UK Cities DNA | The Two Big 'Os'

Two big 'O's'. Oversupply and Obsolescence. Increasingly intertwined and increasingly complex. How do you assess the optimal use for an asset, looking at every angle and quantifying it at a hyper localised level?

4 minutes to read

• Oversupply and obsolescence – industry buzzwords, but actually complex concepts which are often intertwined - but are also binary and can operate as distinct forces.

• From an ESG lens, there are four key obsolescence risk categories – Regulatory, Functional, Physical and Financial. These ESG-related risks are conflated by wider market forces, such as occupational demand.

• Oversupply varies dramatically between property sub-sectors and individual markets. Nationally, Retail is acknowledged to be heavily oversupplied, while Industrial is undersupplied. Offices sit in a nuanced position between these two extremes.

• Oversupply and obsolescence are hyper-localised and often asset-specific. A brand new, high spec, fully ESG-compliant asset is still obsolete if unlet with no prospect of occupational demand.

The two terms—oversupply and obsolescence—are intertwined and increasingly complex. To determine an asset's optimal use, all angles of each need to be assessed and quantified on a hyper-localised scale.

Defining Obsolescence

Building obsolescence is accelerating due to evolving sustainability risks and shifting real estate demands. While these risks are often defined in isolation, they are interconnected and shape investment strategies. Our 2023 ESG Property Investor Survey found that over 75% of European investors aim to enhance portfolios through refurbishment, retrofitting, or repurposing, with 58% targeting underperforming ESG assets for upgrades. Even so, obsolescence is not yet fully understood, suggesting an advantage for investors who can proactively manage these risks.

Proactively addressing these risks can unlock opportunities for investors who can anticipate changes in occupier needs and regulations.

