Continued strong recovery for UK hotel market

Resilient operational trading performance with impressive year-on-year revenue and GOPPAR growth in August, despite ongoing cost pressures and normal seasonality challenges.

3 minutes to read

For further analysis, download Knight Frank’s UK Hotel Dashboard. We provide a detailed overview of key performance indicators for both London & Regional UK, summarising trends in revenues, expenses, and profitability. In this month’s edition we spotlight on the performance of Select Service Hotels for both London and Regional UK.

Key Headlines:

- Seasonal trends resulted in weaker and changing demand in August, compared to July, but with strong operational year-on-year performance, in terms of both revenue and profits.

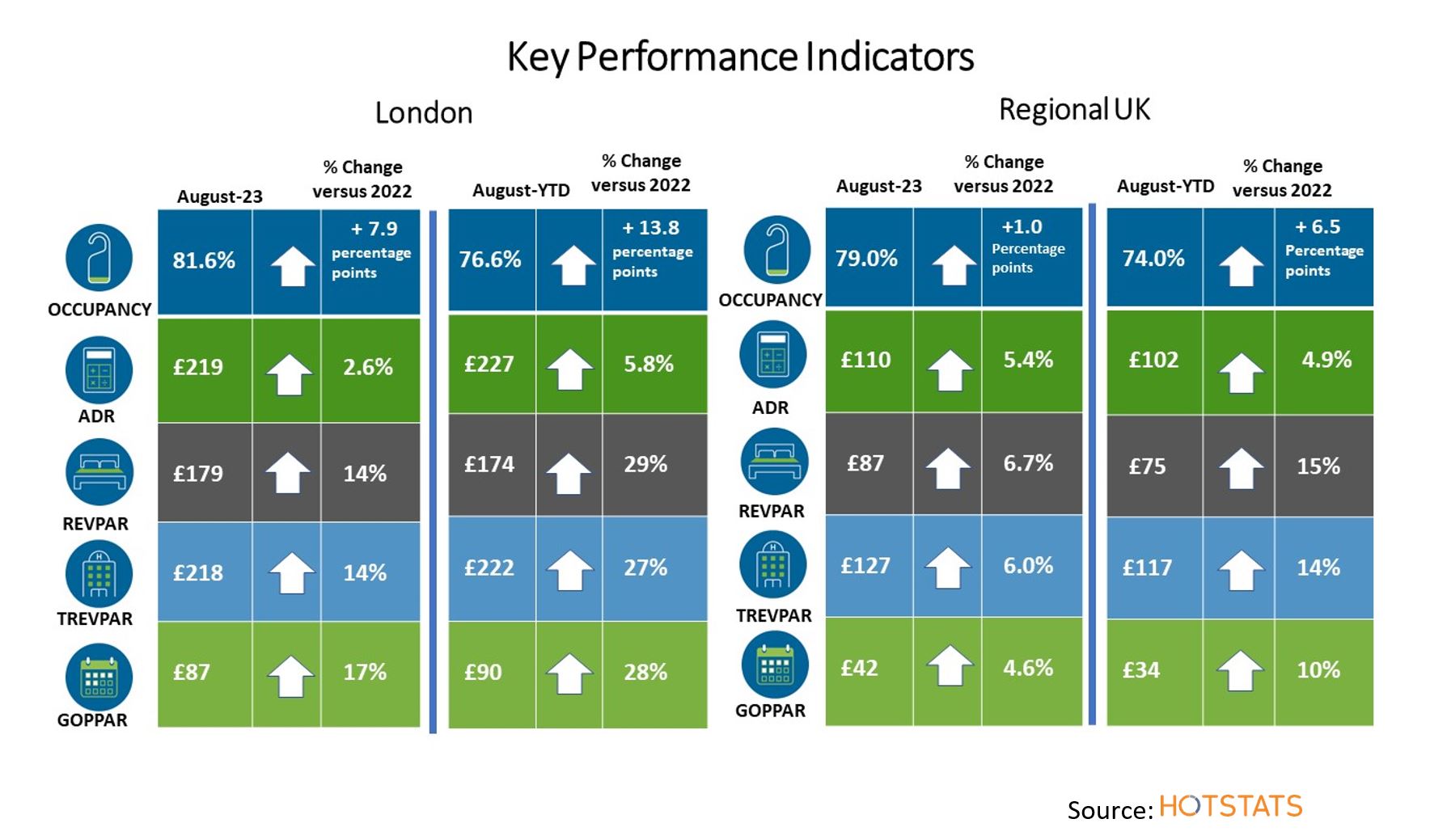

- London hotels achieved occupancy of 81.6% in August, rising by 7.9 percentage points versus August 2022, and with more moderate ADR growth of 2.6%. Hotel demand was supported by the recovery in international demand, with overseas arrivals at Heathrow Airport some 24% ahead of August 2022, but occupancy remains four percentage points below August 2019 levels.

- Improving demand has seen London’s occupancy reach almost 77% as at August YTD 2023, some 14 percentage points above August YTD-2022, whilst London’s hotel supply has seen some 1,800 new hotel rooms open since the start of the year.

- Utility costs increased by 40% PAR in London as at August YTD versus the same period in 2022, but with costs rising by just 15% POR. Whilst higher occupancy is driving higher consumption, the data is also impacted by fixed price contracts ending, making meaningful analysis difficult.

- London recorded strong GOPPAR growth for the month of August, up 17% versus August 2022. For the August-YTD period, GOPPAR of £90 was recorded, an uplift of 28% versus YTD-2022 and is now ahead of its YTD-2019 performance by 2.8%.

