Berlin in five charts – 20 May 2020

The German capital is now open for business having endured a comparatively short 29-day lockdown from 22 March to 20 April when shops 800 sq m or smaller could reopen.

3 minutes to read

Quick to track and trace cases, Germany has seen a total of 177,289 Covid-19 confirmed cases as at 19 May and 8,041 deaths according to Johns Hopkins University.

Property viewings and transactions are now permitted, larger shops and restaurants have lifted their shutters and borders are expected to reopen, initially to Switzerland, France and Austria, from 15 June. Social distancing rules remain in place until 5 June, a maximum of two households can meet in the meantime but large events remain prohibited.

Each of Germany’s 16 Federal States has followed a different path out of lockdown, with some, but not Berlin, having to delay their lockdown easing measures as the all-important R value crept above 1 last week.

The five charts below offer some insight into current property market conditions, the wider economy and the extent to which society is starting to normalise.

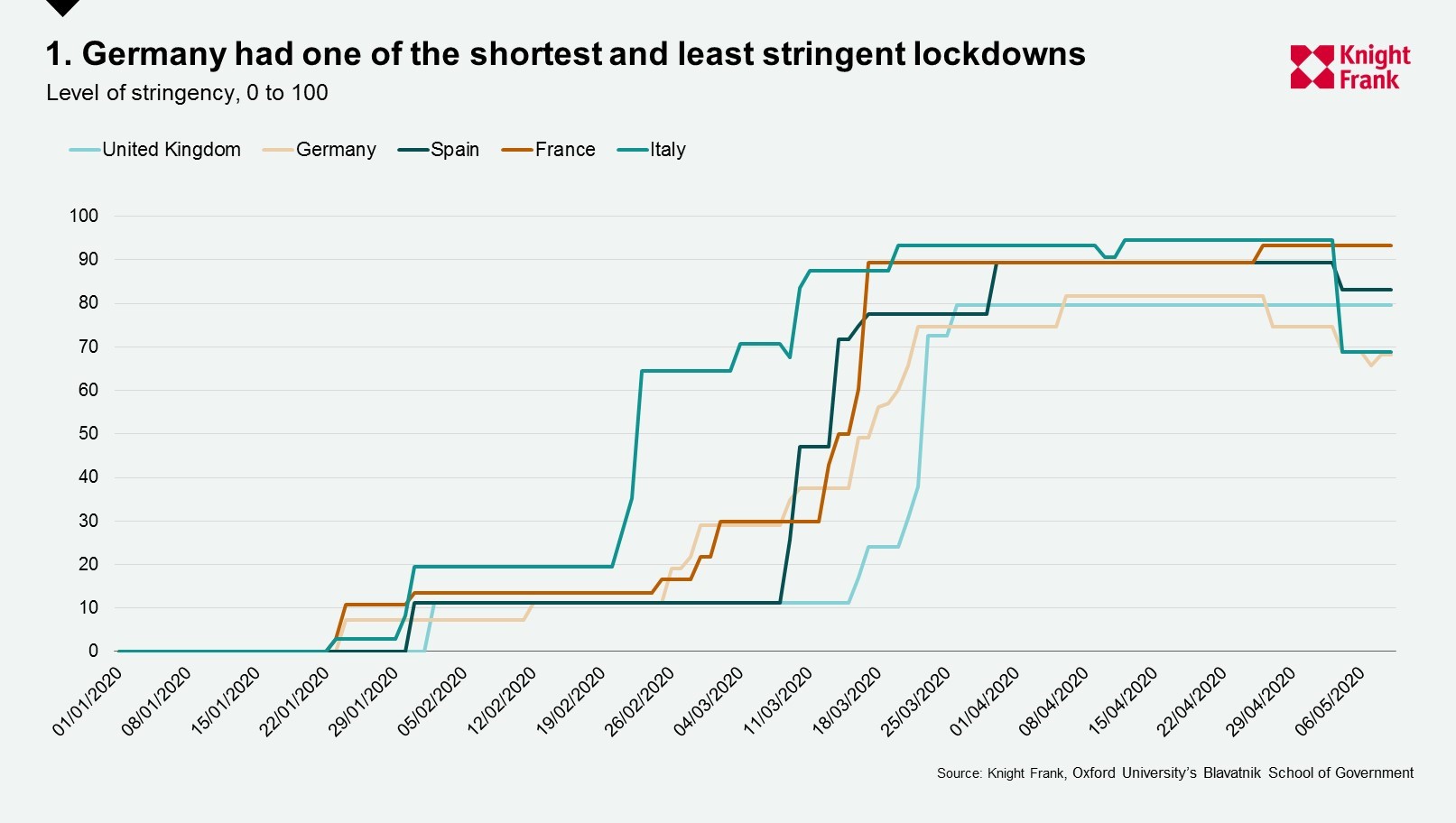

Data from Oxford University’s Blavatnik School of Government database, which has produced an index based on the stringency of lockdown measures, shows Germany’s composite figure reached a maximum of 75 points and stayed at this level for 21 days. This compares to Italy which saw a high of 95 points over a 22-day period.

