Geopolitics: Economic & political uncertainty is not just a UK-centric trend

Global policy uncertainty is outweighing UK based uncertainty

1 minute to read

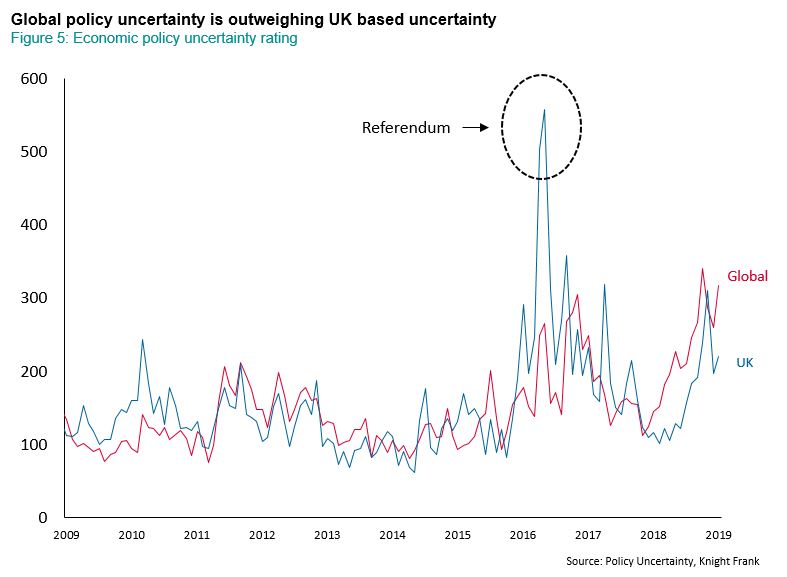

While Brexit has contributed to increased levels of economic uncertainty in the UK, it is important to realise that this current state of ambiguity is not just a UK centric problem and economic uncertainty remains high in many global economies.

Global economic uncertainty is high on the back of the US:China trade war and European politics. This unpredictable global political environment coupled with many mature global economies reaching an extended late cycle is creating increased volatility across global financial markets. Investment activity has been slower during the start of 2019 as a result, and investors are expected to remain cautious while volatility remains elevated.

The UK is not immune to the effects of global uncertainty, however, it does still maintain its status as a global safe heaven with high levels of transparency, liquidity and governance. These attributes have and will continue to underpin investor and tenant demand for real estate in the UK.

Investors need to look beyond the rhetoric and focus on key growth markets where strong demographic trends are spurring wealth creation and helping drive underlying occupier market fundamentals.

Key considerations for investors also include whether new and existing infrastructure is supportive of the building use and subsequent demand stemming from both tenants and prospective investors.