The Red Sea crisis rattles investors

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

British consumers are breathing a collective sigh of relief as inflation cools. GfK's consumer confidence index rose to -19 in January, the highest level since January 2022.

GfK said all five of its confidence gauges rose during the month. The outlook for personal finances in the next 12 months is now out of negative territory for the first time in two years.

A busy spring in the residential market looks very likely given the benign conditions in the mortgage market, but the surprising strength of the economy will give the Bank of England the leeway it needs to hold off cutting rates until it's absolutely sure that inflation is beaten.

The Red Sea

We can expect the Bank of England to strike a cautious tone (again) when it publishes its latest interest rate decision next week. Figures published in late-2023 raised the prospect that we'd see the Monetary Policy Committee hawks capitulate, but data published earlier this month showing the annual rate of inflation actually ticked up in December presented a fly in the ointment.

Wage growth is still a concern, and we're now seeing the first real signs that the conflict in the Red Sea is leading to higher costs among manufacturers. Monday's PMI release showed that the re-routing of ships around the Cape of Good Hope led to the steepest lengthening of vendor delivery times since September 2022. Pre-production inventories fell the most since August and cost burdens increased the most since last spring.

The broader economy is proving remarkably resilient. Private sector output accelerated to its fastest level in eight months, underpinned by growth in the service sector. Again, services firms reported a steep rise in costs, which was mostly linked to strong wage pressures. Importantly, however, prices charged increased at the weakest pace since October - whether firms are able to pass cost pressures through will be crucial in the months ahead.

The PMI rattled investors. Swap rates now imply 95 basis points of rate cuts this year, compared to about 130 basis points last week and 150 basis points in December, according to Bloomberg.

Housebuilding contracts

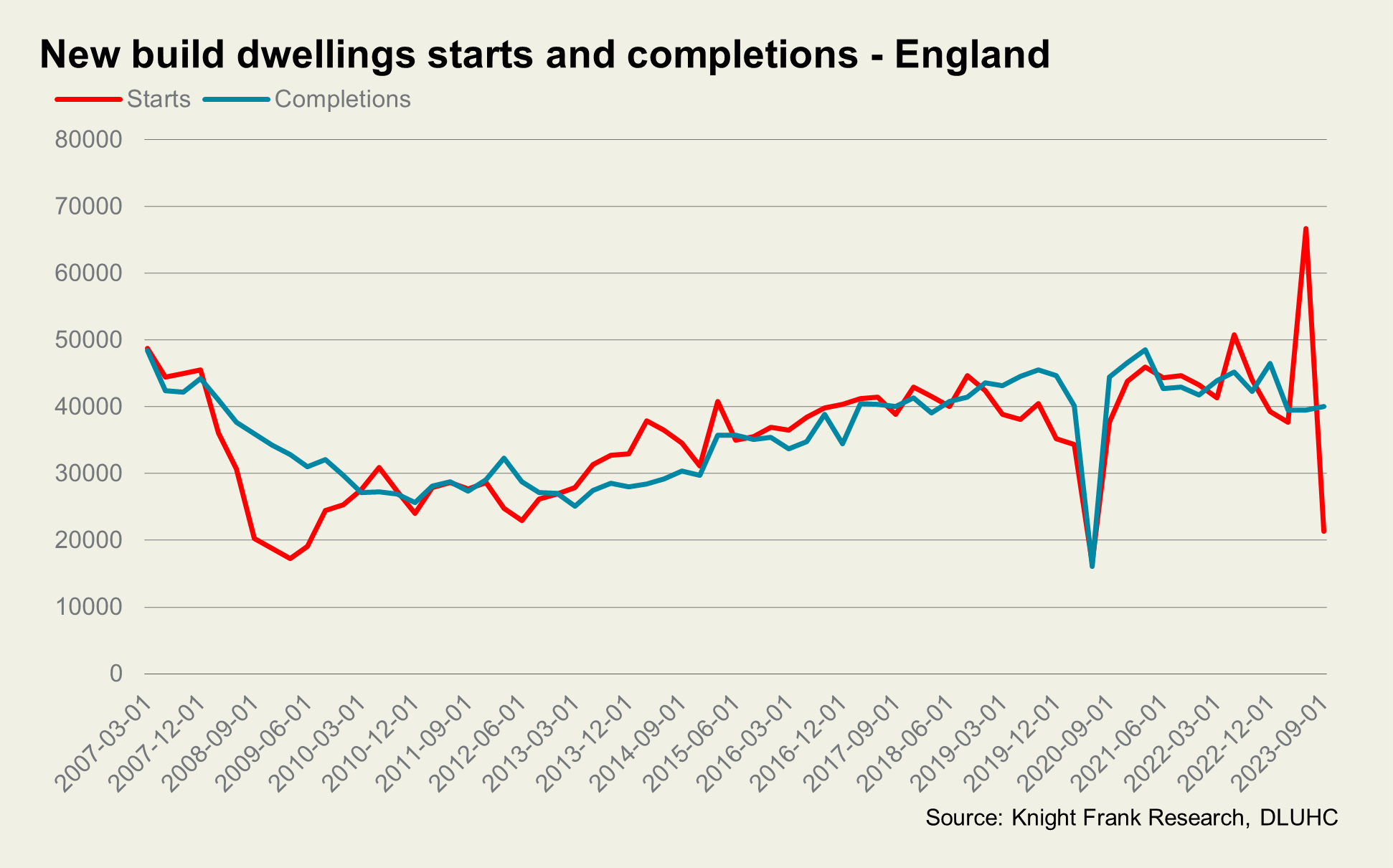

The number of homes started by housebuilders in England plunged 68% in Q3 as developers sought to squeeze starts into the second quarter ahead of the introduction of new environmental regulations.

You can read more from Anna Ward on the data here. The piece includes predictions for the year ahead from our specialist team. Though the development data is being distorted by policy, it's fair to say the trend is clear - planning applications are falling steadily, though interestingly the proportion granted is rising.

"The approval rate is still above 80% which shows perhaps that planning timeframes are more of a deterrent, particularly for SME developers with less deep pockets," says Stuart Baillie, Knight Frank's head of planning. "Approvals are still common, but they take longer to get to.

In other news...

“It feels like now is a key time to address and deal with greenbelt in a grown-up way,’ Roland Brass of Knight Frank tells the FT. “It does feel like now, the next 12 months, is the moment for that to happen.”

Elsewhere - Christine Lagarde says ‘disinflation process is at work’ (FT), rents reach record level outside London (Times), and finally, French council strikes down second-home exemption for Britons (Times).