Testing and contact tracing proved critical, with plans to increase testing to up to 4.5m a week if supply constraints can be overcome, according to The Economist.

Unlike other major European economies, most construction sites carried on working in Germany, with the result that the construction sector was one of few, to record a rise in output in March year-on-year, up 1.8%.

Each week we assess the latest real-time economic data across global cities to gauge both the number of economies starting to emerge out of lockdown and the pace at which their residents are responding.

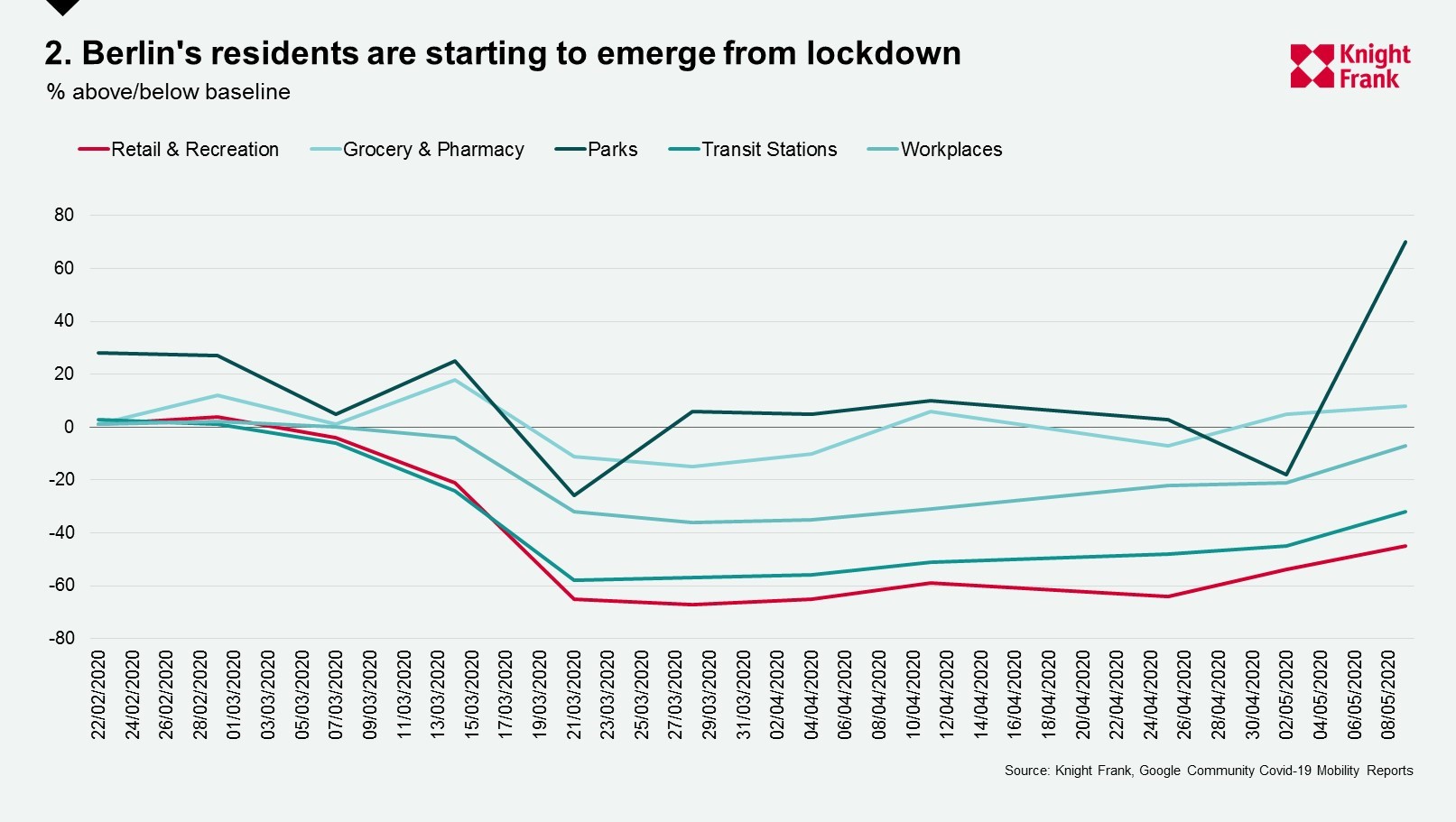

The latest data from Google Covid-19 Mobility Reports shows a sharp increase in the number of Berliners visiting parks since early May, with levels now exceeding the normal baseline.

