A step up in build to rent delivery

There are nearly double the number of BTR homes in the pipeline than currently complete.

2 minutes to read

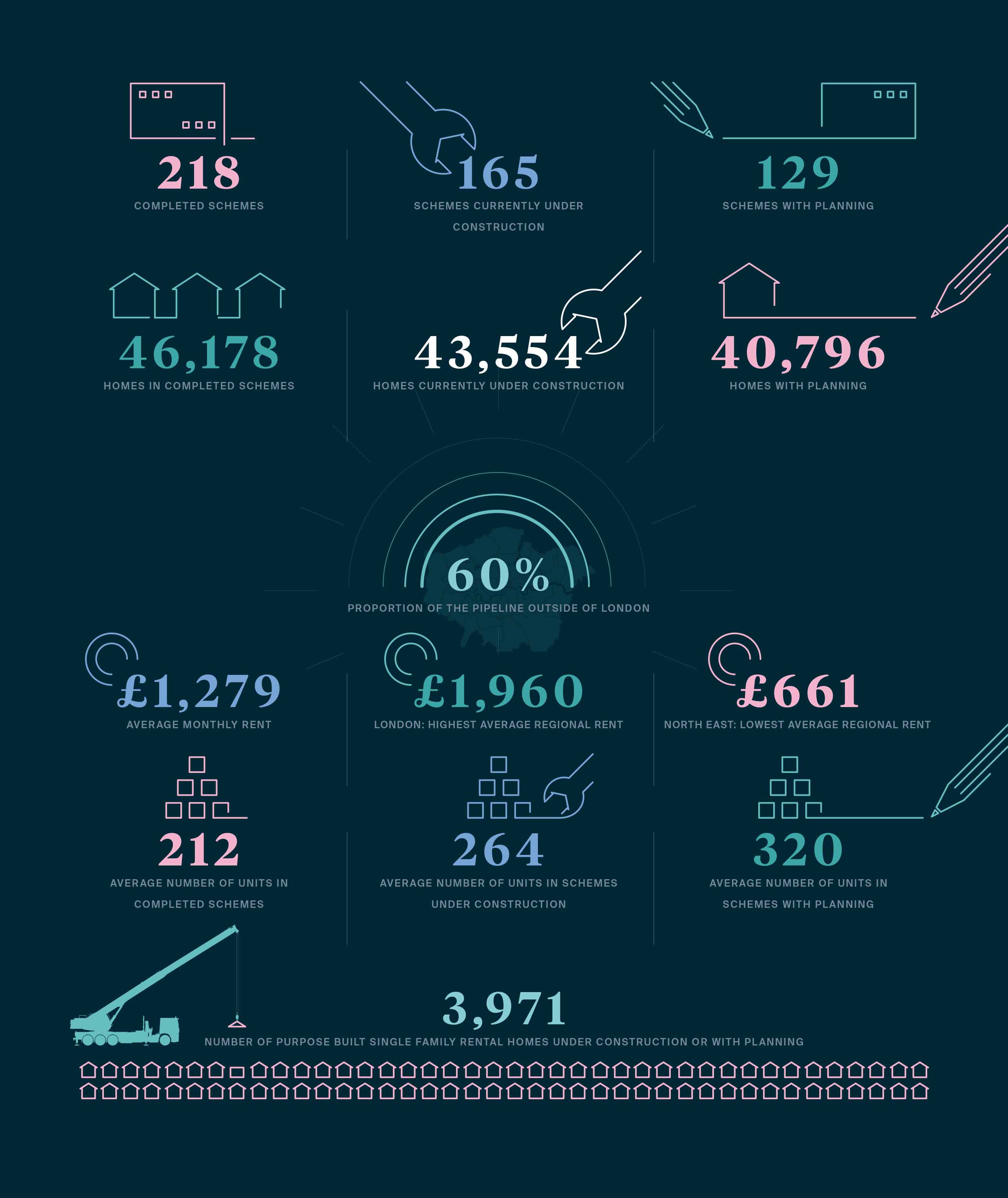

The number of BTR homes currently complete or near completion in schemes of over 75 units in the UK stands at 46,178. A further 43,554 homes are under construction and 40,796 have planning permission granted and will be delivered in the coming years.

In total, there are 130,528 homes in large schemes complete, under construction or with planning, analysis in the Knight Frank/HomeViews Multihousing Report reveals.

