Insight 6: Retrofit or Repurpose?

Retrofit or Repurpose? Rising to the challenge of obsolescence in the London office market

10 minutes to read

In the final insight of the London Series we discuss the challenge of obsolescence in London's secondary office market.

The polarisation of the London office market has been a central theme of The London Series. The consequences of polarisation for prime property performance was discussed in our second insight paper: What drives leasing out-performance? In this sixth and last paper in the series, we turn our attention to the growing challenge of the secondary office market.

In this paper, we calculate that just below 100m sq ft of London’s office stock is at risk of falling foul of the compliance threshold required in 2027 via the proposed introduction of Minimum Energy Efficient Standards (MEES). A further 70m sq ft is also currently below the proposed 2030 threshold for rented offices. Obsolescence is clearly on the rise and over the short-term.

A growing number of London office owners and investors will therefore be faced with some difficult choices if they are to avoid the performance pitfalls of so-called stranded assets. It is a choice that essentially boils down to either retrofitting existing assets to a higher standard (particularly, but not exclusively, around energy efficiency) or repurposing those assets into alternative use classes. This paper explores both routes. It shows that the indicative costs of retrofitting offices to improve their energy performance are modest and can potentially lead to higher rents and sales values. When it comes to repurposing, this paper also points to current precedence, in particularly around the conversion to hotel, residential and purpose-built student accommodation – the shift from boardrooms to bedrooms.

"Occupier demand for secondary quality offices has fallen considerably across London amidst the now well rehearsed ‘flight to quality’."

The scale of the obsolescence challenge

Our starting point is a fundamental one; what do we mean by secondary offices? Understanding the quality grading of buildings can be highly subjective with clarity and consistency often missing from the debate. As in the case of prime, secondary office space can be highly variable in quality and this has implications for how we measure obsolescence risk in the London office market.

At Knight Frank, we breakdown secondary offices, into two broad segments:

- Second hand A: Previously occupied space with air-conditioning, some end-of-trip facilities, good floor to ceiling heights, and a staffed reception area.

- Second hand B: Previously occupied and very basic office space without air-conditioning.

Occupier demand for secondary quality offices has fallen considerably across London amidst the now well rehearsed ‘flight to quality’. Indeed, since the Covid-19 pandemic, annual take-up for these offices has fallen by 34.2%, with second hand A falling by 32% and second-hand B by 54.7%. Conversely, the availability of these offices has risen by 49.2% to 10.4m sq ft.

The leasing challenges of available secondary offices are compounded when we consider the impact of potential MEES legislation which, in its present form, requires the rented office stock to have a minimum EPC rating of B by 2030. Furthermore, the legislation has a more imminent requirement of rented offices having an EPC rating of C by 2027. Our analysis of the latest EPC data held by the government identifies 97.6m sq ft of offices in London with an EPC rating of below C and therefore unlettable from 2027 without capital and works to improve the EPC rating. This equates to 38% of total London office stock. The proportion rises considerably to two-thirds of the stock for offices with an EPC rating C-G, some 168.8m sq ft which does not meet the 2030 EPC B rating threshold.

Retrofitting for continued office use

In our second London Series insight paper we discussed how the post-pandemic acceleration of occupiers to centrally located, sustainable and amenity-rich offices suggests the current development pipeline is likely to lead to an under-supply of almost 5.5m sq ft of prime office space between 2024 and 2026. When combined with the ticking time bomb of potential MEES legislation, unsurprisingly there is a push towards retrofitting non-compliant offices in the capital because it promotes the recycled use of existing materials and reduces the embodied carbon emissions that are a feature of new build development. Last year, the City of London Corporation reported approving 17 retrofitting applications – a record number, and half of all retrofitting planning applications across London.

