6 reasons why the UK needs to build more elderly care homes

Our latest research helps to explain the appeal and opportunity in healthcare development - all despite the short-term challenges.

3 minutes to read

1. Rapid elderly population growth

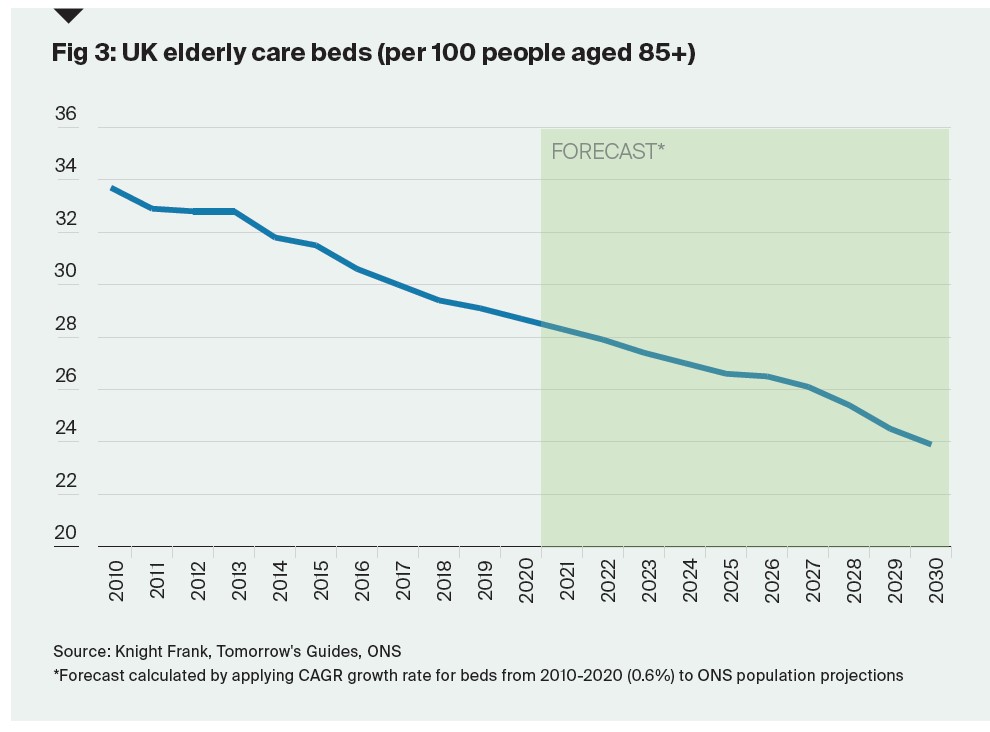

The UK’s over 85 population will grow from 1.6 million in 2020 to 2.1 million in 2030, and 3.7 million by 2050 as the post-war baby boom generation reach their twilight years. While we are building new care homes and beds, the pace of development is not in keeping with elderly population growth The number of care home beds per 100 people over the age of 85 has fallen from 33.7 to 28.7 since 2010 and is forecast to fall further.

2. Existing stock is approaching obsolescence

Of the UK’s care homes, an estimated 70% is now aged 20 years or older. Conversion homes and even 1990’s purpose-built homes are becoming increasingly outdated with care standards improving and specifications changing more than they have done in the past. Fit-for-purpose homes are now expected to contain full en-suite and wet room facilities, wider corridors and ample leisure and living facilities. Many homes are struggling to meet new expectations.

3. Too many homes are closing

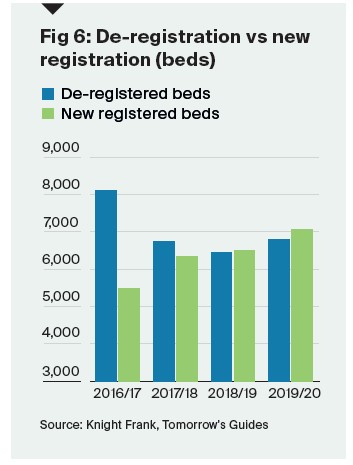

Struggling care homes are closing at roughly the same level as new homes are opening – this is a significant barrier to market growth. In the 2019-20 financial year, a total of 7,058 beds (122 homes) were newly registered and 6,789 (233 homes) were de-registered. The main reasons for closure are failing care standards and financial stress, the latter brought about by increasing staff costs and funding challenges. The current level of home closures is heightening the need for new homes to replace those lost.

4. COVID-19 puts more homes at risk

We expect the pandemic to have a more pronounced effect on smaller independent homes that lack the scale to cope with occupancy loss, or the building design and management infrastructure to better protect against the virus. Currently, there are over 6,500 homes below 40 beds and while the pandemic may serve to accelerate the closure of a poor performing section of these in the short-term, it may also serve to accelerate the building of new homes with increasing pressure to upgrade the market and better protect future residents.

5. Care standards and care needs are changing

Care operators are under pressure to deliver a better standard of care and many are certainly achieving this. The last decade has seen greater integration of memory care into building design with adaptations to improve care for those with dementia and alzheimer's. COVID-19 should have a similar legacy – we will need to build new care homes with wider corridors to help enable social distancing; larger rooms with en suite and wet room facilities as standard to promote resident isolation; adapted fixtures and fittings to limit touch points; and safer visitor areas with enhanced communication systems.

6. Strong private-paying market

While the challenges of care funding and staffing often make the newspaper headlines, we also need to remember that the next generation of over 85’s will have many affluent and high-income members who won’t qualify for state funded care and will also want to pay a premium for the best possible residential care. The self-funded (private-pay) market is already driving much of the new development across the UK and we expect it to do so going forward with private-funded homes performing and trading strongly. Investors are increasingly willing to finance such developments, and will likely be seeking greater exposure to long-term income in the current economic climate and the flight to quality.

To read our full Healthcare Development Opportunities Research 2020 follow this link.

By Joe Brame, Senior Healthcare Analyst