Downwards pressure on prices eases as demand rebounds

The average asking price discount has narrowed since the market re-opened

2 minutes to read

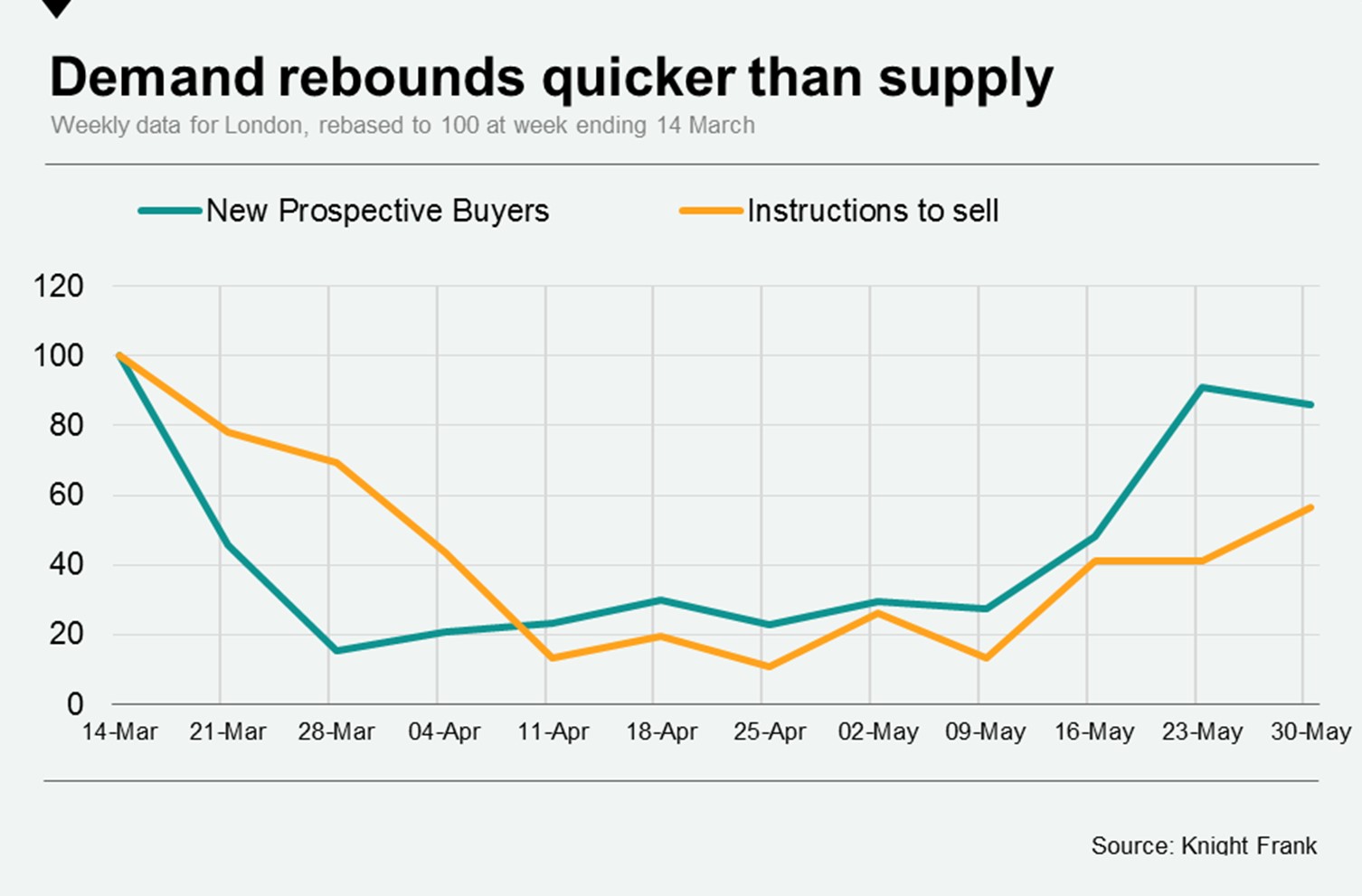

Demand for London property is recovering towards pre-lockdown levels faster than supply, reducing downwards pressure on prices.

The number of new prospective buyers in the week ending 30 May was 35% above the five-year average and only 14% below the figure recorded in the second week of March. Meanwhile, the number of new instructions to sell in the last week of May was 43% below the figure for the same week in March.

While the property market has been open for three weeks following Covid-19 lockdown measures, opinions are divided on prices as supply and demand trends become clearer, as a recent Knight Frank survey showed.

“It feels remarkably similar to the period that followed the EU referendum,” said Tom Bill, head of London residential research at Knight Frank. “There is a mix of opportunistic bids that are unlikely to be accepted, bids agreed at a reasonable discount and many cases where the asking price is right and the guide price is met or exceeded after competitive bidding. It will take a while for the market to find its feet.”

Activity levels in the second week of March had not been noticeably impacted by the Covid-19 pandemic. The number of new prospective buyers was 41% above the five-year average as a result of the post-election bounce. Meanwhile, the number of instructions to sell was 13% higher.

Early indicators suggest downwards pressure on prices has reduced since the market re-opened on 13 May.

The average asking price discount in London during the market lockdown was 6.4%. Since the market re-opened, the figure is 5.5%.

Meanwhile, the average offer made in London was 10.2% below the asking price while lockdown measures were in place. That has narrowed to 7.6% since 13 May.

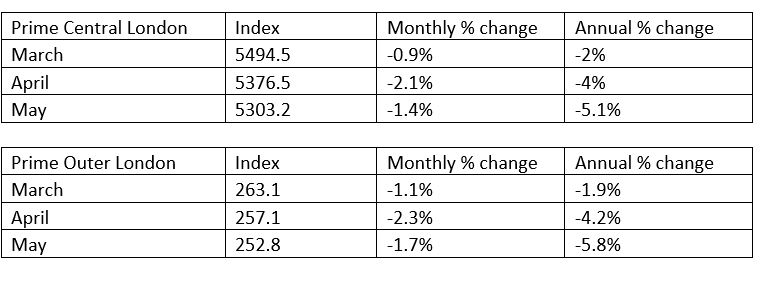

Knight Frank forecasts that prices will fall by 5% in prime London markets this year, with most of the decline already priced in. Based on an analysis of achieved prices over the last 10 weeks, in addition to other economic and housing market data, we have revised our prime London indices downwards for March and April, as the tables below show.

Average prime central London prices fell by 1.4% in May, taking the annual change to -5.1%. Meanwhile, the monthly decline in prime outer London was 1.7% in May, producing an annual decline of 5.8%.

The monthly decline of 2.1% in April in prime central London was the largest such drop since January 2009, as the market felt the impact of the global financial crisis.

More detail on our prime London rental indices and the latest trends in the lettings market will follow later this week.

REVISED PRIME LONDON INDICES