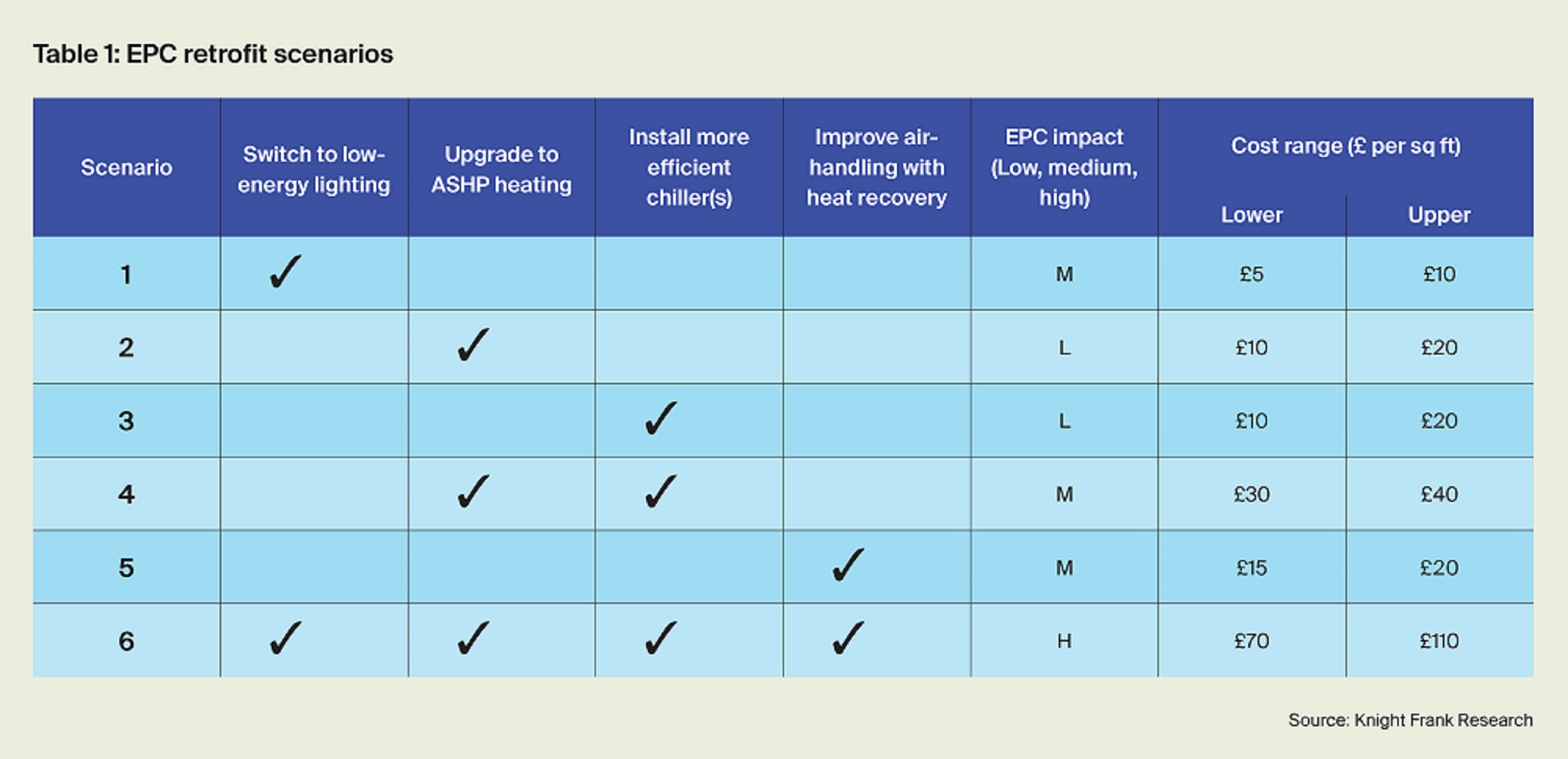

The costs relating to retrofitting an office can vary significantly. In table 1, the Knight Frank Project and Building Consultancy team have estimated the costs associated with the key works required to reduce operational energy consumption. There are six scenarios shown for works a landlord may choose to implement and their likely impact on raising the EPC rating of the office. Scenario 6 shows the mix of interventions required in order to upgrade an EPC non-compliant office to a B rating and future proof assets beyond the potential 2030 MEES deadline.

We estimate the costs associated with the most comprehensive retrofit strategy to be between £70-£110 per sq ft. If every non-compliant office was retrofitted in-line with scenario 6, we project the cost of bringing compliance to the entire London office market to be between £11.8-£18.9bn.