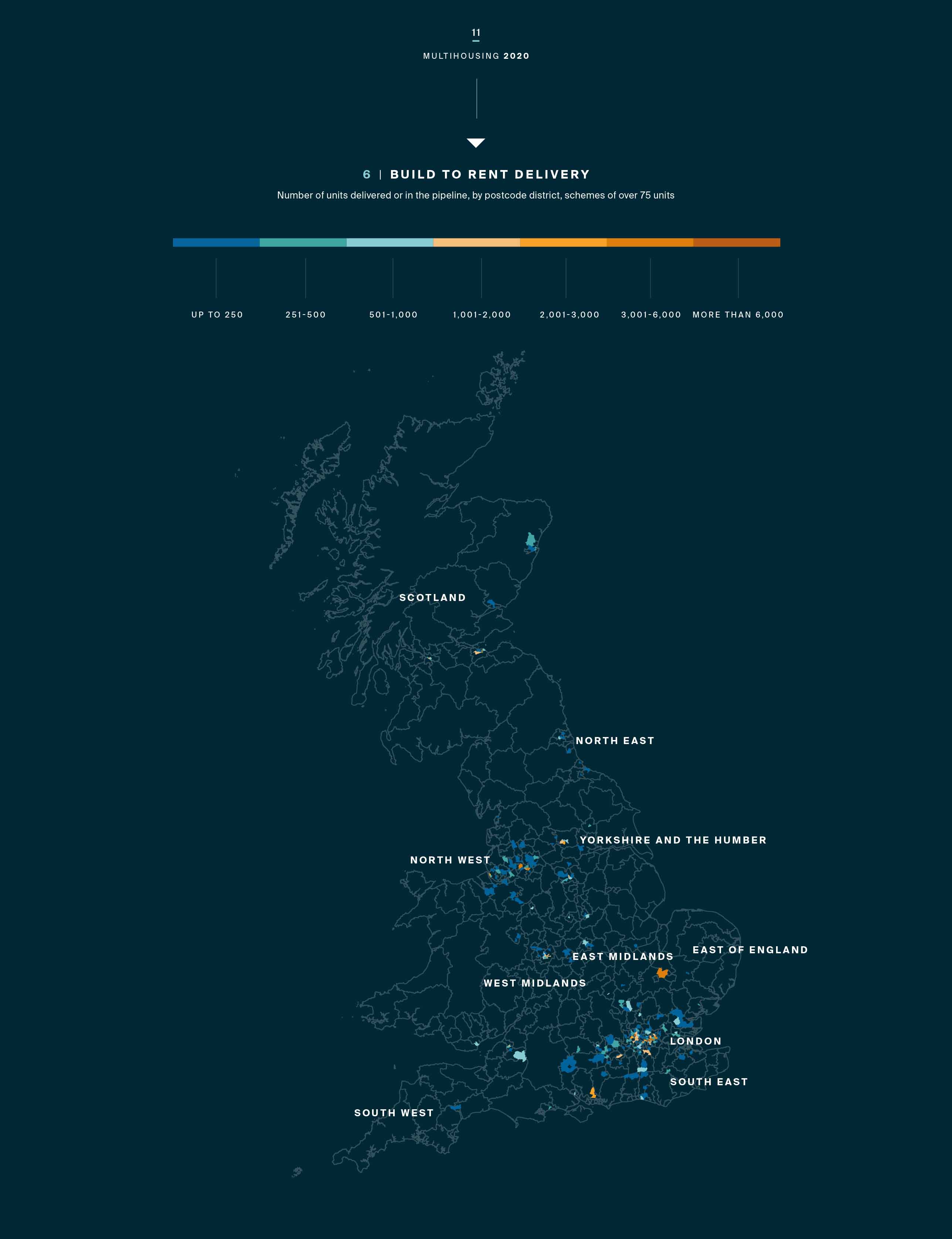

London accounts for around 40% of the total number, broadly reflective of BTR investment volumes over the past few years, with Newham, Tower Hamlets, Ealing and Brent contributing the most completed stock in the capital to date.

Outside of London, key regional cities make up the majority of BTR development, with Manchester, Salford, Birmingham, Liverpool and Leeds accounting for 35% of completed stock.

The picture is changing, however, with investors recognising the potential for BTR in smaller cities with strong fundamentals, as well as strategic locations such as commuter towns with good transport links to major cities, such as Milton Keynes and Guildford.

In total, more than 60% of the BTR homes on large schemes of 75 units and above either under construction or with planning granted will be built outside of London.

Whilst future regional delivery has been - and will continue to be - focused around a select group of the UK's larger urban centres, development is relatively widely dispersed across the country. Most regions now boast a pipeline which far exceeds existing stock.

For investors, the appeal of regional localities is clear. Lower land prices, less competition from the sales market and more attractive entry yields for starters. However, with housing affordability less of an issue outside London, the right demographic needs to be in place at sufficient scale.

As new destinations become more established, and more developments are operational, further regional investment and geographical diversification will follow.

The size of BTR schemes is also growing as investors look to build scale. The average number of units for schemes under construction is 264, compared with 212 homes for schemes which have already been completed.

An increase in the size of schemes chimes with responses to our latest Investor Survey which suggested the ‘sweet spot’ for investors was between 225 and 250 units.