Grocery and pharmacy shopping has been at, or close to, the baseline since mid-March. Retail & recreation as well as transit stations saw an increase in activity from late April, but perhaps the key indicator relates to workplaces, with activity only 7 points below the baseline in the week ending 9 May.

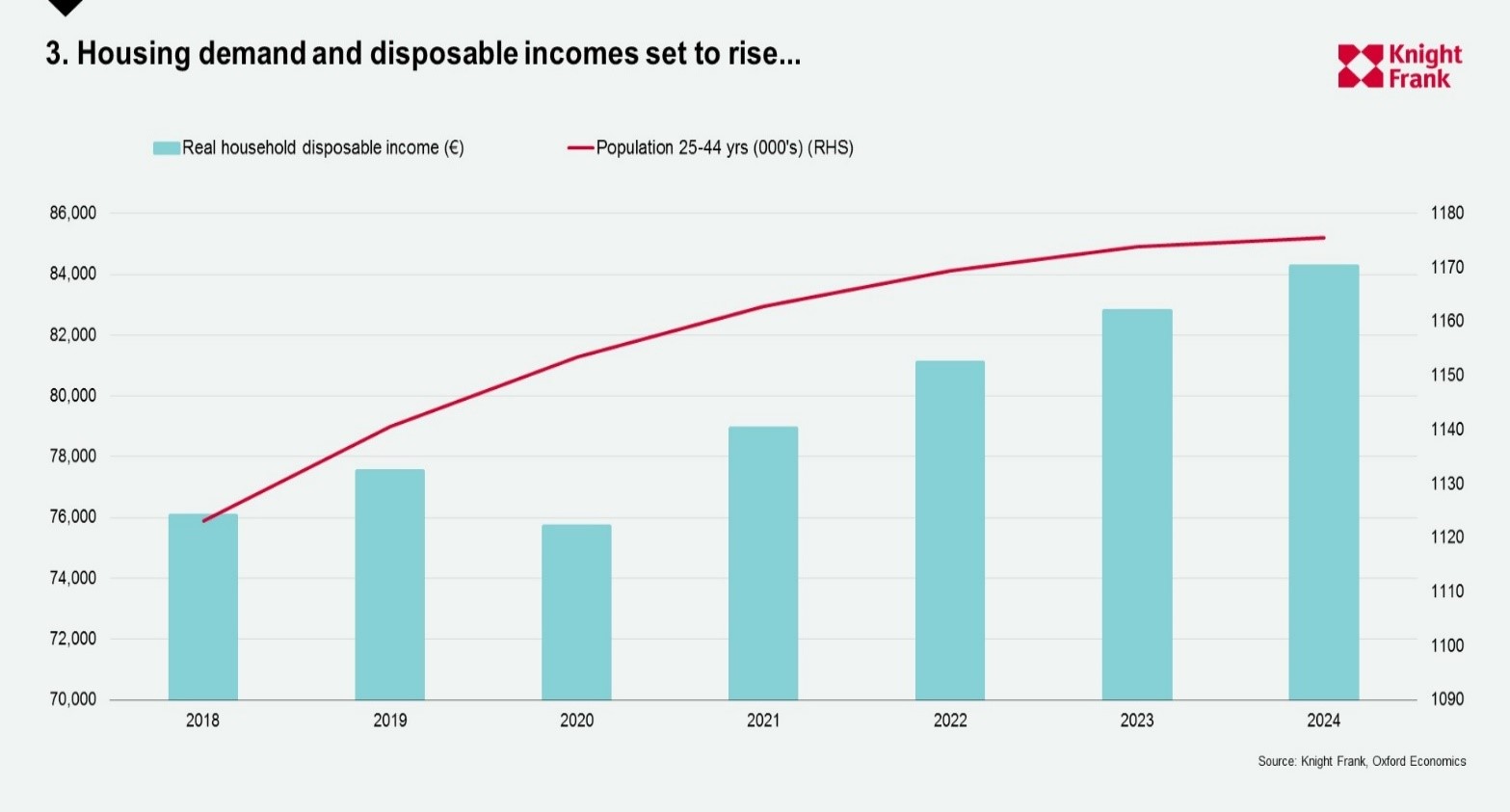

Berlin has been high on the radar of investors for several years, in part because of its relatively low capital values, but also due to its strong tenant demand and diverse employment base. Some 31% of the population is aged between 25 and 44 according to Oxford Economics, and real household disposable incomes, after dipping in 2020 due to the Covid-19 crisis, are expected to increase by 11% over the next four years.