"If every non-compliant office was retrofitted in line with scenario 6, we project the cost of bringing compliance to the entire London office market to be between £11.8 - £18.9b."

It is important to note, improving the EPC compliance of an office will significantly reduce the risk of further future physical obsolescence and avoids the unfortunate classification of becoming ‘stranded’. However, true best-in-class buildings also have limited functional obsolescence and incorporate features which resonate with occupiers and therefore the actual cost of tackling obsolescence is in excess of the range we have quoted.

This market dynamic has arisen because of a growing body of research which shows that sustainable offices that have a strong environmental accreditation are able to command a rental premium. Our own research from 2021, analysing the average impact of BREEAM certifications on London office rents, shows landlords are able to command a rental premium of 12.3% for offices with an ‘Outstanding’ certification compared with uncertified offices.

"Landlords, developers and planners are now taking an holistic approach to urban planning and development, integrating diverse land uses to create more vibrant, sustainable, and liveable communities"

Converting boardrooms to bedrooms

There is, of course an alternative to the retrofitting of secondary assets; repurposing. It is apparent that addressing the obsolescence of offices is a complex multi-faceted task and with the planning environment focussed on reducing the role of embodied carbon in the built environment, the repurposing of single-use buildings to alternative or a mix of real estate uses is increasingly becoming a template for sustainable redevelopment.

Historically, office to residential conversions have been the main route to recycling redundant spaces – particularly in the outer zones of central and Greater London, where commuting patterns point to a readymade residential market. However, landlords, developers and planners are now taking an holistic approach to urban planning and development, integrating diverse land uses to create more vibrant, sustainable, and liveable communities.

Office to hotel conversions

London is a major tourist destination, attracting millions of visitors each year. The city’s vibrant cultural scene, historical landmarks, and business opportunities make it a prime location for hotels. This has resulted in a number of office to hotel conversions in the capital. Unlike office to residential conversion, which is covered under permitted development rights (PDR), planning consent is required to convert an office to hotel use. A more streamlined approach to planning to enable greater levels of office to hotel conversion would be beneficial and accelerate many repurposing opportunities.

