Investors spend £1.9 billion on homes for the UK's renters

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The US economy is running hotter than economies across Europe. That is, to differing degrees, bad news for homeowners everywhere.

The longer the Federal Reserve waits to make the first cut, the longer the US 30-year mortgage rate hovers at 7%. European central bankers were fearful of lagging the Fed on the way up for fear of importing inflation and the same goes for outpacing the Fed on the way down. If US inflation has plateaued at the 3% mark, as the last two releases would suggest, then the ECB will be hesitant to begin cutting rates in June despite mounting evidence that cuts are needed.

We'll get some clarity on this later today when the US Bureau of Labor Statistics publishes inflation data for March. The prognosis is good: economists expect a 0.3% rise in the core rate of inflation, which is too hot for rate cuts, but would "show that the hot CPI readings of the previous two months were an aberration, not the start of an alarming trend," say Anna Wong and Stuart Paul of Bloomberg Economics.

Single family housing

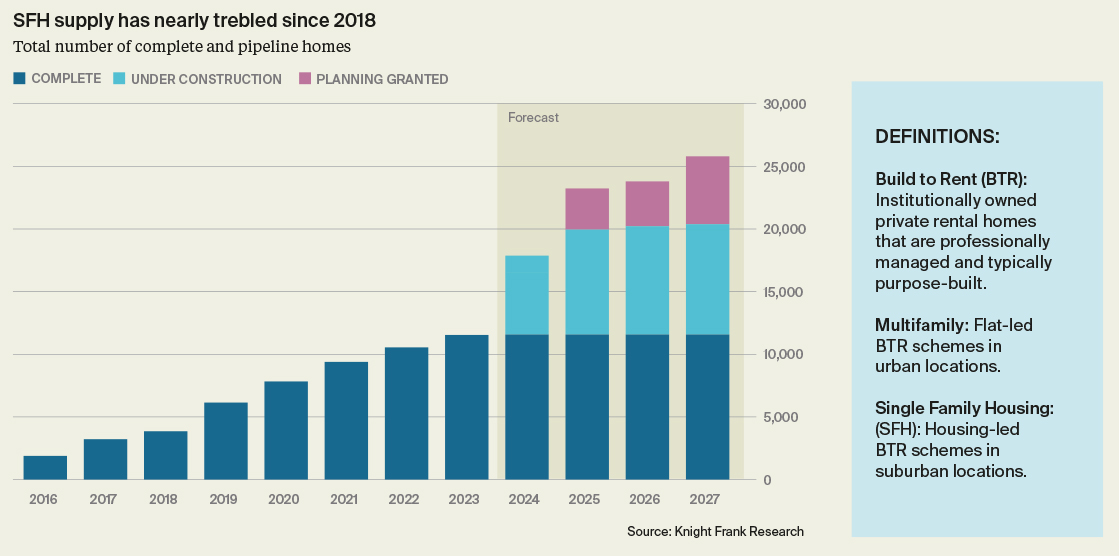

The UK's Single Family rental market has been primed for growth for some time, but conditions were so optimal last year that investors spent a record £1.9 billion acquiring or funding more than 6,200 homes, up fivefold from 2022, according to a new Knight Frank report.

Younger people want high quality, spacious homes with stable tenancies that are suited to putting down roots. Renters are also generally moving less often. In 2012, just 19% of all private renters had lived at their current address for more than five years; now that figure is 30%. That's contributed to a 41% drop in the availability of houses for rent in just a few years - a fall that has been particularly acute for two and three bed houses.

The demand side is compelling, but investment has been helped along by the fact that housebuilders were happy to offload some risk amid the uncertain outlook for interest rates. Some 71% of deals in 2023 were facilitated through transactions with housebuilders, either through bulk deals of stock under construction, or via partnership agreements for yet-to-be-built houses.

The total number of SFH units in the UK, either existing or proposed, is now just above 26,500, with 11,575 operational and a further 15,000 in the pipeline (under construction or with full planning) (see chart).

Needs-based buyers

The mixed picture for UK inflation and interest rates since the beginning of the year means needs-based buyers driving a larger share of activity in prime London residential markets.

While this has benefitted lower-value markets, where a higher proportion of domestic buyers move for education or employment, there has been more hesitancy in discretionary, higher-value markets, Tom Bill writes in his latest update. Uncertainty around recent rule changes for individuals with non-dom tax status may have aggravated the situation, he says.

The number of new prospective buyers between £750,000 and £2 million was 21% above the five-year in the first three months of year, Knight Frank data shows. Above £5 million, the increase was just 3%. Meanwhile, the total number of offers made between £750,000 and £2 million was 6% higher, while above £5 million there was a 6% decline.

Overall, average prices in PCL fell 2.4% in the year to March, the same figure as recorded in February. Meanwhile, prices were down by 1.5% in POL after rising by 0.1% on the previous month.

Rising supply

Supply continues to build in prime London lettings markets, increasing the downwards pressure on rents.

The trend is particularly pronounced in higher value markets, where owners have switched to lettings from sales while property prices are flat or falling. While the number of new lettings listings in PCL and POL was 13% below the five-year average in the first quarter of this year, there was a 40% increase above £1,000 per week.

Average rents rose 5.6% in prime central London (PCL) in the year to March, down from a 16.9% rise in the year to March 2023. Again, this is from Tom Bill's latest update, which you can read here.

In other news...

From our team - Claire Williams on the shifting outlook for European industrial property, Kate Everett-Allen on brightening sentiment among home purchasers in Edinburgh, and Andrew Shirley on landlord-tenant relationships in the rural sector.

Elsewhere - large UK companies see lowest uncertainty in nearly 3 years (Reuters), recruiters report slowest growth in starting pay in over 3 years (Reuters), state housing schemes in England have ‘materially underdelivered’ since 2020 (FT), and finally, Spain to scrap ‘golden visas’ for foreign property investors (FT).