Global Residential Outlook – 16 July 2020

A roundup of the latest data and insight across key global residential markets

7 minutes to read

Key takeaway: With demand side indicators weakening (employment, incomes etc) governments are looking to revitalise housing markets either through tax incentives (UK), the offer of working visas (Barbados) or by bringing forward large-scale regeneration projects (Spain).

Residential Digest

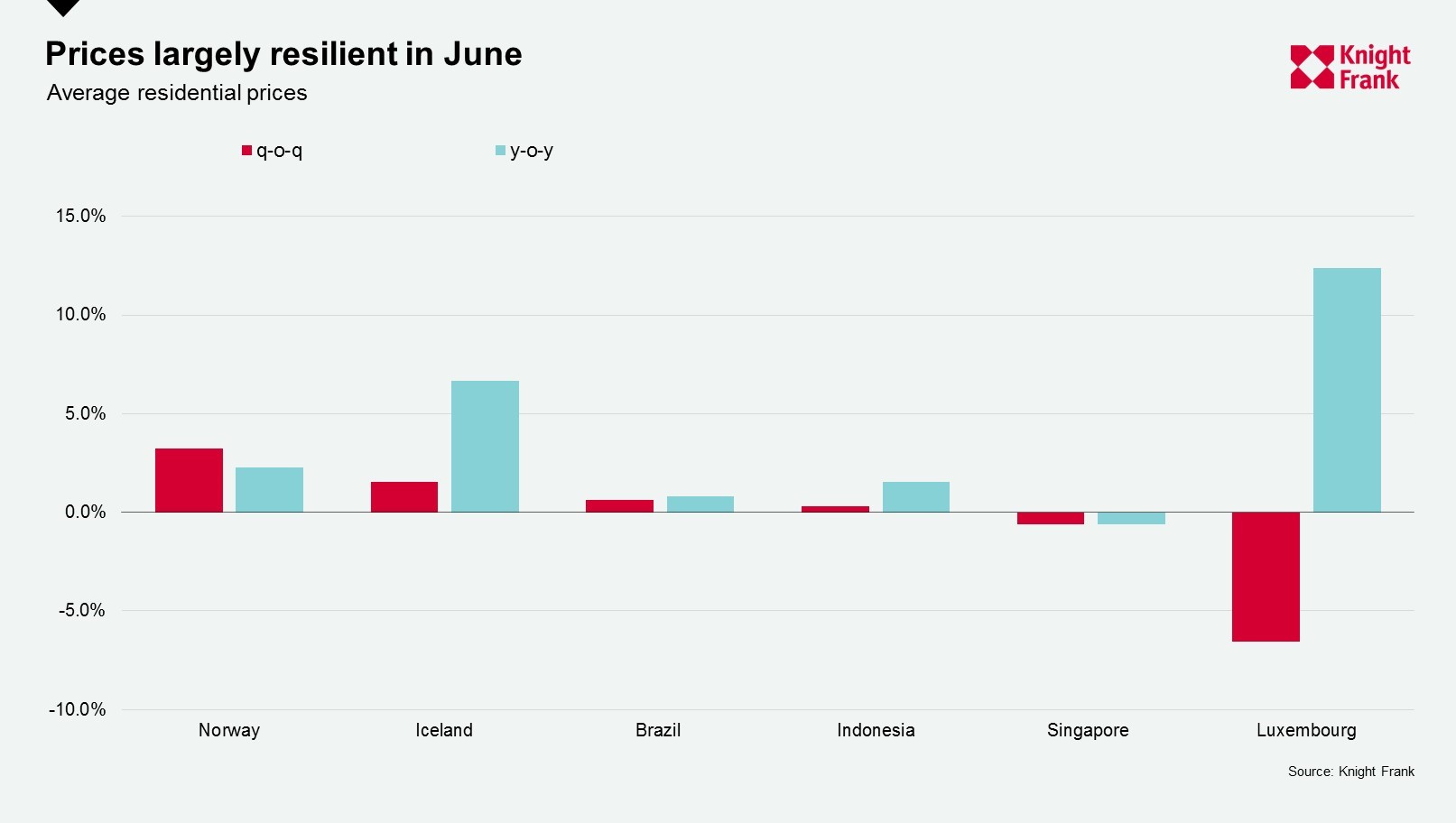

Of those countries that have published pricing data for June, prices fell by 0.2% on average over the quarter but increased 3.9% on an annual basis. To date, of these countries, only Luxembourg has seen a reversal in the direction of price growth post the pandemic.

Need to know

- Worldwide cases of Covid-19 increased by 1 million in five days to reach 13 million this week according to the World Health Organisation.

- The disease is accelerating fastest in Latin America, with the Americas now accounting for more than half the world’s infections and deaths.