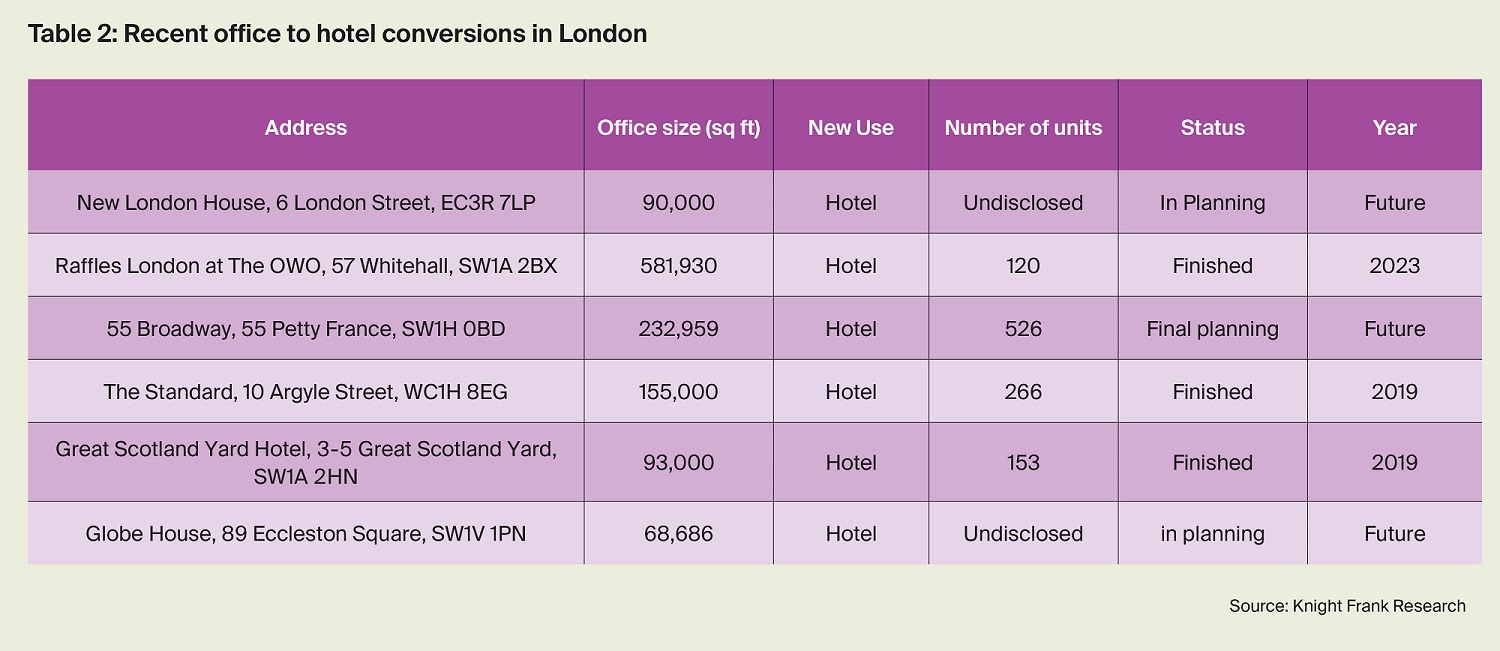

Recent examples of office to hotel conversions are shown in table 2. Whilst recognising that not all offices will be suitable for conversion, an efficient redevelopment will typically be achieved with:

- Low to mid-range floor to ceiling heights

- A strong locational driver – hotel’s clearly offer transient/non-permanent accommodation so lend themselves towards culture-rich and transport heavy locations.

- Flexible floor plates – opens up the building to different hotel brands, concepts and configurations.

Office to residential or purpose-built student accommodation

Repurposing London’s available second hand office space provides an opportunity to erode deep rooted supply shortages in housing and student accommodation. According to StuRents, the UK is likely to experience an undersupply of 621,373 beds by 2026 as demand for higher education continues to strengthen. Similarly, the annual delivery of housing in London continues to fall short of the Mayor of London’s annual target of 53,200 homes. However, recent welcome changes to PDR should provide a catalyst for accelerating repurposing projects.

Data from the Department for Levelling Up Housing and Communities (DLUHC) shows that nearly 23,000 homes have been delivered under PDR in London since 2015. This is only 7% of the total net dwellings built during the same period. Changes to the PDR regime provide the framework to bring forward repurposing projects with the Prior Approval process – a streamlined process that does not require the usual stack of information of a typical planning application, which can be ‘approved’ within just 8 weeks. Importantly the PDR option does not require an Affordable Housing contribution. Since February 2024, the previous floorspace limit has been removed thereby allowing Class MA conversions to a much wider range of premises.

The Knight Frank Planning team has been inundated with enquiries about Class MA PD Rights since the size threshold has been removed thus opening up many more opportunities for conversion. Our first check is always to establish whether or not there is an Article 4 designation removing these PD Rights or where a Planning Authority is proposing to adopt an Article 4 in future and therefore landlords may need to act rapidly to secure planning permission for the change of use. Where PDR is applicable, proposals must meet residential space standards and natural daylight requirements which can be tricky to achieve in deeper commercial floorplates. It is frustrating that PDR conversion only allows for commercial to C3 residential use and therefore a separate Change of Use would still be required to convert such premises to Student Accommodation or Co-Living, which in fact some of these properties may be more suited to. We are helping clients secure the residential status and then exploring opportunities to further modify, extend or even redevelop the premises later.

