Global Residential Outlook – 25 September 2020

Key takeaway:With second surges now evident in a number of countries, consumer sentiment may waiver and transactions may moderate but it may also spur on demand for second homes as the long-term implications of the pandemic are laid bare. It is unlikely we will see the housing market halt entirely as in Q2 2020 when sales were impeded.

Policymakers are starting to look at property or foreign buyer taxes as a means to generate income and boost public finances with Australia proposing a rise in foreign investment applications, Spain debating a higher wealth tax and Canada proposing ‘a tax on wealth inequality’.

3 minutes to read

Need to Know:

Second waves of the pandemic are taking place not just across the UK but several European markets as well. Stricter rules are now in force this week across France, Spain and parts of Central and Eastern Europe.

Italy has managed to keep the virus under control. Experts point to three main reasons – first mover advantage (first to be badly hit in Europe and learnt a lot as a result), high public compliance & stricter enforcement, effective testing and monitoring.

The European Central Bank is reviewing its flagship bond-buying scheme that the ECB launched in response to the coronavirus crisis in March and expanded to €1.35tn in June

Residential digest

Europe

The UK property market saw the highest number of exchanges since the end of 2019 in the week ending 29 August, Knight Frank data shows.

The German city of Leipzig is now on the radar of investors according to a report by our partners in Germany, Ziegert. The city’s population has increased by 19% in the last decade and with average prices at around €4,500 per sq m, half those of other major German cities, the city is attracting attention.

Asia Pacific

The new Australian Residential Review highlights that the country’s housing market has performed better than expected in the second quarter of 2020 with prices nationally up 6.1% year-on-year. A build up of pent-up demand, constrained supply and the extension of government stimulus measures is leading to heightened sales.

With Australian UHNWIs having spent this winter at home for the first time in many years, the prime segment has been equally robust with Sydney, Melbourne and Brisbane all seeing prime price growth remain in positive territory. Stronger enquiry levels set against constrained supply has seen the average days on the market for a prime property in Sydney decline from 90 in March to 82 in June.

The Federal Government in Australia is proposing to increase fees for foreign investment applications. The fees are being updated to reflect the costs associated with reviewing foreign investment applications as a result of the reforms to the foreign investment framework implemented at the onset of the pandemic.

US and Canada

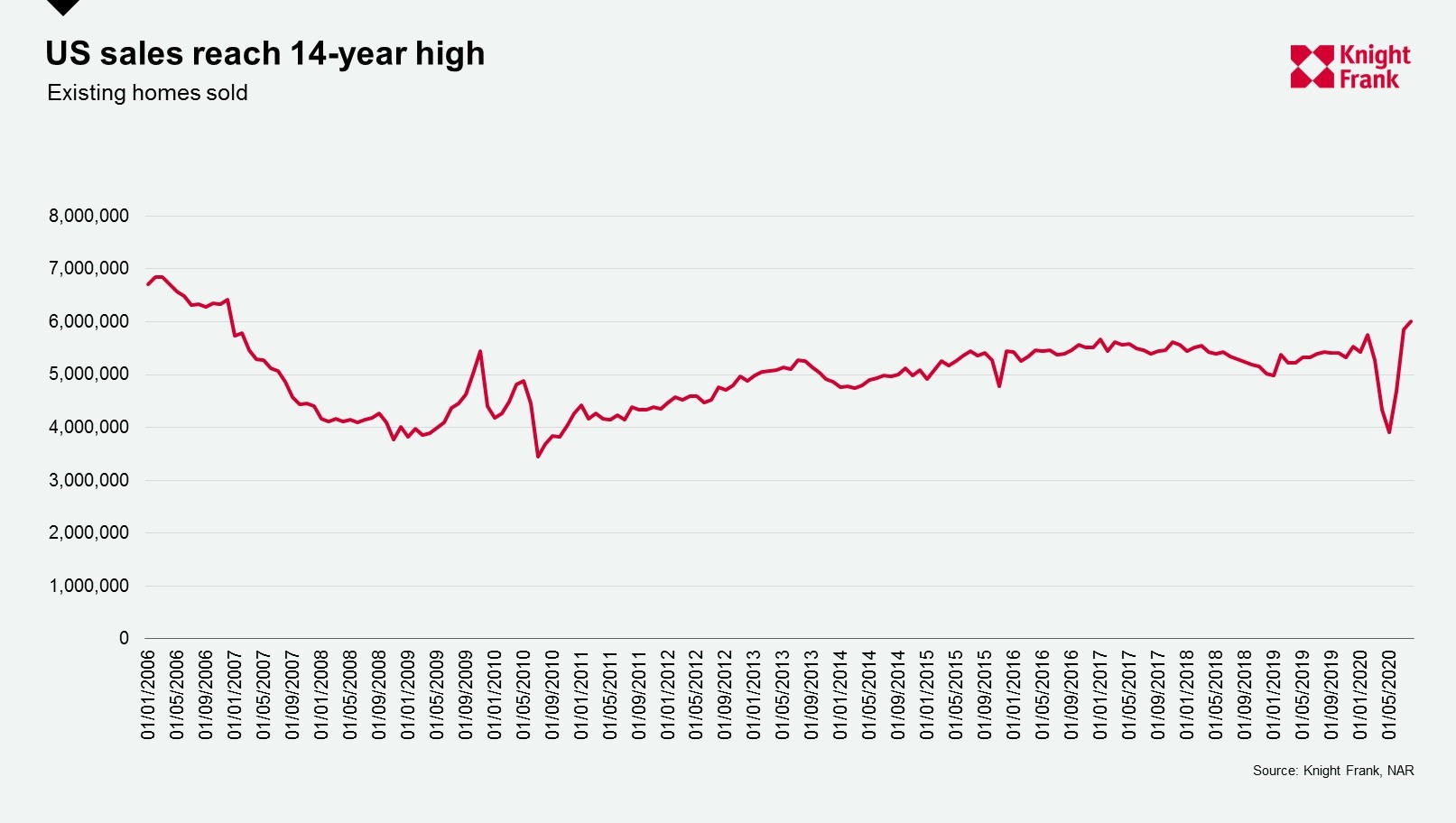

Existing home sales in the US are now at a 14-year high. New data from the National Association of Realtors show sales in the US are up 11% in the year to August 2020. Low interest rates and pent-up demand are driving activity with 69% of the homes sold in August on the market for less than a month.

Middle East

A new retirement visa in Dubai is attracting interest. “Retire in Dubai”, an initiative launched earlier this month to allow expats to apply for a retirement visa if they own a property valued over AED2 million (c.US$550,000), is expected to boost property demand. Estimates from the Dubai Statistics Center suggest there are over 170,000 people over the aged of 55 years in Dubai.

Recommended listening

This week we delve deeper into the findings of our Global Development Report, discuss what second home owners need to consider before the Brexit transition period ends and explore why waterfront properties are commanding such high premiums.

Click one of the links below to listen:

Apple

Spotify

Acast