- The last week has seen localised outbreaks in Melbourne, Hong Kong, Bangalore, UK (Leicester & Blackburn) and in Catalonia in Spain. In the US, California, Florida and other mainly southern states, have reversed measures to reopen their economies.

- Equity markets have rallied in the last week and as a result the Renminbi strengthened past 7 to the dollar. Plus, arguably the world’s top safe haven asset, gold, rebounded in the last week, it now sits above US$1,800 for the for the first time in nine years. Gold has risen about 19% so far this year.

- In terms of population mobility, as measured by Citymapper, Hong Kong and Paris are the most mobile cities with 71% and 67% of the population mobile compared to a baseline period. Tokyo, Los Angeles and New York remain the least active with less than 20% of the population mobile.

- Eight out of 10 investors see both risk and opportunity in the current environment according to a UBS report, with 70% saying they have been financially impacted by the pandemic, 25% significantly so.

Europe

Knight Frank’s new European Residential Investment Report confirms the scale and weight of capital looking for a home in Europe’s residential markets. Using data from Preqin, the report estimates private equity funds are sitting on more than $338bn of unspent funds. Whilst some of this capital will be deployed in traditional commercial real estate sectors, increasingly income-producing residential property, including multifamily residential blocks and student housing, is becoming a key focus.

In Spain, the authorities are pressing ahead with the Madrid Nuevo Norte project, accelerating plans to commence work in 2021. The largest urban regeneration plan in Europe, covering 2.68 million square metres, and extending from the city centre to the northern suburbs, is set to revitalise the area close to Chamartin station and the San Bernabéu stadium delivering over 10,500 homes.

Rental values across Spain fell by 4.9% on average during the State of Emergency which lasted from 14 March to 1 May. According to the online platform BrainsRE, rents fell in 30 of Spain’s 52 provinces during this time with Álava, Cuenca and Seville witnessing the biggest decreases.

In the UK, the threshold at which people start paying stamp duty has been lifted from £125,000 to £500,000. The change took effect immediately on 8 July and will remain in place until 31 March 2021 with the aim of providing a boost to sales activity. Properties over £500,000 will pay stamp duty, however by increasing the nil rate band it means they will pay £15,000 less than before.

In Germany, the Financial Times reports that large institutional investors are targeting property in Berlin despite the rent cap. The rent freeze applies to around 1.5 million homes in the German capital but not to new-build properties built after 1 January 2014.

Emmanuel Macron has promised a further €100bn to finance France’s economic recovery from the coronavirus pandemic — on top of the €460bn already allocated.

Asia Pacific

About 200,000 Hong Kong citizens could move to the UK over the next five years, according to internal Foreign Office estimates — one of Britain’s biggest recent non-European migrations.

Back in March we looked to China for some indication as to how the markets were responding to the first wave of the virus, four months on and we are doing the same as Beijing confirmed a second outbreak following a 55-day stretch without any locally-transmitted cases. My colleague Nicholas Holt, a Beijing resident, looks at how the city is responding.

In South Korea, despite 20 rounds of cooling measures in the last three years, the government has announced an additional 6% tax increase for multiple home-owners in an effort to tackle strong price inflation. Prices in Seoul are rising at a rate of 12.9% per annum and the city was ranked ninth out of 150 cities in our Global Residential Cities Index in Q1 2020.

With residential sales across China’s top 30 cities now back to pre-pandemic levels according to data from Capital Economics, the Financial Times finds Chinese investors are benefitting from housing lotteries that were set up to benefit those on low incomes. More than 40 cities have stuck to a ceiling on new home prices but the price of existing homes have increased by 40% since the end of 2016.

In Australia, my colleague Michelle Ciesielski assesses the latest prime data. Sydney’s luxury residential market is seeing healthy activity with A-Grade properties in high demand, many transacting close to asking price. Cash buyers are commonplace and stock levels reducing. Along with Sydney, Brisbane is seeing expats return and our new Focus on Brisbane report highlights the city’s credentials – ranking 19th out of 140 cities in the Economic Intelligence Units’ Liveable Cities Index.

In Malaysia, the nationwide Movement Control Order (MCO) was in place from 18 March until 4 May, but our new Malaysia Real Estate Highlights Report confirms that business activities and services are gradually resuming with the residential sector expected to be one of the most resilient given the three interest rate reductions actioned in the first half of 2020.

US, the Caribbean and Canada

The Barbados Government has mooted a 12-month Barbados Welcome Stamp to allow visitors to work remotely from Barbados for a year at a time, this could boost long-term rental and buyer demand on the island. We expect to see more countries bereft of tourists over the summer months to adopt a similar strategy - tempting ‘digital nomads’ committed to remote working to relocate and help boost the local economy.