Regulatory Obsolescence Risks

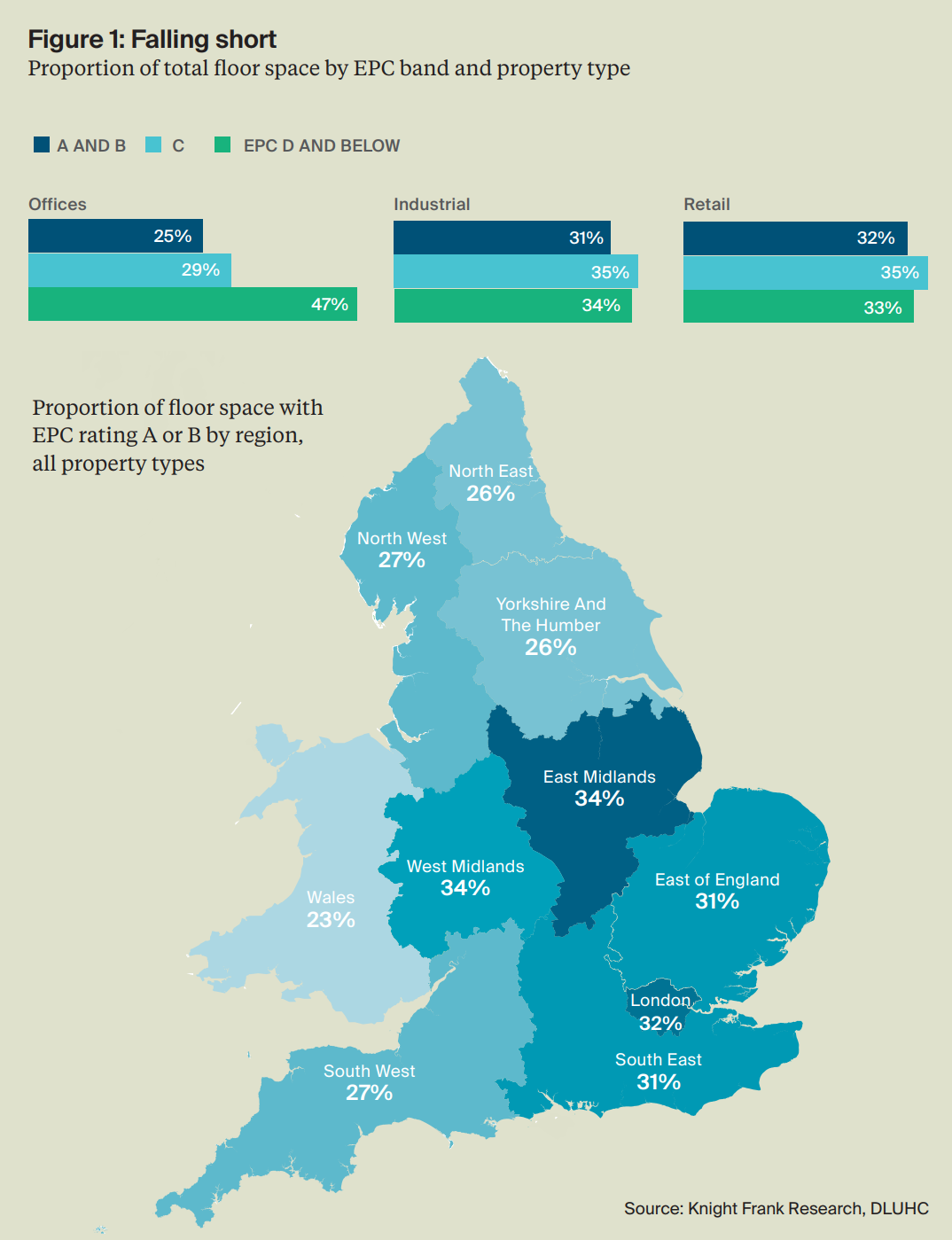

Minimum Energy Efficiency Standards (MEES) changes have stalled since 2021, but stricter domestic standards by 2030 may signal similar non-domestic moves. With 70% of floorspace rated EPC C or below, many assets risk becoming unlettable under proposed rules. Only one-quarter of office stock and under one-third of logistics and retail assets meet requirements. Regional differences play a role, but the harsh reality is that all commercial property sectors are falling short.

What level of office space is required – and where?