- London’s Select Service Hotels outperformed the wider London market in terms of occupancy, reaching 84% in August, but still lags its pre-pandemic performance. Transient rooms revenue account for 93% of the revenue mix, year-on-year transient room rates have increased by 9.6% YTD-2023 and are 28% ahead of YTD-2019. RevPAR is up 24% versus YTD-2019. The strong top-line performance has seen a strong uplift in GOPPAR, up by 33% as at August YTD versus 2022 and 9% ahead of YTD 2019. Profit margins though remain challenged, significantly lower at 47% YTD-2023, compared to 53% YTD-2019.

- Regional UK delivered an impressive month of trading results with a monthly uplift in ADR of 5.4%, the main driver behind year-on-year RevPAR growth of 6.7%. In real terms ADR was 4.1% ahead versus August 2019.

- As at August YTD, Regional UK has seen RevPAR growth 20% ahead of its YTD-2019 performance, boosting income generated from the rooms department by 19% over the same period. Trading, however, has been far more challenged in the Food & Beverage department, with F&B departmental income declining by 18% over the same period.

- Total payroll costs across Regional UK were 14% higher as at August-YTD versus August 2022. Meanwhile, utility costs increased by 27% PAR year-on-year over the same period.

- Despite cost pressures, GOPPAR in August across Regional UK increased on average by 4.6% year-on-year, whilst monthly profits were 20% ahead of August 2019. As at August-YTD GOPPAR at £34 is up by around 10% versus YTD-2022 and YTD-2019.

- Regional UK’s Select Service Hotels are outperforming all regional UK hotel segments, with GOPPAR surging ahead of its YTD-2022 performance by 25% and is 31% ahead of YTD-2019. A challenging cost environment remains, but strong revenue growth, with RevPAR up by 27% versus YTD-19, is fuelling the strong growth in GOPPAR. The YTD profit margin of 35% remains on par with 2019.

Download the latest hotels dashboard here

UK Hotels Trading Performance Review - 2022

The market leading report provides detailed insight into the operational revenues, costs, profitability and KPIs of the UK hotel sector. Despite rising cost pressures, in 2024 the UK Hotel market delivered another strong and profitable year of trading, with improved profit margins.

Download now