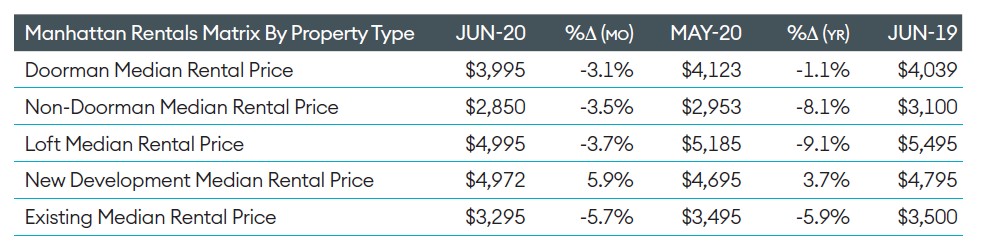

In New York, the latest data from our partners Douglas Elliman confirms the coronavirus lockdown hit the rental market hard, driving Manhattan vacancy rates to their highest level in 14 years and pushing the number of June new lease signings to the lowest level seen in a decade.

However, unlike existing homes, new development rents continued to climb year-on-year.

Following a legal challenge by top US universities, the government has rescinded its plans to strip visas from foreign students meaning those not attending in-person classes will be allowed to remain in the country, providing further rental income for private landlords in major university towns and cities.

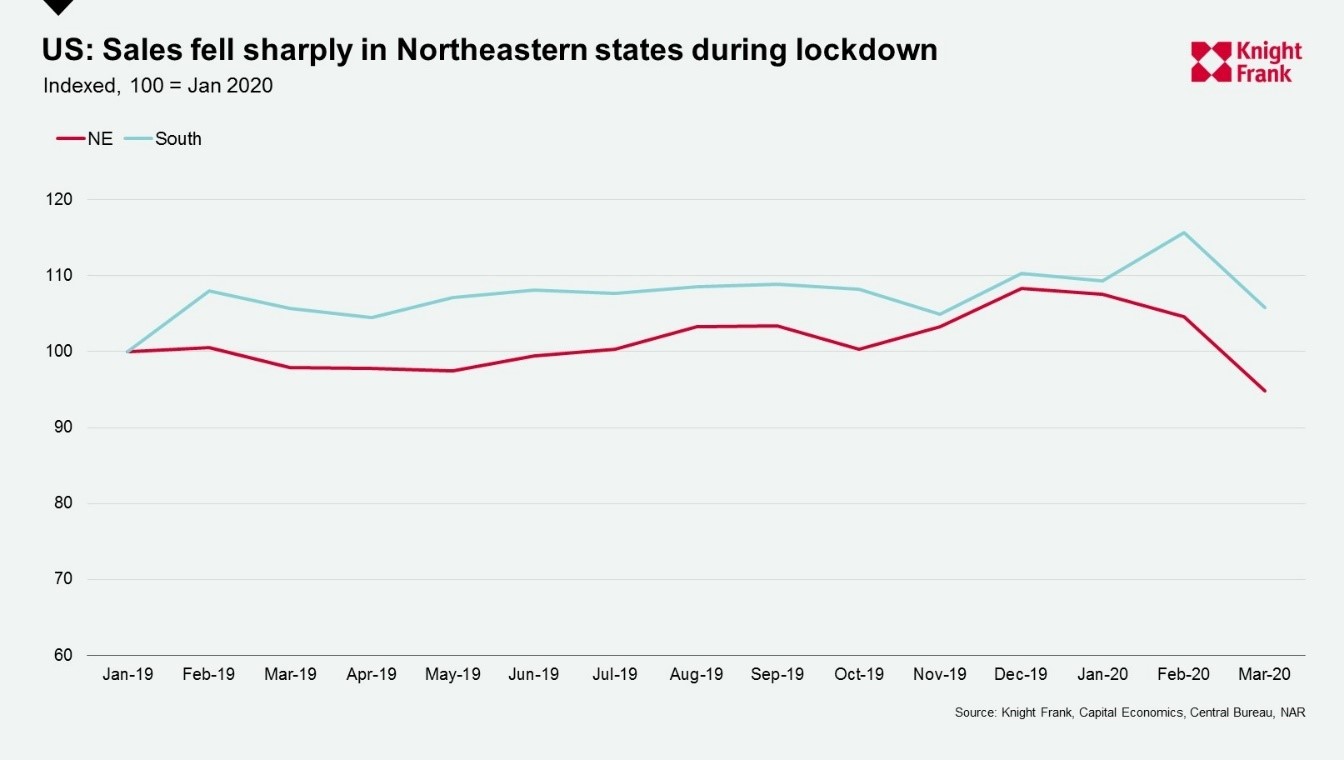

Data from Capital Economics shows North-eastern states witnessed a sharp decline in sales in March as stay-at-home orders were strictly enforced, but the economic forecasters doubts the fall in sales in the South will match the drop seen in the Northeast given sellers and buyers now have more experience in transacting during the pandemic.