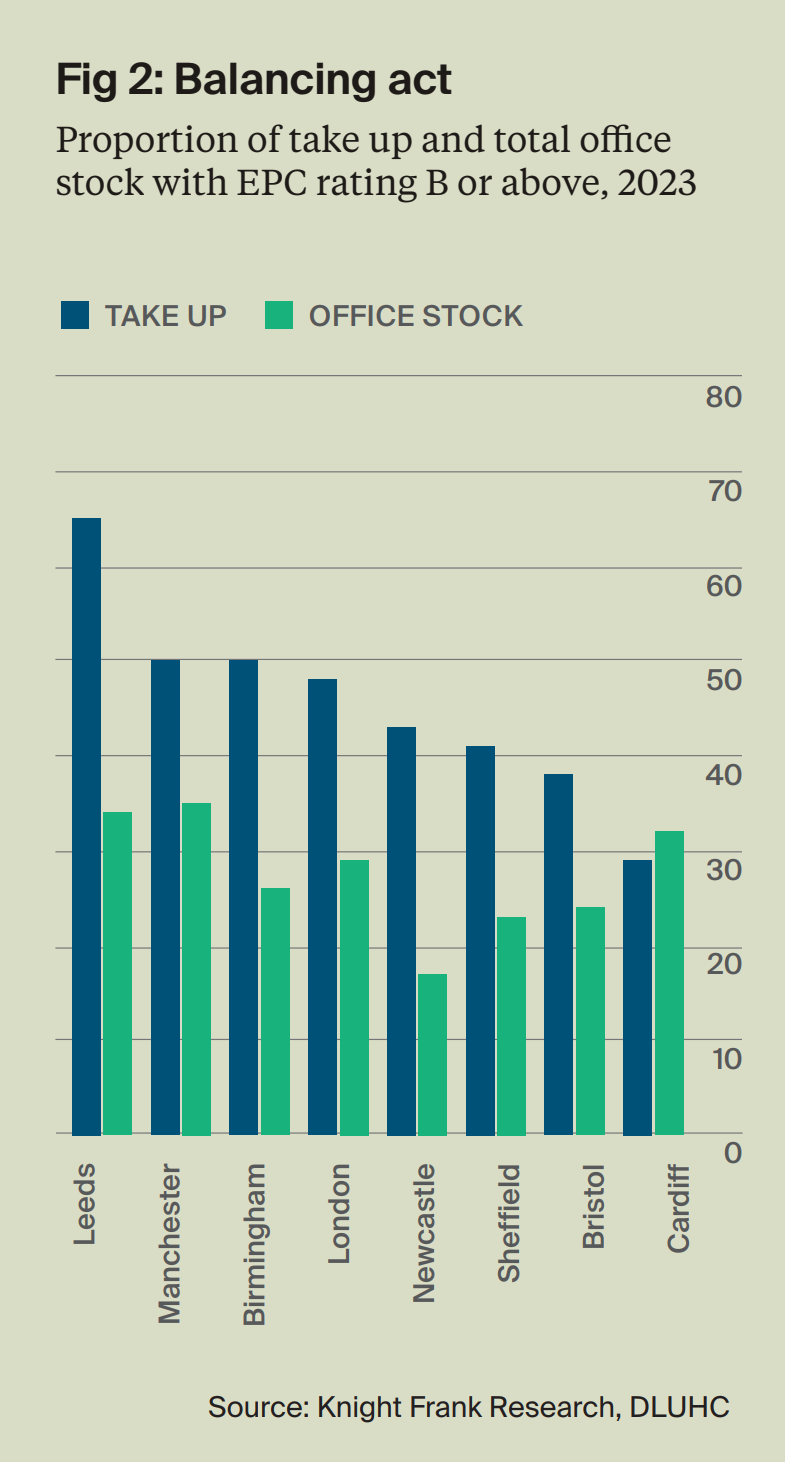

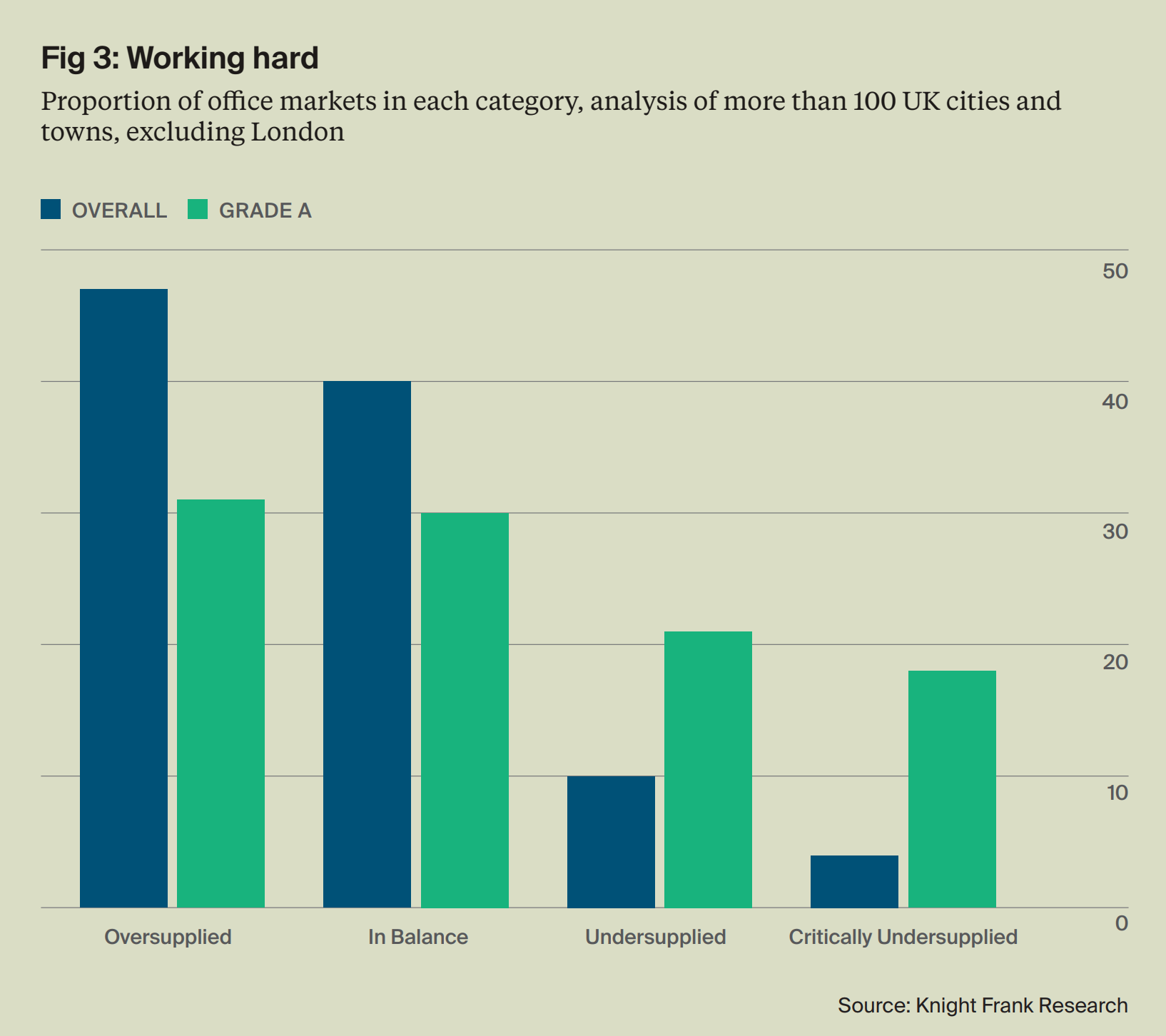

Supply dynamics vary widely, with some locations and property types facing oversupply while others face undersupply. Assessing assets at a localised level is important. Office stock in England and Wales is expected to shrink by 5% (47 million sq ft) in the next decade, with supply varying by location. Analysis shows that 14% of markets are undersupplied, rising to 40% for Grade A space. Regions like the East Midlands and North West have no oversupplied Grade A markets. In London, the West End faces a 4.2 million sq ft shortfall, while Docklands & Stratford are oversupplied by 1 million sq ft. A construction pipeline adds an 11.6 million sq ft surplus, mainly in the City & Southbank.

