Peak interest rates soon, but a long wait for cuts

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

Of the thousands of words of analysis published by the Bank of England yesterday, the word "restrictive" stood out more than any other.

Monetary policy is now "restrictive", the Bank said as it raised the base rate for the 14th consecutive time to 5.25%. It's the first time that officials have said interest rates are now high enough to be weakening activity and cooling inflation.

Investors have been steadily trimming expectations of where the Bank Rate will peak since last month's positive inflation print. That continued after the decision. Analysts at NatWest cut their forecast for the peak rate to 5.5%, from a previous estimate of 6%.

Barring any nasty surprises in the next few sets of monthly inflation figures, we are probably a few months, if not weeks away from peak rates. That peak, however, is likely to be maintained for some time - the Bank emphasised that policy would need to be "sufficiently restrictive for sufficiently long" to return inflation to the 2% target.

The long wait for rate cuts

How long is "sufficiently long"?

Forecasts published alongside yesterday's decision were compiled back when markets were expecting the Bank Rate to peak at 6% next year while averaging a little under 5.50% for three years. Under that scenario, inflation falls to 5% by the end of this year and only hits the 2% target by Q2 2025.

The outlook for inflation has improved since then, but only to a point. The forecasts suggest that it's reasonable to expect a bank rate of around 5% or more through next year provided current economic conditions persist.

“We interpret [the Bank's comments] as meaning that rates are now close to their peak and will then stay at high levels for some time,” Andrew Goodwin, economist at Oxford Economics tells the FT. He thinks the BoE will start loosening policy “several months later than in the US and eurozone”.

The property perspective

For the residential property market, the short term implications of yesterday's decision are good. The rise to 5.25% was baked in, and the relatively positive reaction in financial markets should widen the scope for mortgage lenders to reduce rates further during the coming weeks.

Tracker rates are still quite a bit cheaper than fixed rate products, despite the rise in the base rate. Borrowers have reacted fairly swiftly to the changing outlook and many are now opting for trackers, often with a view to fixing once rates ease further, according to Knight Frank Finance.

Though sentiment should improve during the weeks ahead, "downwards pressure on prices and transaction volumes will continue into next year as more people roll off fixed-rate deals and... demand will remain subdued through to the next election," Tom Bill said in a comment issued to media after the decision.

Indeed the Bank appeared pretty sanguine on the housing market. House prices are expected to fall "modestly" in the coming months, it said. Forbearance from banks and various regulations supporting borrowers "should limit the impact of higher interest rates on mortgage defaults and therefore may reduce downward pressure on house prices," it added.

Housing investment, which makes up a little over 5% of total economic activity and includes investment in existing homes, will fall by a sizable 6% in both 2023 and 2024, and by 3% in 2025. Meanwhile, we may see greater sales from buy-to-let investors "given the sector’s larger size relative to previous downturns and the range of factors currently putting pressure on investors’ profitability, although market exits from landlords have not so far been on a scale that is likely to have a material impact on overall house prices," the Bank concluded.

Mortgage repayments for life

Conditions are now acutely difficult for first-time buyers (FTBs).

A prospective buyer earning the average wage and looking to buy the typical first-time buyer property with a 20% deposit would see monthly mortgage payments account for 43% of their take home pay, assuming a 6% mortgage rate, Nationwide said this week. Even a 10% deposit is equivalent to 55% of gross annual average income.

There are few solutions to the affordability hurdle beyond taking a longer mortgage term, a theme so common that it has the potential "to slow or weaken the transmission of higher interest rates to the economy," the Bank of England said yesterday.

Taylor Wimpey earlier this week said 27% of first-time buyers took on mortgage terms of more than 36 years in the first half of the year, compared to just 7% in 2021. More than four in every ten second-steppers are taking terms of more than 30 years.

Planning and housing delivery

"Planning remains extremely challenging and is likely to impact the future delivery of new homes across our industry," Taylor Wimpey said as it reported its half year results.

The view is shared by scores of volume and SME housebuilders. Planning delays are a recurrent issue, with half of housebuilders responding to our quarterly survey allowing over a year to secure reserved matters approval on an allocated site. Typically, this approval process should take eight weeks or three months for large developments.

Our survey shows that 18% of respondents would allow up to two years, with just 13% building in up to six months of approval time.

