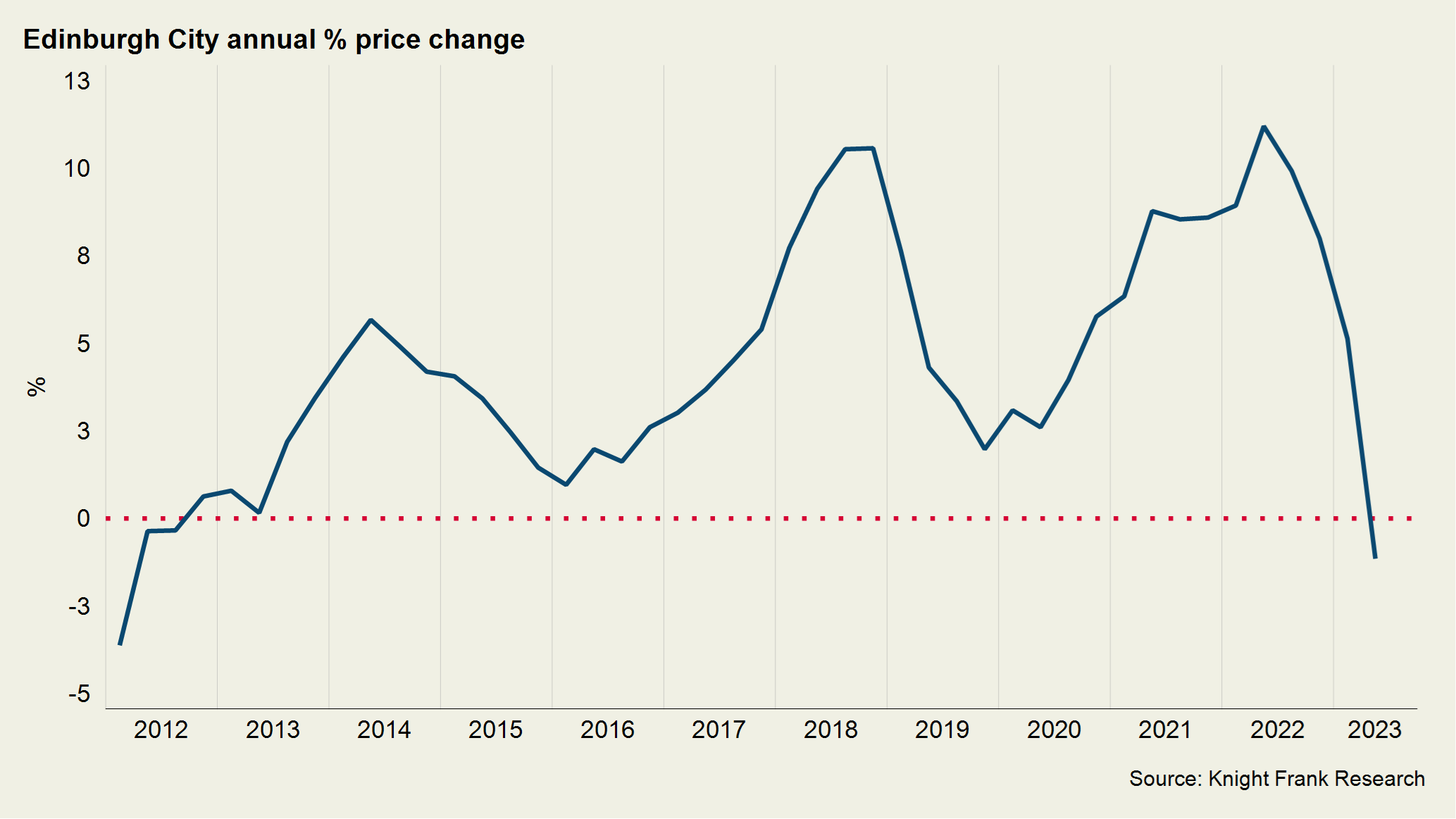

Edinburgh house price growth turns negative for first time in a decade

Higher borrowing costs weigh on sentiment in the Scottish capital in Q2.

2 minutes to read

Edinburgh City Index 130.1 / Quarterly change -1.8% / Annual change -1.1%

The average price of a property in Edinburgh declined on an annual basis for the first time in over a decade in the second quarter of 2023, as demand moderated in the face of volatility in the mortgage market.

Values dropped by 1.8% in the three months to June, Knight Frank data shows, the second consecutive quarterly drop after a 0.2% decline between January and March.

On an annual basis the average price of a property was 1.1% lower in Q2, which was the first annual decline since a 0.3% contraction in Q3 2012 (see chart).

Elevated borrowing costs, after 13 consecutive increases to the base rate by the Bank of England, remain a major concern for many, according to our summer sentiment survey.

The number of new prospective buyers registering in Edinburgh was down by close to a quarter (23%) in Q2 compared with the five-year average (excluding 2020), as the situation weighed on sentiment.

“Demand has reduced due to the increase in borrowing costs, although the family house market remains active, with supply tight,” said Edward Douglas-Home, head of Scotland residential at Knight Frank.

Edinburgh with its mix of city amenities, cultural interest and convenience combined with easy access to countryside proved particularly popular during the recent pandemic period. The average price of a property in the city has increased by 19.6% since March 2020.

Discretionary market cools

Price declines were more pronounced in the higher price brackets, which have seen the largest gains during the pandemic, with a quarterly decline of 3.3% for properties valued at over £2m in Q2.

Some discretionary buyers at the top end of the market are choosing to sit tight, while others are becoming ‘accidental’ landlords and renting their properties out after failing to achieve the sale price they want.

Higher value properties benefited from people’s desire for more space to live and work in sparked by the pandemic, as well as their relative affordability given weaker growth in the years before, which was due to political uncertainty and a series of tax changes that disproportionately affected them.

In the ten years to March 2020, properties in Edinburgh valued at more than £2m saw prices increase by 7.3%, while those under £1m saw growth of 32.2%. However, from March 2020 to June 2023 the average price of a £2m+ property climbed by close to a third (32.6%), while the increase below £1m was 13.8%.

Despite softer demand, supply in the city remains tight, and this will ease downwards pressure on pricing.

Along with strong UK wage growth, high levels of employment and forbearance from lenders it is why we forecast prices will fall 10% through the remainder of this year and next, avoiding a cliff-edge.