tuesday, up +0.8% to 1178. Year to date gains in the index are currently at +8%, following cumulative declines of -44% over the past 36 sessions.

Oil: Brent Crude and the West Texas Intermediate (WTI) have increased +0.6% and +0.7% over the morning to $48.16 and $45.20, respectively. This is the highest price both Brent Crude and the WTI have been since March.

Gold: The price of gold decreased -1.7% on Tuesday to $1,807 per troy ounce, the lowest price achieved for the metal since mid July. However, gold is +18% above where it was at the start of the year.

Brexit: There is currently an 88% likelihood of a trade deal between the UK and the European Union being signed in 2020, according to Oddschecker. This compares to a 82% probability one week ago and a 75% likelihood last month.