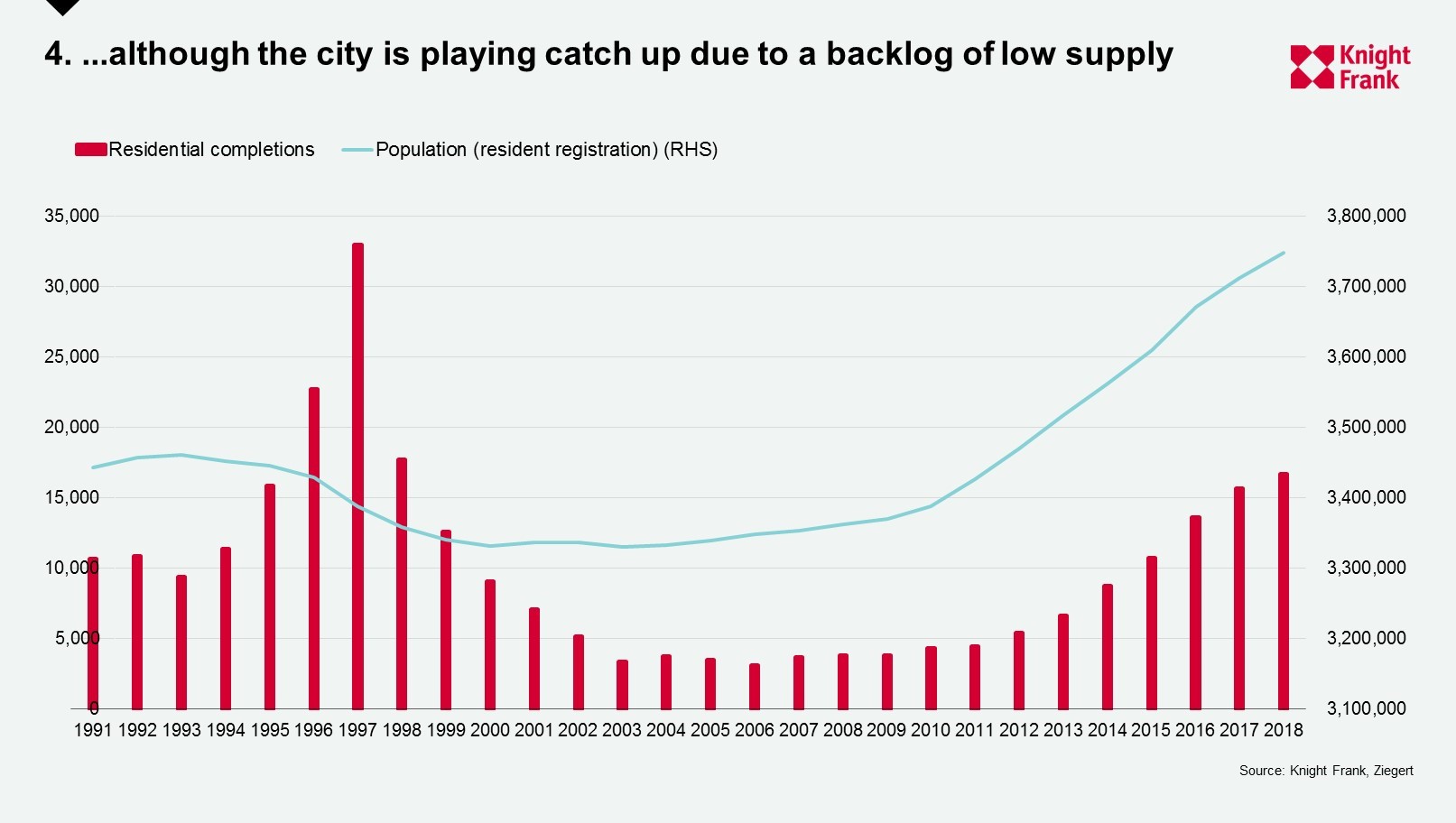

Between 2010 and 2018, the city’s population increased by around 360,000, yet over the same period, only 86,370 new homes were built. This has inevitably pushed residential prices higher and at the same time heightened rental demand – some 85% of Berlin’s population rent. Although completion levels have started to rise in recent years, a large number equate to micro-apartments.