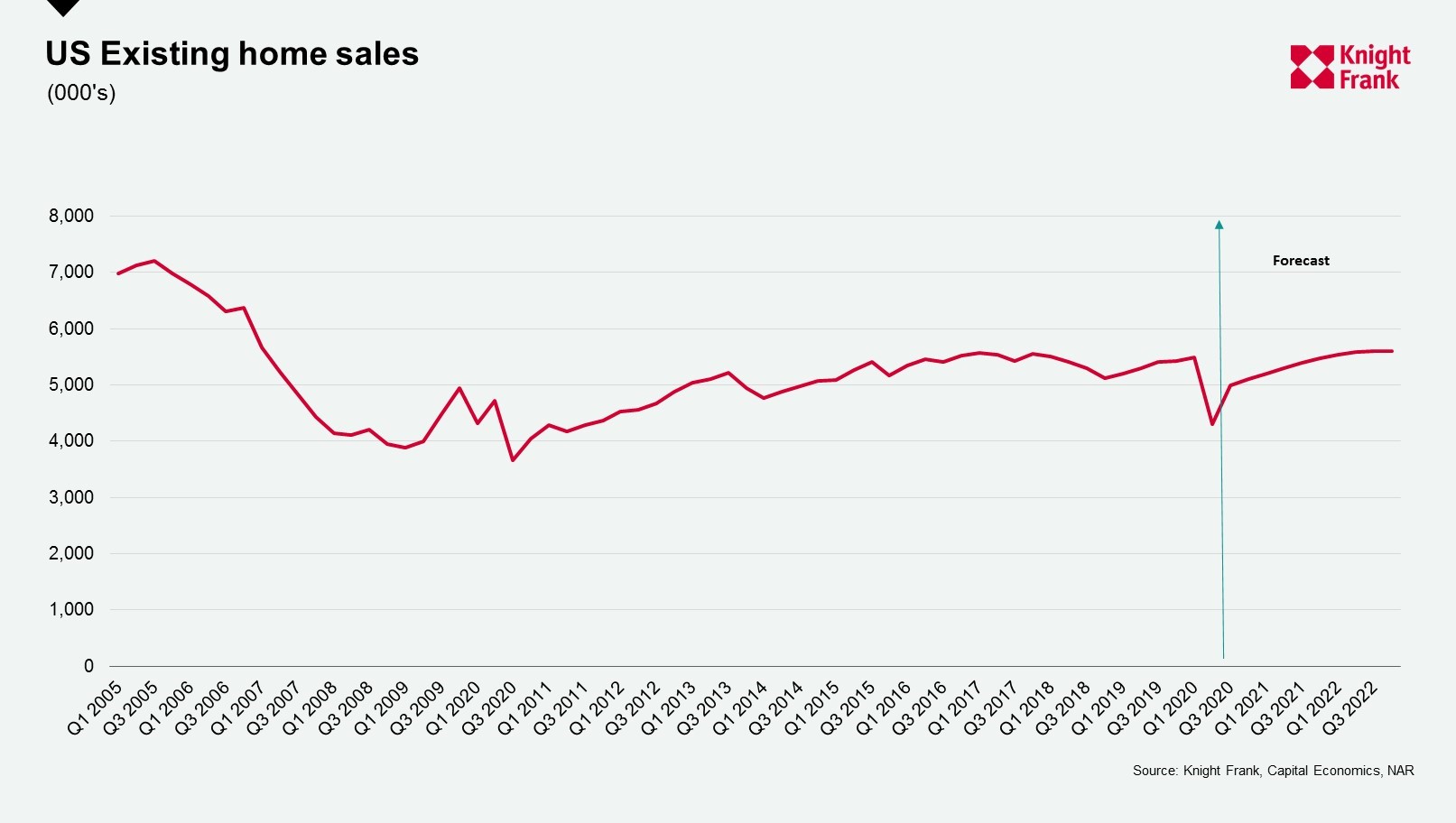

There is no evidence that housing demand is weakening. After a brief pause in the second half of June, mortgage applications for home purchases hit a 10-year high in the first week of July.

This trend was reflected in existing home sales which recovered in June, but with the reintroduction of lockdowns the recovery may be erratic and slower than anticipated.

This week’s recommended listening & viewing

In our Intelligence Talks podcast this week we discussed how Spanish property markets are faring as Europe moves out of lockdown.

Anna Ward chats to Grosvenor’s Javier Martin, Knight Frank’s Carlos Zamora and Pia Arrieta about the future of city living in Spain and what their forecasts for the market post-Covid. Click one of the links below to listen. Listen on Apple, Spotify or Acast