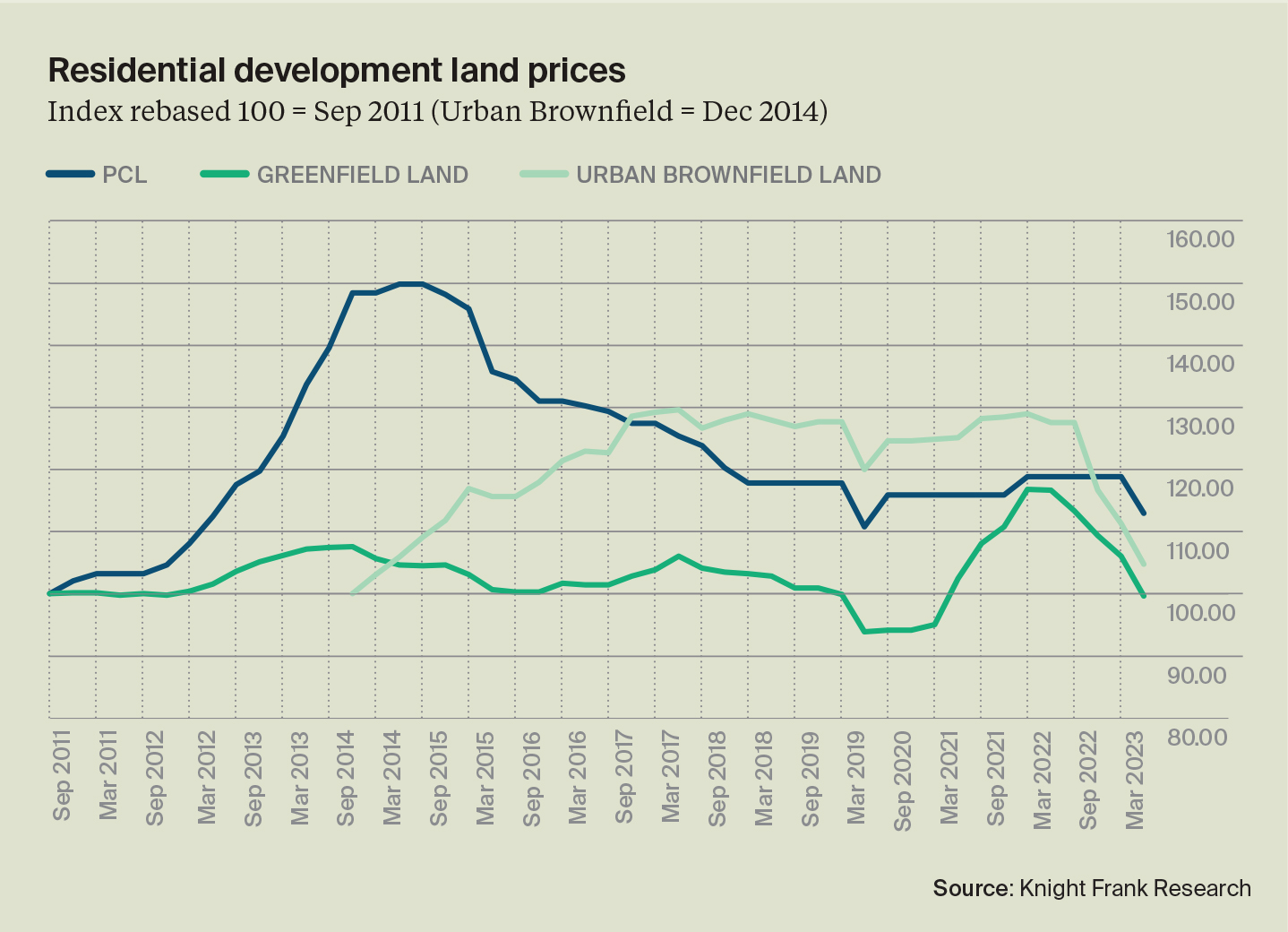

More than half of our respondents thought that ‘mortgage availability and cost for purchasers’ would have the greatest impact on the housebuilding sector in the third quarter. Average greenfield land prices fell 6.1% in Q2, taking the annual drop to 14.6% - the biggest quarterly and annual decline on record. Brownfield values fell 5.9% on quarter and 17.9% annually – the steepest quarterly drop since the pandemic impacted Q2 2020 and the largest annual decline on record (see chart).

In other news...

From our team - continued high demand spurred on by the pandemic has led to many French locations recording double-digit property price growth, writes Kate Everett-Allen. Nicola Ryan explores whether hybrid work lowers carbon emissions.

Elsewhere - UK estate agents build up lettings as homes sales boom ends (FT), Chinese deal activity in US slumps to lowest level in 17 years (FT), and finally, Shaftesbury Capital on a winner in West End (Times).