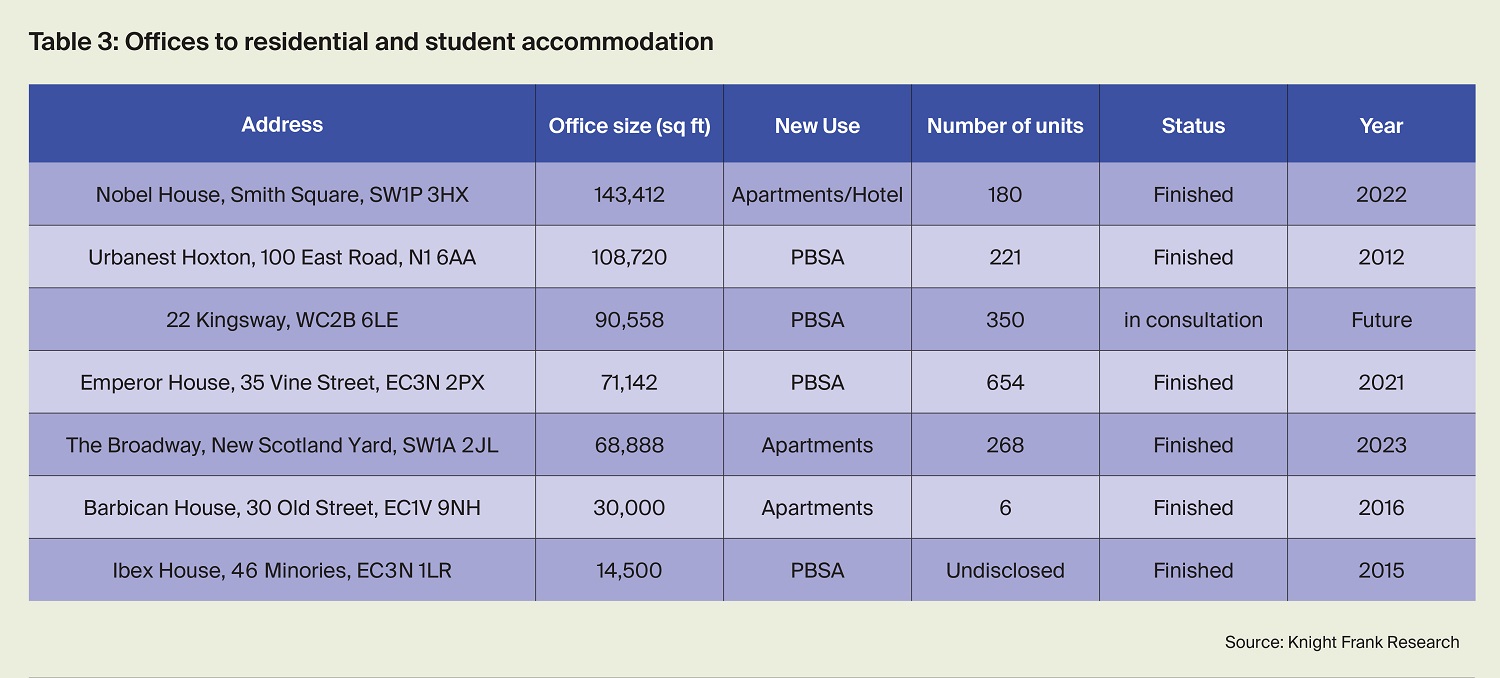

Recent examples of office to residential or purpose-built student accommodation (PBSA) are shown in table 3. Typical conversions require the existing office space to have the following key characteristics:

- Substantial floor to ceiling heights.

- Larger floorplates to allow for the creation of a variety of residential arrangements.

- Capacity within the core for a second stairwell.

- The location to be amenity rich and well-connected.

- Proximity for PBSA to universities and other centers of education.

Stepping up to the challenge

The dual routes of repurposing or retrofitting an office space offers a range of benefits that align with wider ambitions to transition to a significantly decarbonised built environment. By repurposing existing office facilities rather than constructing new ones, landlords and developers can significantly reduce their carbon footprint and avoid assets becoming stranded. Retrofitting allows for the integration of energy-efficient technologies, such as low energy lighting, smarter heating and cooling systems, and insulation improvements, leading to substantial energy savings and achieving an EPC rating which meets the proposed MEES legislation.

"We are helping clients secure the residential status and then exploring opportunities to further modify, extend or even redevelop the premises later."

Stuart Baillie, Partner and Head of Planning at Knight Frank

Either route presents owners and developers with challenges and costs. The alternative however, is the prevalence of under-performing assets, the continued bottling of demand into a prime market that can’t keep pace, and real risks to the cohesion of many parts of London. In this sense, either repurposing or retrofitting provides an opportunity to enhance asset performance, bring renewed vitality to assets that steal a march on the delivery of completely new office buildings, or contribute to the ongoing competitiveness of London as a sustainable place to live, work and play.