Residential market outlook – week beginning 24th August 2020

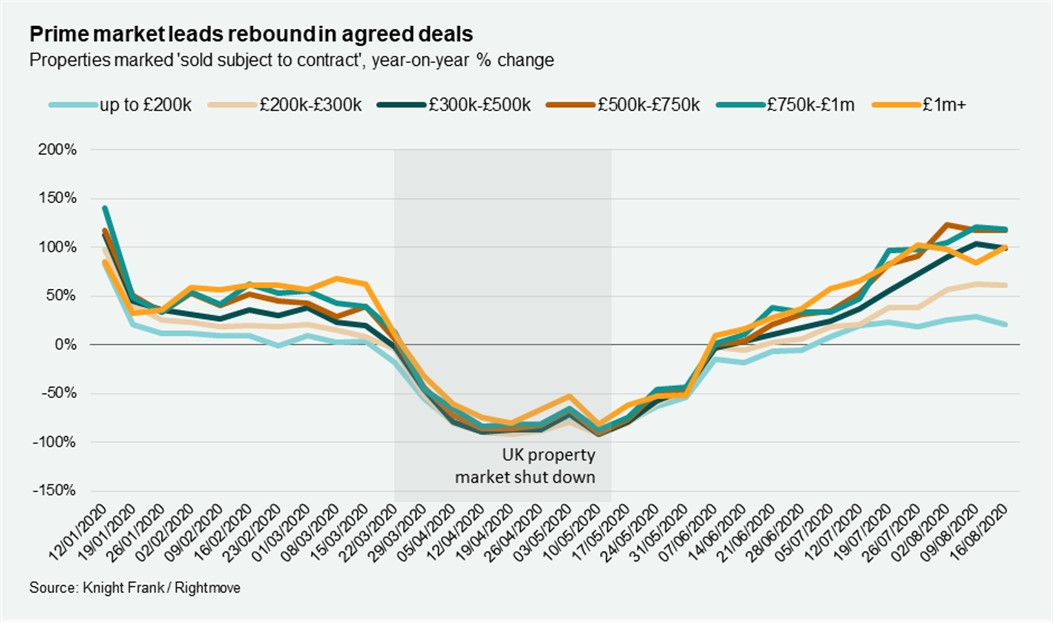

The prime market has led the strong rebound in property market activity, new analysis shows.

2 minutes to read

Demand for property has surged since UK markets re-opened in May. The strength and speed of the recovery may have come as a surprise to many, but evidence suggests it is continuing.

In the week ending the 16th August, analysis of sales subject to contract (SSTC) on Rightmove shows a 61% jump compared with the same week the previous year.

Such a strong rebound reflects the ongoing release of pent-up demand following lockdown, coupled with the recent cut to stamp duty, a trend we have explored in previous updates.

It is also likely that there are wider behavioural shifts in play, as people reassess their housing needs – the ‘escape to the country’ narrative is one that has been covered in detail.

But a closer look at the data suggests there are other nuances at play. The biggest increase in deals agreed since the end of lockdown, for example, has taken place in the prime market. A quicker recovery here tallies with a similar trend which took place during the period that followed the global financial crisis.

The number of properties SSTC above £1 million was 100% higher than the same week in 2019, our analysis shows, whilst for properties valued between £750,000 and £1 million the jump was an even larger 119%.

By comparison, the number of offers accepted for properties valued up to £500,000 was 53% higher.

The numbers match Knight Frank data which shows a similar trend. In London, the number of offers accepted for that same week was 68% higher year-on-year and in the country the figure was 158% higher.

A stronger recovery at the top-end reflects the fact that such buyers financial position means they tend to be able to transact more quickly, whilst more affluent households are also less reliant on lending.

For now, pent-up demand, the stamp duty holiday and extension of the furlough scheme all continue to support a strong recovery in the market.