Due to the pressure on rents, the Berlin authorities introduced a rental cap in February — the Mietendeckel. The cap which will freeze rents for the next five years at the level they were on 18 June 2019, is in effect now but still awaiting formal approval by the federal constitutional court. Although the cap does not apply to homes built after 2014, the concern is housing supply may fall further if developers see reduced demand from investors, which in turn could lead to less construction and greater price inflation.

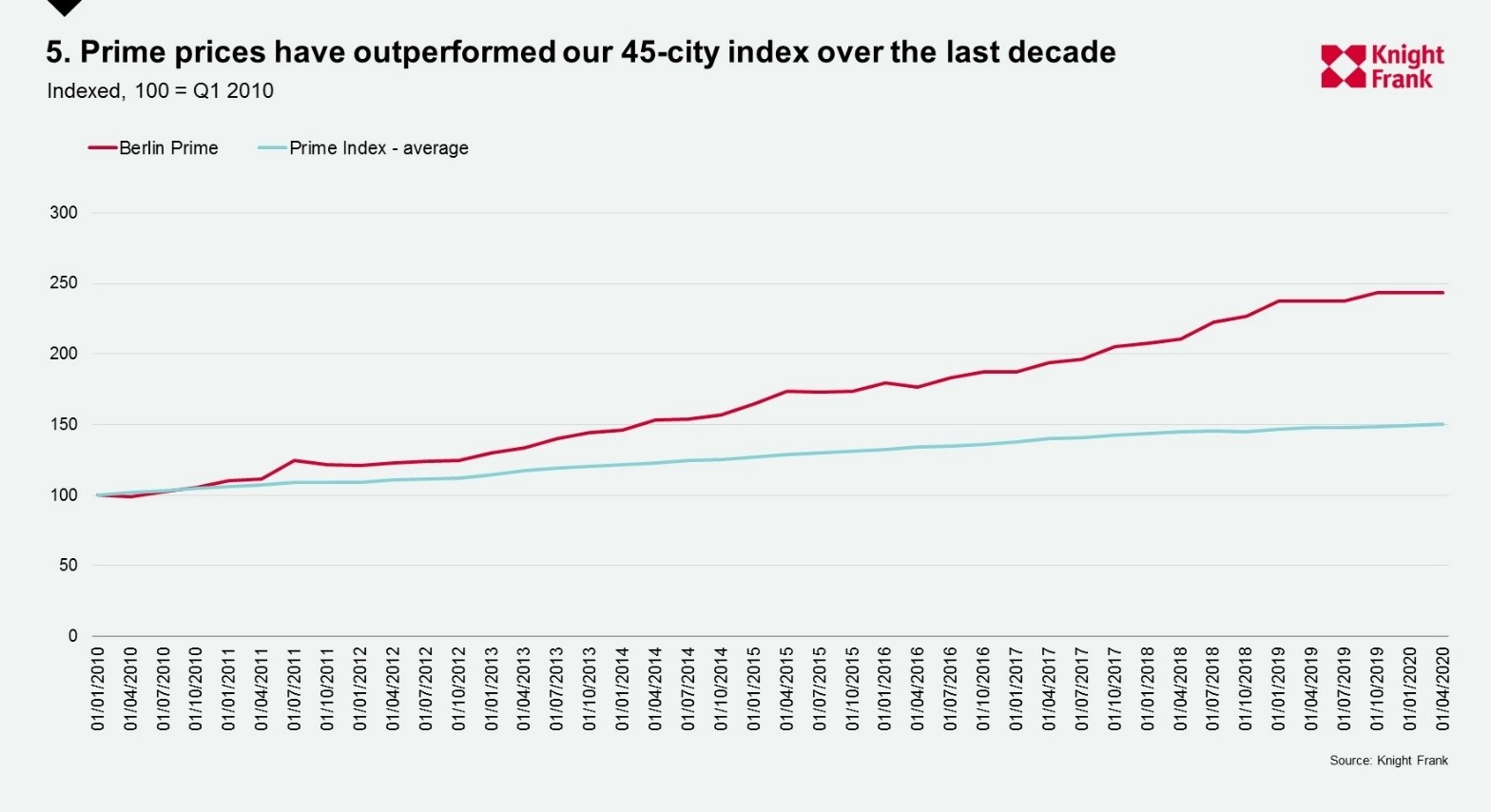

Berlin has ranked highly in Knight Frank’s Prime Global Cities Index since 2018, recording 9.2% average annualised growth in the last five years, outperforming our overall index which tracks the movement in prime prices across 45 cities and increased by 3.4% over the same period.

For more information on the Berlin market please contact Oliver Banks or Kate Everett-Allen.