UK Property Market Outlook: Week Beginning 16 November

How can investors navigate the UK property market if the positive news on a vaccine gathers pace?

3 minutes to read

After Pfizer announced its vaccine was 90% effective last week, Professor John Bell from the University of Oxford predicted life would return to normal by next spring.

The reaction of financial markets was rapid.

Share prices jumped for airlines, hospitality businesses and manufacturers of the deep freezers needed to store the Pfizer vaccine.

Meanwhile, shares in video call operator Zoom fell 18% and other tech stocks were similarly hit as investors bet patterns of behaviour established during the pandemic would start to unwind.

This potential reversal was apparent within seconds of the Pfizer announcement on Bloomberg terminals across the world. It is likely to play out over many months and in a less emphatic way in UK residential markets.

For investors who believe the vaccine news will remain positive, an analysis of what has happened to property prices since May is a good place to start. If the Pfizer announcement proves to be a turning point, assumptions and trends established in the property market during 2020 may also begin to reverse.

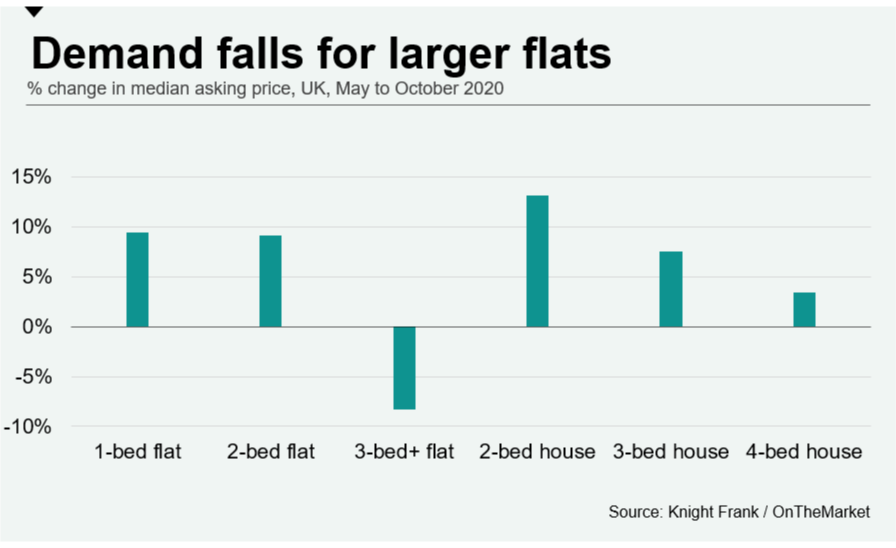

The trends are familiar by now. Demand has grown for properties with outdoor space, which has benefitted the country house market as well as more suburban locations. In broad terms, house prices have also performed better than flat prices for the same reason.

The arrival of a vaccine won’t, of course, produce the mirror image of this trend. That would be as simplistic as saying Covid-19 is meaningfully shrinking demand in London and other big cities, reversing centuries of urbanisation. The truth will not be as black and white in a slow-moving, sentiment-driven market where other factors such as affordability are at play.

However, for investors who believe the vaccine news will remain positive, there is one property type that has under-performed in 2020 – the large flat. This is due to the fact demand for larger flats has more readily switched to houses. That, to some, will signal a buying opportunity.

The median asking price of a three-bedroom-plus flat dropped 8.7% between May and October in the UK, an analysis of OnTheMarket data shows. It was the only property type analysed to record a decline over this period, as the below chart shows. Meanwhile the median asking price for a two-bedroom house rose 13.2%, the largest such increase, indicating how demand has shifted. See bottom for full numbers.

Furthermore, the only property type not to see its value increase in the third quarter of 2020 was flats, according to the Prime Country House Index. While the overall index posted quarterly growth of 2% in Q3, the value of flats declined by 1%.

In London, this downwards trend has been exacerbated by the lack of overseas buyers due to international travel restrictions, many of whom typically prefer apartments because they are more common in other cities across the world.

“The largest discounts in recent months have been for bigger flats,” said Keir Waddell, head of Knight Frank’s Riverside office. “The stamp duty holiday has helped the market for smaller flats, which has also been driven by people downsizing their London base and buying somewhere bigger in the country. As international travel restrictions are relaxed, I would expect that overseas demand to return.”

As the news on a vaccine gathers pace, that’s something for investors to weight up.

Median asking price changes, May 2020 to October 2020 (OnTheMarket)

One-bedroom flat +9.5% to £230,000 from £210,000

Two-bedroom flat +9.1% to £300,000 from £275,000

Three-bedroom-plus flat -8.3% to £550,000 from £600,000

Two-bedroom house +13.2% to £215,000 from £190,000

Three-bedroom house +7.5% to £288,000 from £267,995

Four -bedroom house +3.4% to £450,000 from £435,000