Covid-19 Daily Dashboard – 7 September 2020

An overview of key economic and financial metrics.

1 minute to read

Download an overview of key economic and financial metrics relating to Covid-19 on 7 September 2020.

Equities: Equity market performance in Europe has been positive this morning, with the FTSE 250 adding +1.4% and the DAX +1.2%. The STOXX 600 and the CAC 40 are also higher, both up +1.0%. In Asia stocks were mixed, with the Kospi (+0.7%) and the S&P / ASX 200 (+0.3%) both higher on close, while the TOPIX (-0.4%), Hang Seng (-0.4%) and CSI 300 (-2.1%) were down on close. In the US, markets remain closed due to a national holiday, however, futures for the S&P 500 are marginally lower (-0.3%).

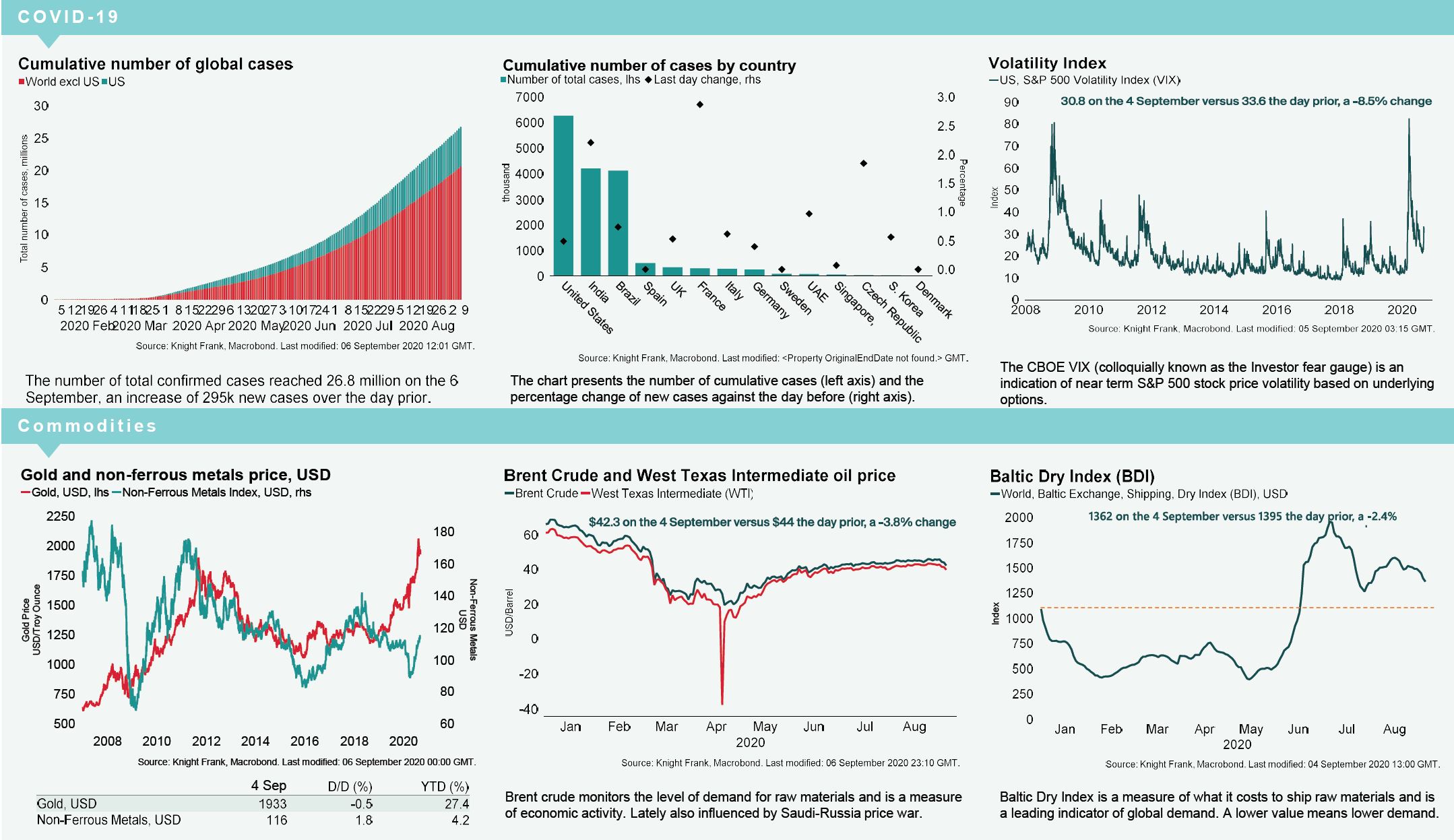

VIX: The CBOE market volatility index is down -9.3% to 30.7, partially offsetting the sharp increase of last week amid a tech-based sell-off in US equity markets. The Euro Stoxx 50 volatility price index is currently 28.4.

Bonds: The UK 10-year gilt yield and the German 10-year bund yield are currently at 0.25% and -0.48% respectively.

Currency: Sterling and the euro have slightly depreciated to $1.32 and $1.18. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.31% and 1.16% per annum on a five-year basis.

Oil: Following Saudi Aramco’s announcement on Sunday that it would cut prices on crude shipments to Asia, Brent Crude and the West Texas Intermediate (WTI) have decreased -1.7% and -1.9% to $41.92 and $39.00 per barrel.

Baltic Dry: Following a decline of -8.4% over the previous seven trading sessions, the Baltic Dry lost a further -2.4% on Friday, down to 1,362, its lowest level since the end of July.