Retail: the need for granular, hyper-local analysis

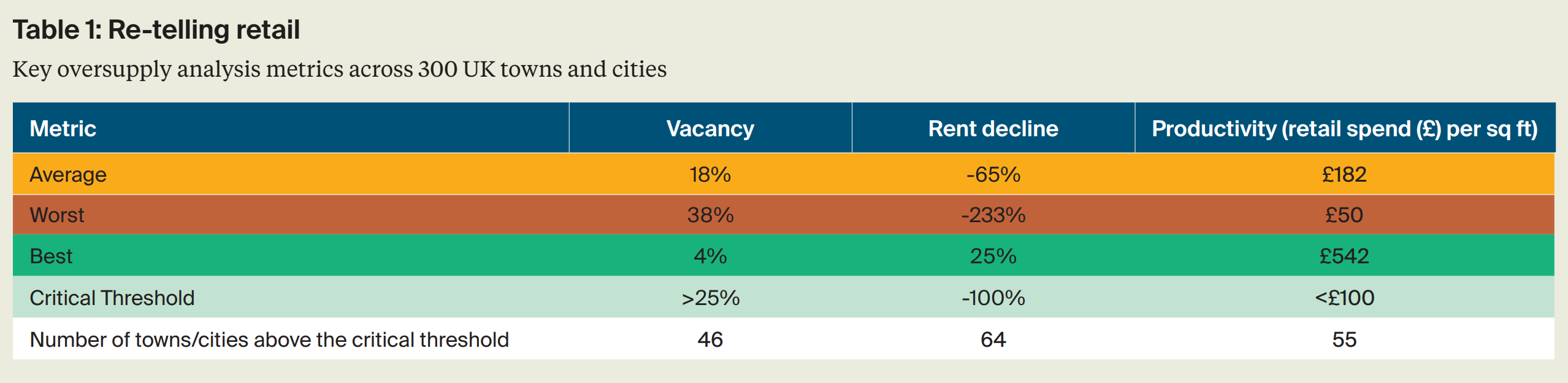

The UK retail market faces oversupply driven by e-commerce, overdevelopment, and ageing stock. While a national vacancy rate of 15% suggests around 170 million sq ft of excess retail space, true oversupply is highly localised, with vacancy rates, rental trends, and productivity metrics varying widely across UK towns. Vacancy rates range from 4% to 38%, rents have dropped by 65% on average, and productivity varies from under £50/sq ft to over £500/sq ft. Ten towns, mostly in the North, Scotland, and Wales, underperform across all metrics, highlighting the need for hyperlocal analysis to rebalance supply and optimise assets.

Logistics outlook

The logistics market, however, is comparatively undersupplied, with just 20 months of supply available. Yet again, this varies by region and unit size. The West and East Midlands are most constrained at 15–18 months, while Scotland has 38 months. Large units (over 400,000 sq ft) are especially scarce, with less than nine months of supply, and grade A options are even fewer. Smaller units have over 27 months of supply.

How might this change with future occupier needs?

Future occupier needs will likely position real estate as a key driver of business strategy, focusing on talent attraction, collaboration, and ESG commitments. With real estate responsible for 40% of UK carbon emissions, energy efficiency will be crucial to achieving net-zero goals. ESG considerations already influence 93% of occupiers’ real estate decisions, and the growing adoption of initiatives like Science Based Targets will drive demand for efficient spaces. Social value is also rising, particularly in sectors like retail, which can transform communities through employment and revitalisation of high streets, reflecting its role as a cornerstone of social and economic well-being.

Oversupply vs obsolescence – in combination or in isolation?

Oversupply and obsolescence, though distinct, are often interconnected, as an oversupplied market amplifies the disparity between asset quality, pushing weaker assets toward obsolescence. However, obsolescence isn’t confined to oversupplied markets; even high-spec, ESG-compliant buildings can become obsolete if they remain unoccupied. These forces, whether acting alone or together, are reshaping significant portions of the real estate market, with many assets already obsolete or at risk of becoming so. The critical challenge lies not just in understanding how assets reach obsolescence but in determining what to do with those that are stranded or obsolete.