Luxury house prices stage a (modest) recovery

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

Luxury house prices across the globe staged a modest recovery in the second quarter as mortgage rates fell in some locations and central banks neared the end of their interest rate hiking cycles.

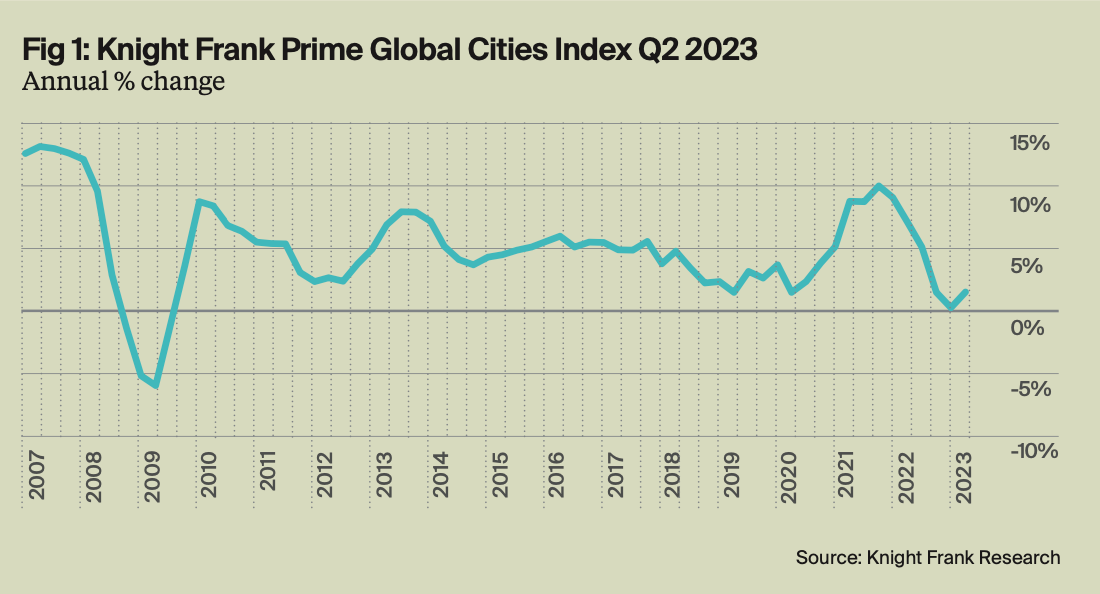

Average annual prices rose 1.5% during the year to June across the 46 markets covered by the Knight Frank Prime Global Cities Index. That's up from 0.4% in the year to March, though is well down from the recent peak of 10.2% seen in the final quarter of 2021.

While policy rate tightening cycles are not yet at an end, there is a sense in many markets that the worst of interest rate uncertainty is past. Meanwhile, some of the markets worst hit by the housing slowdown - Auckland and Stockholm, for example - have turned a corner and saw positive growth during the three months to June. Prices rose in 57% of markets during the period. We delve into the best and worst performing markets in the report. Read it here.

A shifting outlook

Investors are skittish amid the shifting outlook for interest rates. Asset prices lurch and swing with every datapoint that alters the prevailing narrative.

Last week's set of inflation figures contained some worrying details. Betting on peak rates moved out to 6% early next year. A profit warning from Crest Nicholson on Monday prompted shares in housebuilders to fall across the board.

Five days later and the outlook has shifted again. Activity in the private sector during August shrank at the fastest pace since January 2021, ending six months of gains, according to Wednesday's S&P Global / CIPS Purchasing Managers Index. There was evidence of continued wage pressures in the survey, however the results suggest that inflation should moderate further in the months ahead.

“Although cost pressures remain elevated, thanks mainly to rising wages, the deteriorating demand environment is curbing companies' pricing power," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. "Prices charged for goods and services are growing at a rate commensurate with consumer price inflation cooling to 4% in the months ahead. A further pull-back in hiring in August meanwhile indicates that the labour market is losing steam, which should feed through to lower wage pressures."

The release prompted bets on peak rates to ease back to 5.75%. The FTSE 250 recorded its best session in more than a month. Real estate investment trusts (REITs) and housebuilder shares were among the biggest gainers.

Easing mortgage rates

The turn in inflation prompted a moderate improvement in consumer confidence. The GfK consumer sentiment indicator rose to -25 in August from -30 in July, the biggest rise since April. Households' expectations for their personal financial situation over the coming year rose to -3 from -7, well above the reading of -31 a year ago.

Gabriella Dickens, an economist at Pantheon Macroeconomics, told the FT that the readings were boosted by the decline in mortgage rates over the past month.

We had wondered if last week's inflation numbers and subsequent rise in swap rates would prompt the lenders to put those rate cuts on ice, but easing has continued through this week. Nationwide was among a few lenders to announce reductions with cuts of 0.4% off selected fixed rates that started on Wednesday.

The end of pricing power

The UK isn't the only economy with a shrinking private sector. The Purchasing Managers Index for the Eurozone fell to its lowest level since November 2020. Business activity in Germany, Europe's largest economy, contracted at the fastest pace for three years.

A narrow majority of economists polled by Reuters expect the ECB to pause its rate hiking cycle in September.

The US PMI revealed an economy approaching stagnation. The marginal growth was the weakest since February. Rising wages and energy prices is pushing up manufacturers' costs, which could be worrying for inflation, however weaker demand is now limiting companies' pricing power, which should help keep a lid on inflation around the 3% mark, according to Chris Williamson of S&P Global Market Intelligence.

That US PMI is the first data in several weeks that counters the narrative that the Federal Reserve will need to continue hiking to keep a lid on inflation. Yields on Treasuries have risen throughout the summer, which has pushed mortgage rates higher. The 30-year fixed rate mortgage is now running at 7.31%, the highest rate since December 2000. Existing home sales hit a six month-low during July.

In other news...

The transfer of wealth from boomers to ‘zennials’ will reshape the global economy (FT).